42+ 2019 social security taxable benefits worksheet Live

Home » Free Worksheets » 42+ 2019 social security taxable benefits worksheet LiveYour 2019 social security taxable benefits worksheet images are ready in this website. 2019 social security taxable benefits worksheet are a topic that is being searched for and liked by netizens today. You can Get the 2019 social security taxable benefits worksheet files here. Download all royalty-free vectors.

If you’re searching for 2019 social security taxable benefits worksheet pictures information linked to the 2019 social security taxable benefits worksheet interest, you have come to the ideal blog. Our website always gives you suggestions for downloading the maximum quality video and image content, please kindly surf and find more informative video content and images that match your interests.

2019 Social Security Taxable Benefits Worksheet. On average this form takes 5 minutes to complete. Fill out securely sign print or email your 1040 social security worksheet 2014-2020 form instantly with SignNow. You exclude income from sources outside the United. Discover learning games guided lessons and other interactive activities for children.

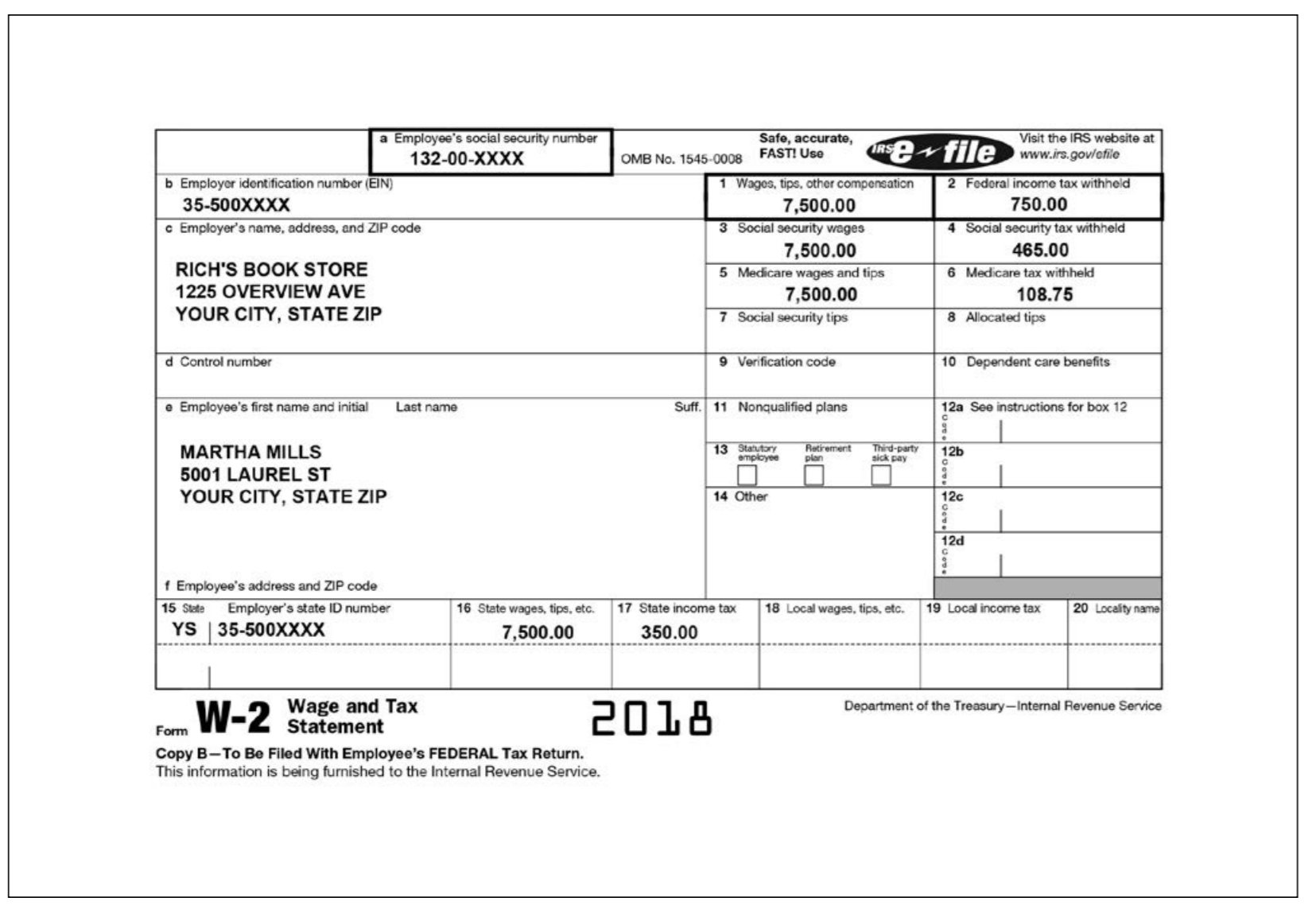

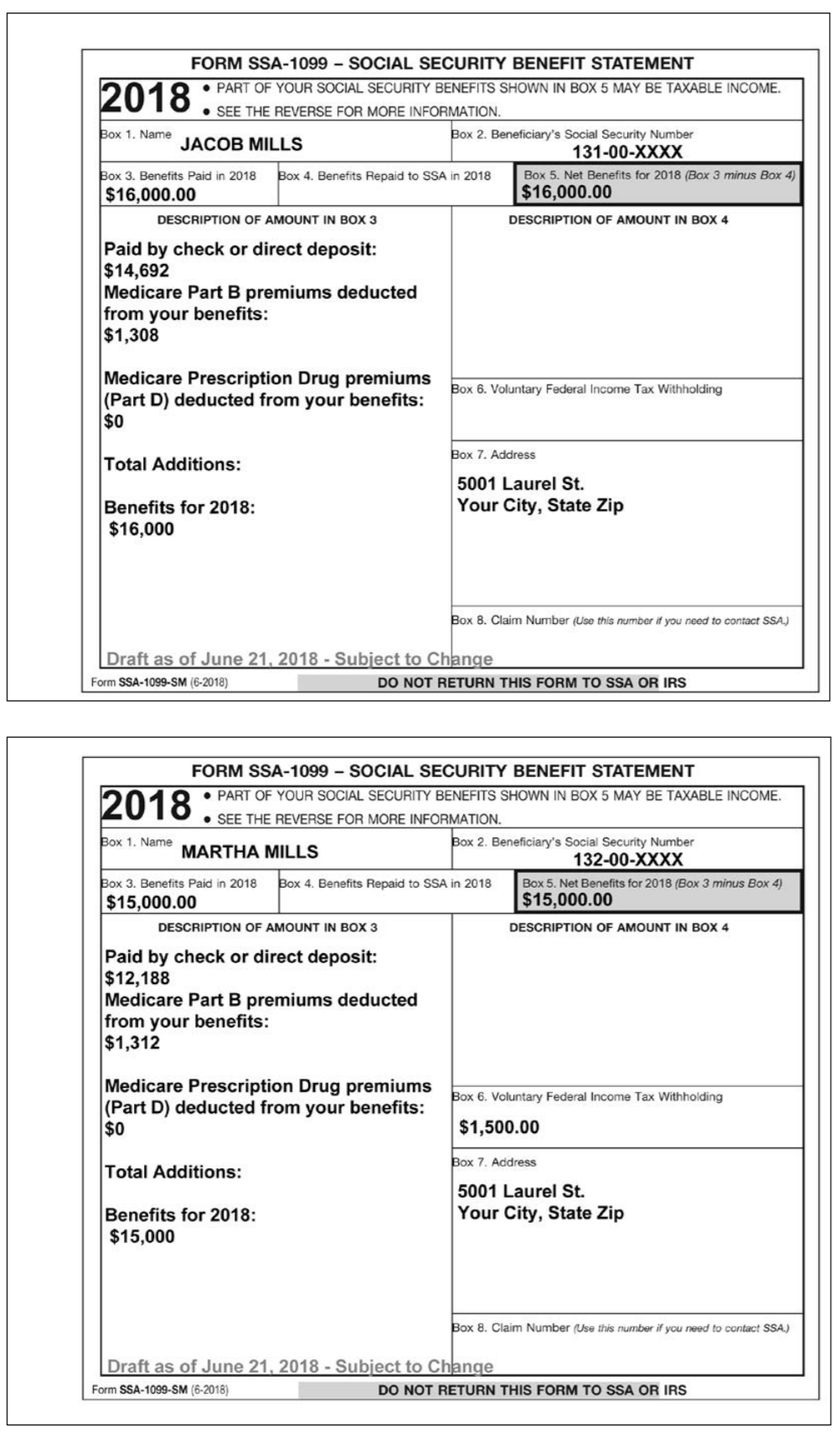

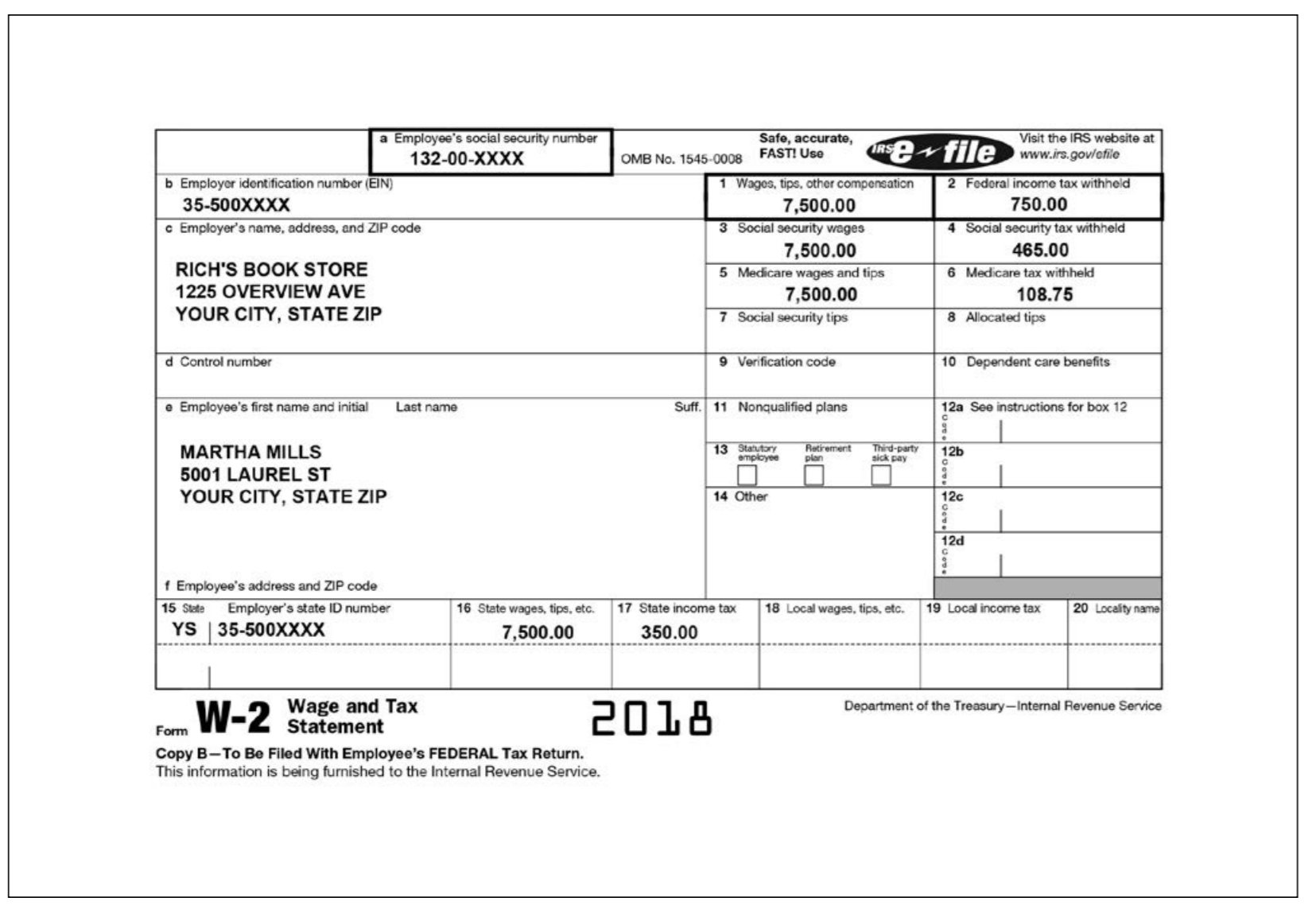

Basic Scenario 7 Jacob And Martha Mills Direction Chegg Com From chegg.com

Basic Scenario 7 Jacob And Martha Mills Direction Chegg Com From chegg.com

Instead go directly to IRS Pub. Enter the total amount from box 5 of all your Forms SSA1099 and. Enter the smaller of line 17 or line 18. As your gross income increases a higher percentage of your Social Security benefits become taxable up to a maximum of 85 of your total benefitsThe TaxAct program will automatically calculate the taxable amount of your Social Security income if any. Enter one-half of line 1. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

Worksheet April 18 2019 1536.

Worksheet April 18 2019 1536. Worksheet to Figure Taxable Social Security Benefits. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Use Fill to complete blank online IRS pdf forms for free. Enter the total amount from box 5 of all your Forms SSA1099 and. Subtract line 8 from line 7.

Source: chegg.com

Source: chegg.com

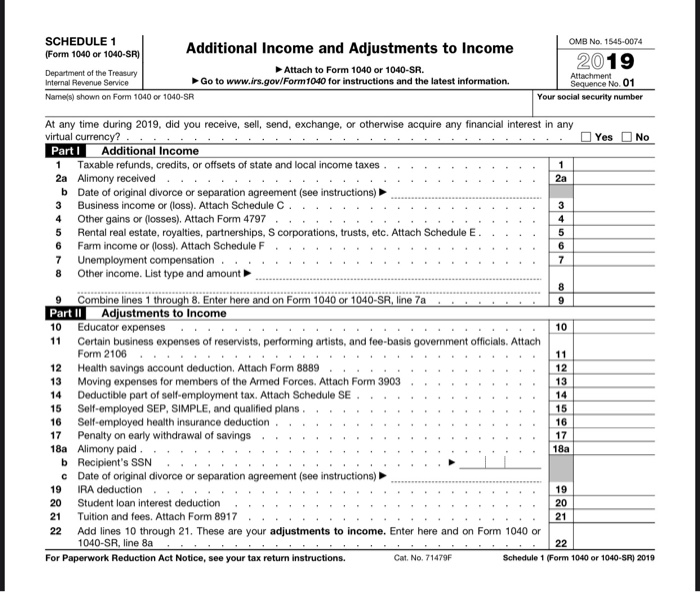

This calculator figures your taxable social security benefits based upon the IRSs 2019 Form 1040 2019 Schedule 1 and 2019 Publication 915 Worksheet 1 which was published January 10 2020 and made no substantive changes to the 2018 worksheet calculations. Social Security Benefits Worksheet Before you begin. