15+ Adjusted current earnings worksheet Information

Home » Worksheets Online » 15+ Adjusted current earnings worksheet InformationYour Adjusted current earnings worksheet images are ready. Adjusted current earnings worksheet are a topic that is being searched for and liked by netizens today. You can Find and Download the Adjusted current earnings worksheet files here. Find and Download all royalty-free photos.

If you’re searching for adjusted current earnings worksheet pictures information connected with to the adjusted current earnings worksheet topic, you have come to the ideal site. Our site always gives you hints for refferencing the maximum quality video and image content, please kindly surf and locate more enlightening video content and images that fit your interests.

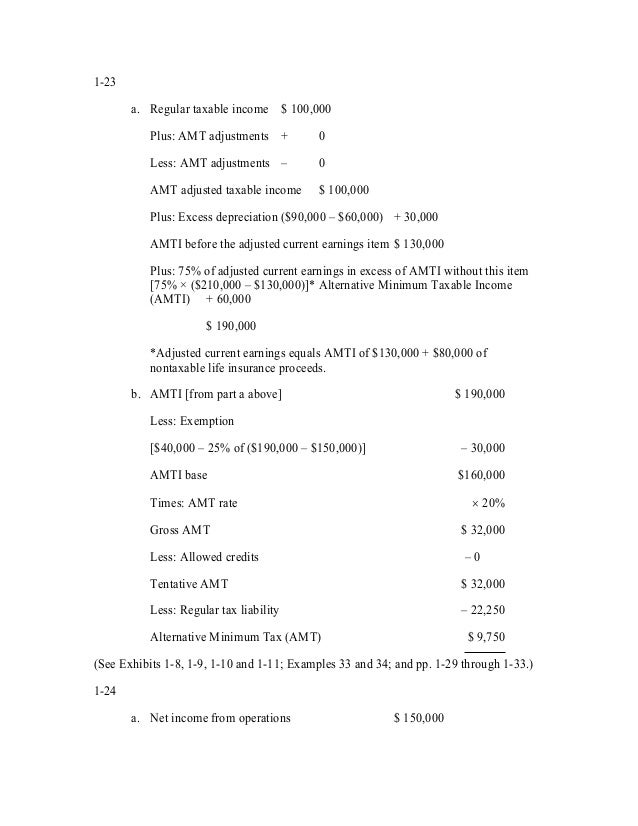

Adjusted Current Earnings Worksheet. 2018 Iowa Adjusted Current Earnings ACE Worksheet Instructions page 2. The Adjusted Current Earnings ACE depreciation adjustment is computed as the difference between the Alternative Minimum Tax and ACE depreciation. United States tax law defines the Adjusted Current Earnings ACE depreciation rules. In contrast a negative amount of adjusted current earnings of 10 exceeds a negative amount or loss of pre-adjustment alternative minimum taxable income of 30 by the difference between the absolute numbers or 20 3010.

