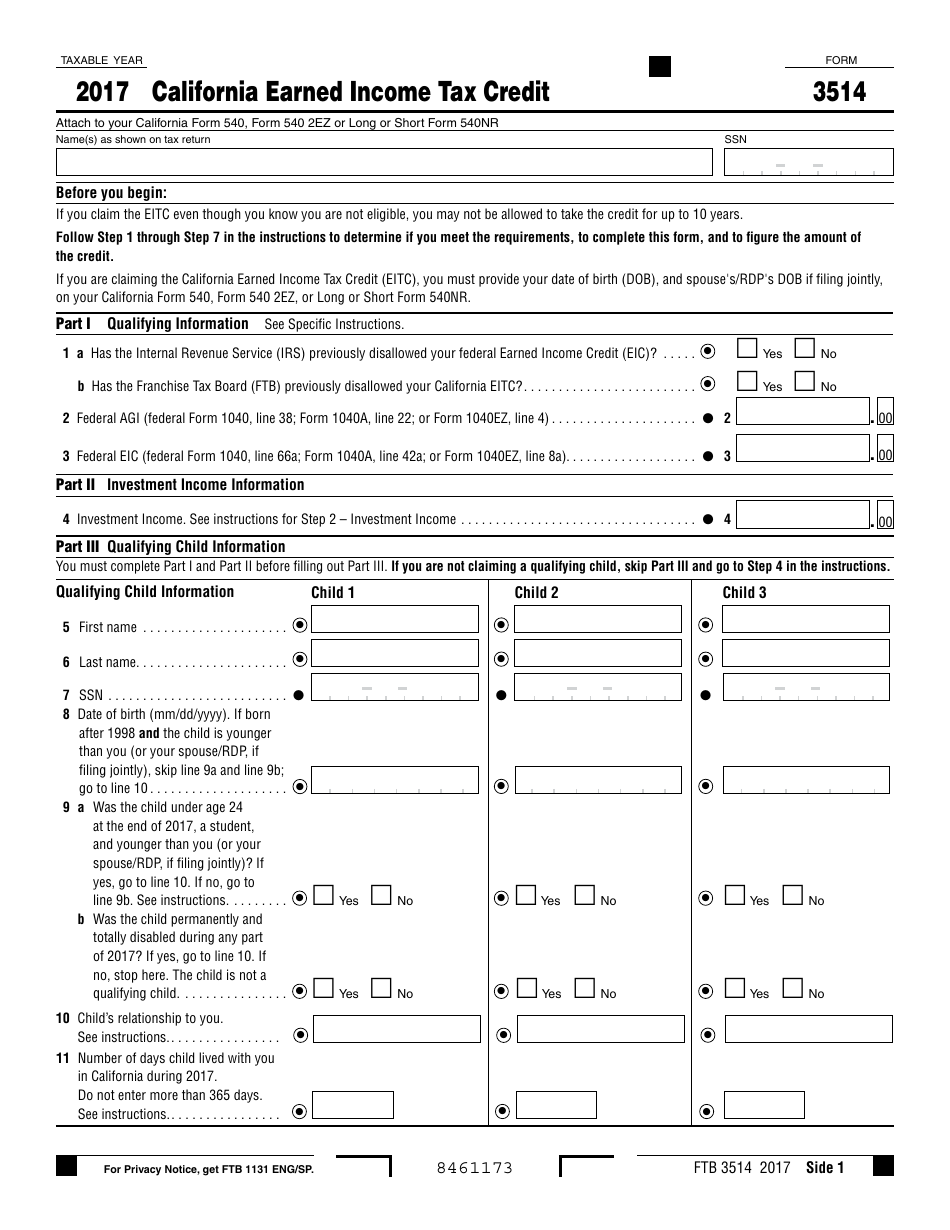

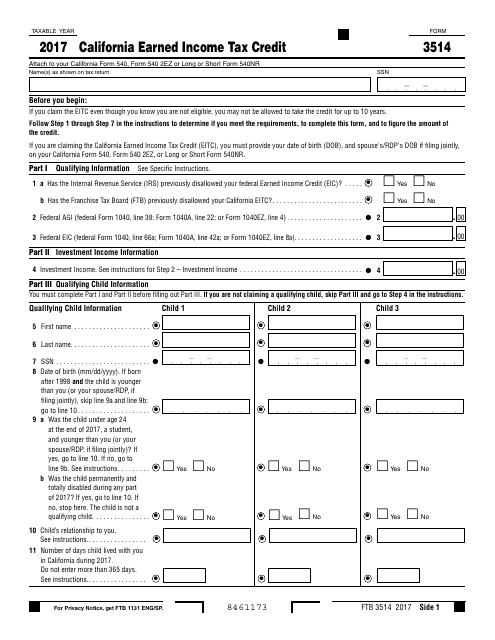

42+ California earned income tax credit worksheet 2017 Free Download

Home » Free Worksheets » 42+ California earned income tax credit worksheet 2017 Free DownloadYour California earned income tax credit worksheet 2017 images are ready. California earned income tax credit worksheet 2017 are a topic that is being searched for and liked by netizens today. You can Get the California earned income tax credit worksheet 2017 files here. Download all free photos and vectors.

If you’re searching for california earned income tax credit worksheet 2017 images information related to the california earned income tax credit worksheet 2017 topic, you have come to the ideal blog. Our website frequently gives you suggestions for viewing the maximum quality video and image content, please kindly hunt and locate more informative video content and images that fit your interests.

California Earned Income Tax Credit Worksheet 2017. Tax relief legislation Recent legislation provided certain tax-related benefits including an election to use your 2019 earned income to figure your 2020 earned income credit. California Earned Income Tax Credit Worksheet Part I All Filers. California Earned Income Tax Credit Worksheet 2017. If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year you may qualify for up to 1000 through this credit.

2017 Personal Income Tax Booklet 540 Ftb Ca Gov From ftb.ca.gov

2017 Personal Income Tax Booklet 540 Ftb Ca Gov From ftb.ca.gov

2019 Earned Income Tax Credit Table. Complete the California Earned Income Tax Credit Worksheet below. Tax relief legislation Recent legislation provided certain tax-related benefits including an election to use your 2019 earned income to figure your 2020 earned income credit. Election to use your 2016 earned income to figure your 2017 EIC if your 2016 earned income is more than your 2017 earned income. California Earned Income Tax Credit EITC EITC reduces your California tax obligation or allows a refund if no California tax is due. If you work let the EITC work for you.

The maximum amount of in-.

To figure the amount of your credit or to have the IRS figure it for you see the instructions for Form 1040A lines 42a and 42b or Form 1040 lines 66a and 66b. California Earned Income Tax Credit Worksheet 2018. Claiming your EITC is easy. 976 for more information. This is not a tax table. California Earned Income Tax Credit Worksheet Part Iii Line 6.

Source: thefinancebuff.com

Source: thefinancebuff.com

2019 Earned Income Tax Credit Table. The maximum amount of in-. This is not a tax table. California earned income tax credit worksheet 2017 References in these instructions are to the Internal Revenue Code IRC as of January 1 2015 and to the California Revenue and Taxation Code RTC. Earned income credit EIC and additional child tax credit ACTC.

Source: wildcountryfinearts.com

Source: wildcountryfinearts.com

La Earned Income Credit Worksheet. See Election to use prior year earned income for more information. To see if you were impacted by one of the Presidentially declared disasters eligible for this re-lief or to get more information about disaster tax relief see Pub. If you work let the EITC work for you. California Earned Income Tax Credit Worksheet 2017.

Election to use your 2016 earned income to figure your 2017 EIC if your 2016 earned income is more than your 2017 earned income. Disaster relief enacted for those impacted by Hurricane Harvey Irma or Maria allows prior year earned income to be elected as 2017 earned income when fig-uring both the 2017 EIC and the 2017 ACTC. Earned income credit EIC and additional child tax credit ACTC. California Earned Income Tax Credit Worksheet 2017. Today we are delighted to announce that we have discovered an awfully interesting content to be pointed out.

Source: pinterest.com

Source: pinterest.com

Today we are delighted to announce that we have discovered an awfully interesting content to be pointed out. If you file Form 540 or 540 2EZ after completing Step 6 skip Step 7 and go to Step 8. Earned Income Tax Credit Worksheet B. Election to use your 2016 earned income to figure your 2017 EIC if your 2016 earned income is more than your 2017 earned income. Tax relief legislation Recent legislation provided certain tax-related benefits including an election to use your 2019 earned income to figure your 2020 earned income credit.

Source: lacooperativa.org

Source: lacooperativa.org

Claiming your EITC is easy. For 2021 taxes due in April 2022 you could get a much higher Earned Income Tax Credit EITC or Child Tax Credit. Whats New Self-Employment Income For taxable years beginning on or after January 1 2017 California conforms to federal law to include in the. This is not a tax table. Claiming your EITC is easy.

Source: hrblock.com

Source: hrblock.com

See Election to use prior year earned income for more information. Posts Related to Earned Income Credit Worksheet 2017. The maximum amount of in-. 2019 Earned Income Tax Credit Table. Disaster relief enacted for those impacted by Hurricane Harvey Irma or Maria allows prior year earned income to be elected as 2017 earned income when fig-uring both the 2017 EIC and the 2017 ACTC.

Source: uslegalforms.com

Source: uslegalforms.com

If you are married. To figure the amount of your credit or to have the IRS figure it for you see the instructions for Form 1040A lines 42a and 42b or Form 1040 lines 66a and 66b. Complete the California Earned Income Tax Credit Worksheet below. If you file a Form 540NR after completing Step 6 go to Step 7. It will reduce the taxes you owe and will even be refunded to you if you do not owe taxes on your return.

Source: wildcountryfinearts.com

Source: wildcountryfinearts.com

If you have work income you can file and claim your EITC refunds even if you dont owe any income tax. To see if you were impacted by one of the Presidentially declared disasters eligible for this re-lief or to get more information about disaster tax relief see Pub. The maximum amount of investment income you can have and still get the credit is. If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year you may qualify for up to 1000 through this credit. This means extra cash in your pocket.

Source: hrblock.com

Source: hrblock.com

The 2017 Earned Income Tax Credit. If you have work income you can file and claim your EITC refunds even if you dont owe any income tax. Posts Related to Earned Income Credit Worksheet 2017. If you file Form 540 or 540 2EZ after completing Step 6 skip Step 7 and go to Step 8. California earned income tax credit worksheet 2017 References in these instructions are to the Internal Revenue Code IRC as of January 1 2015 and to the California Revenue and Taxation Code RTC.

Source: templateroller.com

Source: templateroller.com

If you work let the EITC work for you. Make sure you file your taxes even if you dont owe anything so that you get these credits. 21 Posts Related to California Earned Income Tax Credit Worksheet. If you claim the EITC even though you know you are not eligible you may not be allowed to take the credit. The maximum amount of investment income you can have and still get the credit is.

Source: ftb.ca.gov

Source: ftb.ca.gov

Just file your state and or federal tax returns. Enter your California earned income from form FTB 3514. Just before referring to California Earned Income Tax Credit Worksheet 2017 please are aware that Instruction will be our answer to an even better the day after tomorrow as well as discovering wont just avoid as soon as the college bell ringsThat will becoming mentioned many of us offer you a various straightforward nonetheless informative articles or blog posts plus web themes built. Earned Income Credit Worksheet. Earned income credit EIC and additional child tax credit ACTC.

Source: templateroller.com

Source: templateroller.com

If you claim the EITC even though you know you are not eligible you may not be allowed to take the credit. California earned income tax credit worksheet 2017 References in these instructions are to the Internal Revenue Code IRC as of January 1 2015 and to the California Revenue and Taxation Code RTC. This is not a tax table. This is not a tax table. The 2017 Earned Income Tax Credit.

Source: wildcountryfinearts.com

Source: wildcountryfinearts.com

Election to use your 2016 earned income to figure your 2017 EIC if your 2016 earned income is more than your 2017 earned income. The maximum amount of investment income you can have and still get the credit is. Tax relief legislation Recent legislation provided certain tax-related benefits including an election to use your 2019 earned income to figure your 2020 earned income credit. Earned income credit EIC and additional child tax credit ACTC. If you are married filing separately you do not qualify for this credit.

This is not a tax table. Whats New Self-Employment Income For taxable years beginning on or after January 1 2017 California conforms to federal law to include in the. If you are married. California Earned Income Tax Credit Worksheet 2015. It will reduce the taxes you owe and will even be refunded to you if you do not owe taxes on your return.

Source: communitytax.com

Source: communitytax.com

2019 Earned Income Tax Credit Table. The maximum amount of investment income you can have and still get the credit is. Claiming your EITC is easy. Earned Income Credit Worksheet Pdf. This is not a tax table.

Source: ppic.org

Source: ppic.org

Earned Income Credit Table 2015 Worksheet. Posts Related to Earned Income Credit Worksheet 2017. For 2021 taxes due in April 2022 you could get a much higher Earned Income Tax Credit EITC or Child Tax Credit. Complete the California Earned Income Tax Credit Worksheet below. If you work let the EITC work for you.

Source: templateroller.com

Source: templateroller.com

Posts Related to Earned Income Credit Worksheet 2017. To see if you were impacted by one of the Presidentially declared disasters eligible for this re-lief or to get more information about disaster tax relief see Pub. Just file your state and or federal tax returns. Complete the California Earned Income Tax Credit Worksheet below. Earned income credit EIC and additional child tax credit ACTC.

If you file Form 540 or 540 2EZ after completing Step 6 skip Step 7 and go to Step 8. Earned Income Credit Worksheet. After you have figured your earned income credit EIC use Schedule EIC to give the IRS information about your qualifying children. The Young Child Tax Credit was introduced in tax year 2019. If you file a Form 540NR after completing Step 6 go to Step 7.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title california earned income tax credit worksheet 2017 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.