38++ Amt home mortgage interest adjustment worksheet Info

Home » Free Worksheets » 38++ Amt home mortgage interest adjustment worksheet InfoYour Amt home mortgage interest adjustment worksheet images are ready in this website. Amt home mortgage interest adjustment worksheet are a topic that is being searched for and liked by netizens now. You can Get the Amt home mortgage interest adjustment worksheet files here. Get all free images.

If you’re looking for amt home mortgage interest adjustment worksheet images information connected with to the amt home mortgage interest adjustment worksheet topic, you have pay a visit to the right blog. Our site frequently gives you hints for seeking the highest quality video and image content, please kindly search and locate more enlightening video content and images that match your interests.

Amt Home Mortgage Interest Adjustment Worksheet. To access the Deductible Home Mortgage Interest Worksheet in ProSeries. Field enter D H and M to find Ded Home Mort in the form menu. 24000 on line 1 10000 plus 9000 plus 5000 10000 on line 2 9000 on line 3 -0- on line 4 19000 on line 5 10000 plus 9000 and 5000 on line 6 24000 minus 19000. Sign in to your TaxAct Online return.

Form 4626 Alternative Minimum Tax Corporations From slideshare.net

Form 4626 Alternative Minimum Tax Corporations From slideshare.net

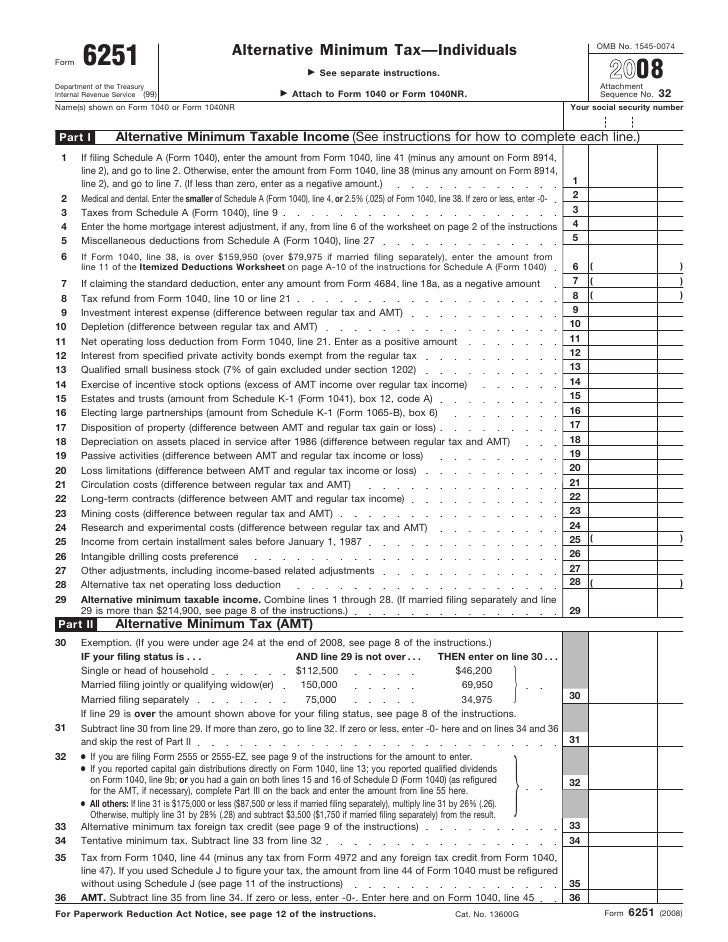

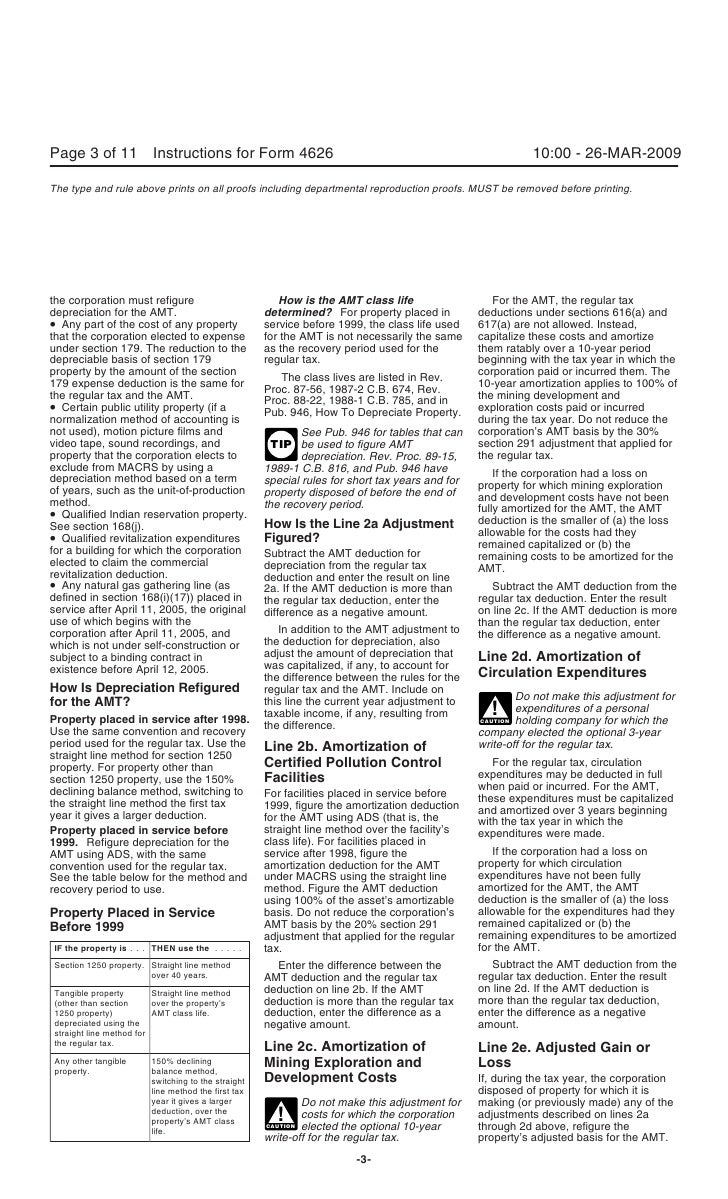

To access the Deductible Home Mortgage Interest Worksheet in ProSeries. Field enter D H and M to find Ded Home Mort in the form menu. The definitions of certain terms used in the worksheet are as follows. Complete the Home Mortgage Interest Adjustment Worksheet provided in the 2017 federal form 6251 instructions the amount of your using Iowa home mortgage interest deduction entered on the IA 1040 Schedule A. Line 4Home Mortgage Interest Adjustment Complete the Home Mortgage Interest Adjustment Worksheet to figure the amount to enter on this line. Interest Line 4 Enter the home mortgage interest adjustment if any from line 6 of the worksheet on page 2 of the instructions 56e.

Concerning the alternative minimum tax AMT contains a definition of AMT-deductible qualified housing interest21 There it is defined as qualified residence interest both indebtedness that is incurred in acquiring property22 Thus IRS reasoned if.

Mortgage or home equity loan interest to the extent the loan proceeds are used to purchase construct or improve a principal residence. They paid 5000 in interest on the home equity loan in 2014. Follow the Form 4952 instructions for line 1 but when completing line 1 also include any interest that would have been deductible if tax-exempt interest on private activity bonds were includible in gross income. The definitions of certain terms used in the worksheet are as follows. Year however no AMT adjustment is needed since. For purposes of calculating the AMT home mortgage interest adjustment any interest amounts entered in the Home Mortgage Interest Limitation section in the MortgInt screen that are omitted from this section will be treated as eligible mortgage interest to the extent the deduction for mortgage interest is allowed.

Source: pinterest.com

Source: pinterest.com

24000 on line 1 10000 plus 9000 plus 5000 10000 on line 2 9000 on line 3 -0- on line 4 19000 on line 5 10000 plus 9000 and 5000 on line 6 24000 minus 19000. I refinanced once - and my mortgage was also sold from one bank to another in 2019 - so I received 3 1098 Forms. This ruling may affect the amount some taxpayers report as a home mortgage interest adjustment on Form 6251 Alternative Minimum Tax-IndividualsThe instructions for Form 6251 include a worksheet. If the mortgage interest. Include a worksheet that may help you determine whether.

Source: leefin.com

Source: leefin.com

Sign in to your TaxAct Online return. For a taxpayer with a vacation home who is subject to AMT a larger allocation of property tax to the rental activity may be beneficial. If you end up taking the Standard Deduction the interest wont be used for the Federal return. Include a worksheet that may help you determine whether. Concerning the alternative minimum tax AMT contains a definition of AMT-deductible qualified housing interest21 There it is defined as qualified residence interest both indebtedness that is incurred in acquiring property22 Thus IRS reasoned if.

Source: kitces.com

Source: kitces.com

If the mortgage interest. An eligible mortgage is a mortgage whose proceeds were used to buy build or substantially improve your main home. Year however no AMT adjustment is needed since. Mortgage interest years before 2018 and after 2025. This was a change from the Tax Cuts and Jobs Act.

Source: slideshare.net

Source: slideshare.net

Enter your AMT disallowed investment interest expense from 2019 on line 2. Include a worksheet that may help you determine whether. This was a change from the Tax Cuts and Jobs Act. Line 4Home Mortgage Interest Adjustment Complete the Home Mortgage Interest Adjustment Worksheet to figure the amount to enter on this line. This information is needed now to calculate the amount of Home Mortgage Interest you can claim.

Source: thebalance.com

Source: thebalance.com

Year however no AMT adjustment is needed since. The definitions of certain terms used in the worksheet are as follows. If the mortgage interest. Concerning the alternative minimum tax AMT contains a definition of AMT-deductible qualified housing interest21 There it is defined as qualified residence interest both indebtedness that is incurred in acquiring property22 Thus IRS reasoned if. Click Tools on the right side of the screen to expand the.

An eligible mortgage is a mortgage whose proceeds were used to buy build or substantially improve your main home. QRI is interest on. Follow the Form 4952 instructions for line 1 but when completing line 1 also include any interest that would have been deductible if tax-exempt interest on private activity bonds were includible in gross income. This information is needed now to calculate the amount of Home Mortgage Interest you can claim. This ruling may affect the amount some taxpayers report as a home mortgage interest adjustment on Form 6251 Alternative Minimum Tax-IndividualsThe instructions for Form 6251 include a worksheet.

Source: irs.gov

Source: irs.gov

Click the Forms link on the right side of the screen. The instructions for Form 6251 include a worksheet to help taxpayers determine the correct home mortgage interest adjustment. Concerning the alternative minimum tax AMT contains a definition of AMT-deductible qualified housing interest21 There it is defined as qualified residence interest both indebtedness that is incurred in acquiring property22 Thus IRS reasoned if. For a taxpayer with a vacation home who is subject to AMT a larger allocation of property tax to the rental activity may be beneficial. The worksheet in the TaxAct program titled Form 6251 - Home Mortgage Interest Adjustment Worksheet - Line 4 calculates the amount to transfer to Line 4 of IRS Form 6251 Alternative Minimum Tax - Individuals as an adjustment to the AMT tax calculated.

Field enter D H and M to find Ded Home Mort in the form menu. The worksheet in the TaxAct program titled Form 6251 - Home Mortgage Interest Adjustment Worksheet - Line 4 calculates the amount to transfer to Line 4 of IRS Form 6251 Alternative Minimum Tax - Individuals as an adjustment to the AMT tax calculated. Year however no AMT adjustment is needed since. An eligible mortgage is a mortgage whose proceeds were used to buy build or substantially improve your main home. I refinanced once - and my mortgage was also sold from one bank to another in 2019 - so I received 3 1098 Forms.

Source: slideshare.net

Source: slideshare.net

To view the worksheet in TaxAct Online. To view the worksheet in TaxAct Online. Tap the F6 key to go to the Open Forms window. Enter the total of the home mortgage interest you deducted on lines 10 producer or royalty owner. They paid 5000 in interest on the home equity loan in 2014.

Source: pinterest.com

Source: pinterest.com

The worksheet in the TaxAct program titled Form 6251 - Home Mortgage Interest Adjustment Worksheet - Line 4 calculates the amount to transfer to Line 4 of IRS Form 6251 Alternative Minimum Tax - Individuals as an adjustment to the AMT tax calculated. Include a worksheet that may help you determine whether. However on the Deductible Home Mortgage Interest Worksheet TurboTax adds the full amount of all 3 loans together even though 2 of them have been paid off to calculate the average balance of all home acquisition debt part 2 line 2 so my debt appears 3 x larger than it. QRI is interest on. Enter the total of the home mortgage interest you deducted on lines 10 producer or royalty owner.

Source: fool.com

Source: fool.com

The instructions for Form 6251 include a worksheet to help taxpayers determine the correct home mortgage interest adjustment. Click the Forms link on the right side of the screen. They paid 5000 in interest on the home equity loan in 2014. 24000 on line 1 10000 plus 9000 plus 5000 10000 on line 2 9000 on line 3 -0- on line 4 19000 on line 5 10000 plus 9000 and 5000 on line 6 24000 minus 19000. They enter the following amounts on the Home Mortgage Interest Adjustment Worksheet.

Source: slideshare.net

Source: slideshare.net

In 2018 this is also the. If you end up taking the Standard Deduction the interest wont be used for the Federal return. Lines 7 through 21. Mortgage interest years before 2018 and after 2025. If the mortgage interest.

Source: investopedia.com

Source: investopedia.com

The instructions for Form 6251 include a worksheet to help taxpayers determine the correct home mortgage interest adjustment. Click Tools on the right side of the screen to expand the. Year however no AMT adjustment is needed since. To access the Deductible Home Mortgage Interest Worksheet in ProSeries. The instructions for Form 6251 include a worksheet to help taxpayers determine the correct home mortgage interest adjustment.

This was a change from the Tax Cuts and Jobs Act. I refinanced once - and my mortgage was also sold from one bank to another in 2019 - so I received 3 1098 Forms. 24000 on line 1 10000 plus 9000 plus 5000 10000 on line 2 9000 on line 3 -0- on line 4 19000 on line 5 10000 plus 9000 and 5000 on line 6 24000 minus 19000. For the regular tax individual taxpayers can deduct mortgage interest that is qualified residence interest QRI. For purposes of calculating the AMT home mortgage interest adjustment any interest amounts entered in the Home Mortgage Interest Limitation section in the MortgInt screen that are omitted from this section will be treated as eligible mortgage interest to the extent the deduction for mortgage interest is allowed.

In 2018 this is also the. For purposes of calculating the AMT home mortgage interest adjustment any interest amounts entered in the Home Mortgage Interest Limitation section in the MortgInt screen that are omitted from this section will be treated as eligible mortgage interest to the extent the deduction for mortgage interest is allowed. Include a worksheet that may help you determine whether. Complete the Home Mortgage Interest Adjustment Worksheet provided in the 2017 federal form 6251 instructions the amount of your using Iowa home mortgage interest deduction entered on the IA 1040 Schedule A. Tap the F6 key to go to the Open Forms window.

Source: pinterest.com

Source: pinterest.com

For the regular tax individual taxpayers can deduct mortgage interest that is qualified residence interest QRI. The worksheet in the TaxAct program titled Form 6251 - Home Mortgage Interest Adjustment Worksheet - Line 4 calculates the amount to transfer to Line 4 of IRS Form 6251 Alternative Minimum Tax - Individuals as an adjustment to the AMT tax calculated. This was a change from the Tax Cuts and Jobs Act. This ruling may affect the amount some taxpayers report as a home mortgage interest adjustment on Form 6251 Alternative Minimum Tax-IndividualsThe instructions for Form 6251 include a worksheet. Complete the Home Mortgage Interest Adjustment Worksheet provided in the 2017 federal form 6251 instructions the amount of your using Iowa home mortgage interest deduction entered on the IA 1040 Schedule A.

Source: thehgroup.com

Source: thehgroup.com

Complete the Home Mortgage Interest Adjustment Worksheet provided in the 2017 federal form 6251 instructions the amount of your using Iowa home mortgage interest deduction entered on the IA 1040 Schedule A. This information is needed now to calculate the amount of Home Mortgage Interest you can claim. This was a change from the Tax Cuts and Jobs Act. As clarified by Revenue Ruling 2005-11 a taxpayer should include in the worksheet calculation as interest paid on a mortgage whose proceeds were used to refinance an eligible mortgage qualified housing interest on a. To view the worksheet in TaxAct Online.

Source: slideplayer.com

Source: slideplayer.com

This ruling may affect the amount some taxpayers report as a home mortgage interest adjustment on Form 6251 Alternative Minimum Tax-IndividualsThe instructions for Form 6251 include a worksheet. Include a worksheet that may help you determine whether. To view the worksheet in TaxAct Online. Click Tools on the right side of the screen to expand the. Sign in to your TaxAct Online return.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title amt home mortgage interest adjustment worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.