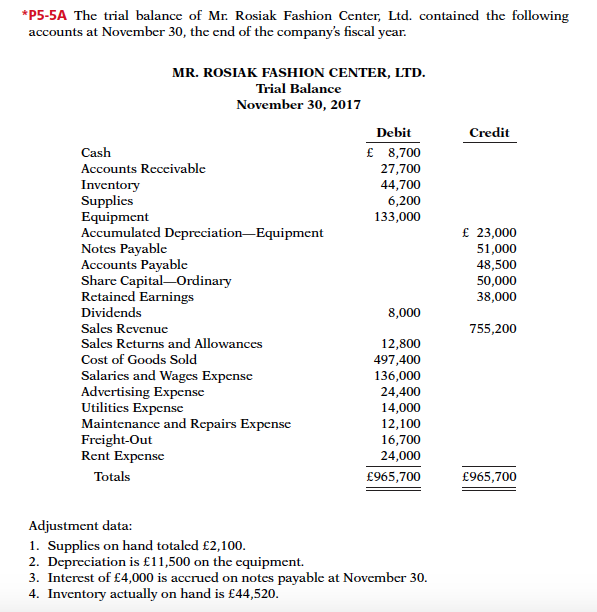

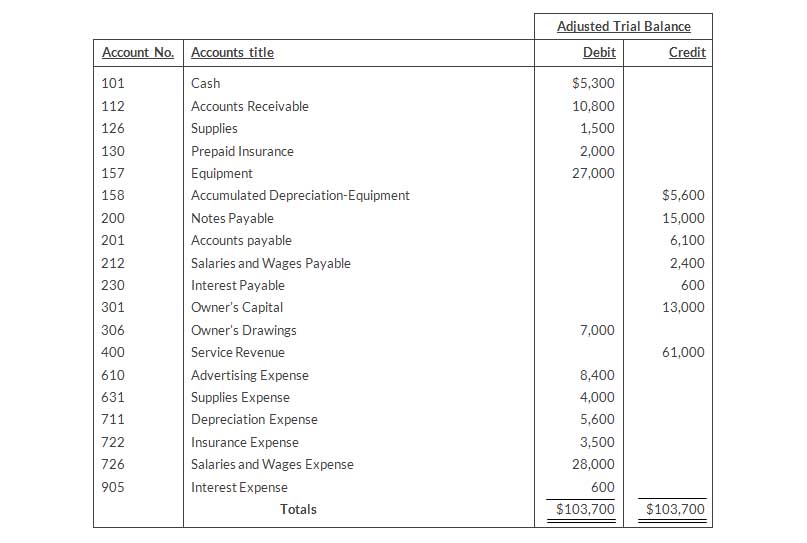

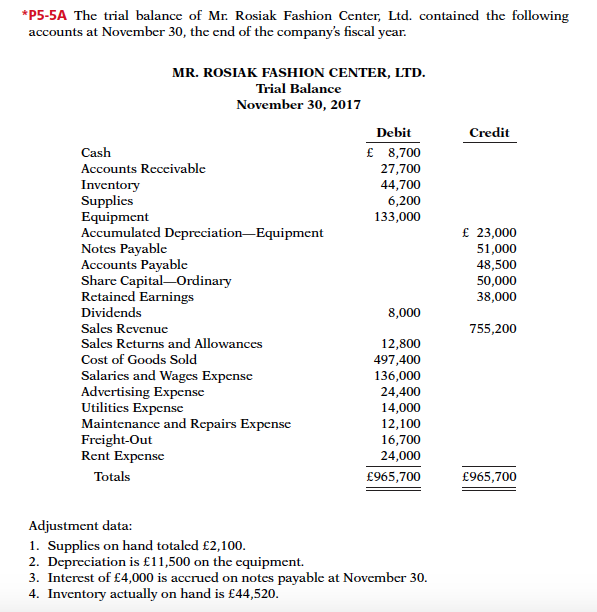

Instructions A Prepare An Adjusted Trial Chegg Com From chegg.com

Instructions A Prepare An Adjusted Trial Chegg Com From chegg.com

43-013d 09072018 pre-adjustment AMTI if the income items to which they relate were included in the corporations pre-adjustment AMTI for the tax year. Fair rate of return on business net tangible assets. Using a 10-column worksheet is an optional step companies may use in their accounting process. Print CAPE Ratio Cyclically Adjusted Price-to-Earnings Worksheet 1. In contrast a negative amount of adjusted current earnings of 10 exceeds a negative amount or loss of pre-adjustment alternative minimum taxable income of 30 by the difference between the absolute numbers or 20 3010. Worksheet MT-ACE Adjusted Current Earnings ACE Compute your adjusted current earnings mt-acepm6 Worksheet line 2e A Minnesota adjusted current earnings ACE depreciation adjust-ment is required on line 2e if you have property placed in service before 1988 that requires an adjustment on line 2b3 or 2b4 of the federal.

CPCA1402L 120913 Pre-adjustment AMTI.

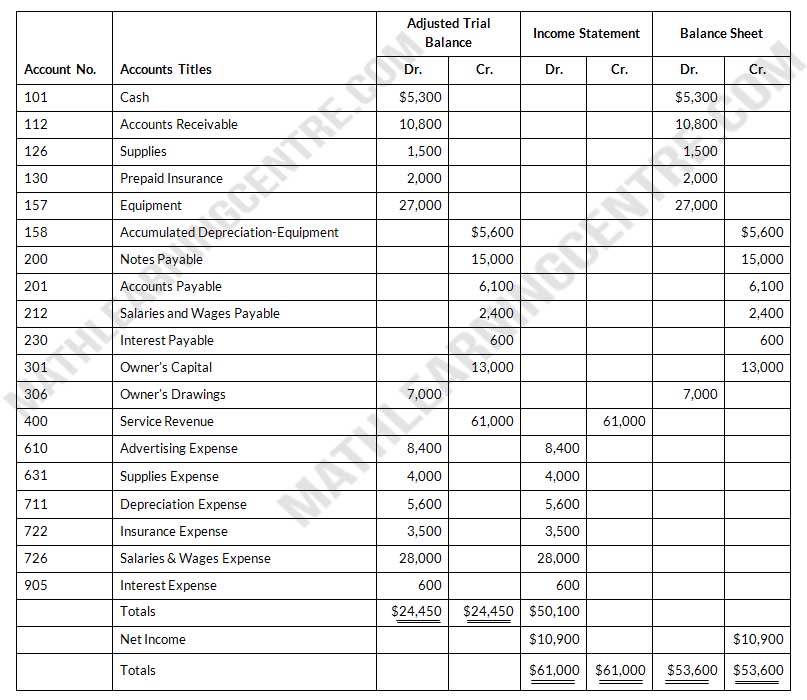

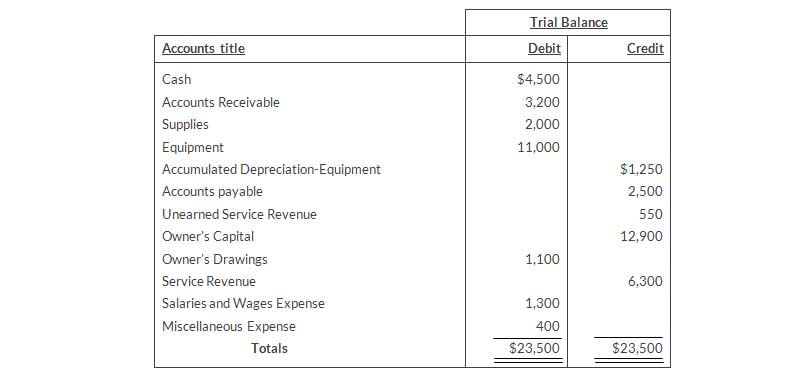

Fair rate of return on business net tangible assets. Iowa Adjusted Current Earnings Worksheet 43-013. The adjustment carries to the Form 4626 ACE worksheet or to the Schedule K Other Adjustments and Tax Preference Items line. The 10-column worksheet is an all-in-one spreadsheet showing the transition of account information from the trial balance through the financial statements. Adjusted current earnings ACE adjustment. Report Fraud Identity Theft.

Source: pinterest.com

Source: pinterest.com

Enter the California ACE amounts to calculate the CA Schedule P ACE Adjustment Worksheet. A company has a current market price of 100. Adjusted Current Earnings ACE Worksheet A See ACE Worksheet Instructions which begin on page 8. Accountants use the 10-column worksheet to help calculate end-of-period adjustments. In contrast a negative amount of adjusted current earnings of 10 exceeds a negative amount or loss of pre-adjustment alternative minimum taxable income of 30 by the difference between the absolute numbers or 20 3010.

Source: mathlearningcentre.com

Source: mathlearningcentre.com

Iowa Adjusted Current Earnings Worksheet 43-013. The application uses the information in this section to complete the CA Schedule P ACE Adjustment Worksheet for Schedule P of Form 100 or 100W. The 10-column worksheet is an all-in-one spreadsheet showing the transition of account information from the trial balance through the financial statements. United States tax law defines the Adjusted Current Earnings ACE depreciation rules. Print CAPE Ratio Cyclically Adjusted Price-to-Earnings Worksheet 1.

Source: mathlearningcentre.com

Source: mathlearningcentre.com

Retained earnings needs to be adjusted in the current period. Accordingly the adjustment for adjusted current earnings would be 75 percent of 40 or 30. Retained earnings needs to be adjusted in the current period. Also for line 8 of the ACE Worksheet take into account only property placed in service on or after the change date. Examples of these income items and.

Source: pinterest.com

Source: pinterest.com

SHP Regulation 24 CFR 583315 states Resident Rent. Enter the amount from line 3 of Form 4626. Enter zero on line 2c of the Adjusted Current Earnings ACE Worksheet. 43-013d 09072018 pre-adjustment AMTI if the income items to which they relate were included in the corporations pre-adjustment AMTI for the tax year. Subtract line 3 from line 4a.

Source: slideshare.net

Source: slideshare.net

When completing line 5 of the ACE Worksheet take into account only amounts from tax years beginning on or after the change date. When completing line 5 of the ACE Worksheet take into account only amounts from tax years beginning on or after the change date. Fair rate of return on business net tangible assets. 2018 Iowa Adjusted Current Earnings ACE Worksheet Instructions page 2. A company has a current market price of 100.

A company has a current market price of 100. Using a 10-column worksheet is an optional step companies may use in their accounting process. Adjusted current earnings ACE adjustment. Enter the amount from line 3 of Form 4626. The Capitalized Excess Earnings worksheet provides you with the following business valuation inputs.

Source: pinterest.com

Source: pinterest.com

Report Fraud Identity Theft. Also for line 8 of the ACE Worksheet take into account only property placed in service on or after the change date. Examples of these income items and. A company has a current market price of 100. This worksheet will determine the household rent payment based on the greatest of 10 of Monthly Gross Income or 30 of Monthly Adjusted Income.

Source: pinterest.com

Source: pinterest.com

Similarly a BCVR entry to recognise the land on hand at acquisition at fair value is made in the consolidation worksheet for each year that the land remains in the subsidiary. This form is not valid for Form 1120S returns. Accountants use the 10-column worksheet to help calculate end-of-period adjustments. 43-013d 09072018 pre-adjustment AMTI if the income items to which they relate were included in the corporations pre-adjustment AMTI for the tax year. Report Fraud Identity Theft.

Source: mathlearningcentre.com

Source: mathlearningcentre.com

In contrast a negative amount of adjusted current earnings of 10 exceeds a negative amount or loss of pre-adjustment alternative minimum taxable income of 30 by the difference between the absolute numbers or 20 3010. CPCA1402L 120913 Pre-adjustment AMTI. Similarly a BCVR entry to recognise the land on hand at acquisition at fair value is made in the consolidation worksheet for each year that the land remains in the subsidiary. Examples of these income items and. SHP Regulation 24 CFR 583315 states Resident Rent.

Source: pinterest.com

Source: pinterest.com

2018 Iowa Adjusted Current Earnings ACE Worksheet Instructions page 2. 2018 Iowa Adjusted Current Earnings ACE Worksheet Instructions page 2. Using a 10-column worksheet is an optional step companies may use in their accounting process. The 10-column worksheet is an all-in-one spreadsheet showing the transition of account information from the trial balance through the financial statements. The application uses the information in this section to complete the CA Schedule P ACE Adjustment Worksheet for Schedule P of Form 100 or 100W.

Source: pinterest.com

Source: pinterest.com

Examples of these. Worksheet MT-ACE Adjusted Current Earnings ACE Compute your adjusted current earnings mt-acepm6 Worksheet line 2e A Minnesota adjusted current earnings ACE depreciation adjust-ment is required on line 2e if you have property placed in service before 1988 that requires an adjustment on line 2b3 or 2b4 of the federal. Examples of these. CPCA1402L 120913 Pre-adjustment AMTI. Enter the California ACE amounts to calculate the CA Schedule P ACE Adjustment Worksheet.

Source: pinterest.com

Source: pinterest.com

The Adjusted Current Earnings ACE depreciation adjustment is computed as the difference between the Alternative Minimum Tax and ACE depreciation. United States tax law defines the Adjusted Current Earnings ACE depreciation rules. If the fields in this section are blank the application uses the CA AMT amount as the. ACE from line 10 of the ACE worksheet in the instructions. Enter zero on line 2c of the Adjusted Current Earnings ACE Worksheet.

Source: pinterest.com

Source: pinterest.com

If line 3 exceeds line 4a enter the difference. Using a 10-column worksheet is an optional step companies may use in their accounting process. Also for line 8 of the ACE Worksheet take into account only property placed in service on or after the change date. United States tax law defines the Adjusted Current Earnings ACE depreciation rules. Fair rate of return on business net tangible assets.

Source: pinterest.com

Source: pinterest.com

Iowa Adjusted Current Earnings ACE Worksheet 43013. Similarly a BCVR entry to recognise the land on hand at acquisition at fair value is made in the consolidation worksheet for each year that the land remains in the subsidiary. Adjusted current earnings ACE adjustment. The Adjusted Current Earnings ACE depreciation adjustment is computed as the difference between the Alternative Minimum Tax and ACE depreciation. Print CAPE Ratio Cyclically Adjusted Price-to-Earnings Worksheet 1.

Source: pinterest.com

Source: pinterest.com

You can update your ACE book according to ACE rules automatically. The Capitalized Excess Earnings worksheet provides you with the following business valuation inputs. Retained earnings needs to be adjusted in the current period. United States tax law defines the Adjusted Current Earnings ACE depreciation rules. Similarly a BCVR entry to recognise the land on hand at acquisition at fair value is made in the consolidation worksheet for each year that the land remains in the subsidiary.

Source: sk.pinterest.com

Source: sk.pinterest.com

Fair rate of return on business net tangible assets. In contrast a negative amount of adjusted current earnings of 10 exceeds a negative amount or loss of pre-adjustment alternative minimum taxable income of 30 by the difference between the absolute numbers or 20 3010. When completing line 5 of the ACE Worksheet take into account only amounts from tax years beginning on or after the change date. Iowa Adjusted Current Earnings ACE Worksheet 43013. The Adjusted Current Earnings ACE depreciation adjustment is computed as the difference between the Alternative Minimum Tax and ACE depreciation.

Source: chegg.com

Source: chegg.com

Also for line 8 of the ACE Worksheet take into account only property placed in service on or after the change date. 2018 Iowa Adjusted Current Earnings ACE Worksheet Instructions page 2. Examples of these. Accountants use the 10-column worksheet to help calculate end-of-period adjustments. Accordingly the adjustment for adjusted current earnings would be 75 percent of 40 or 30.

Source: pinterest.com

Source: pinterest.com

Report Fraud Identity Theft. Business earnings and earnings growth rate. SHP Regulation 24 CFR 583315 states Resident Rent. Examples of these. In contrast a negative amount of adjusted current earnings of 10 exceeds a negative amount or loss of pre-adjustment alternative minimum taxable income of 30 by the difference between the absolute numbers or 20 3010.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title adjusted current earnings worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.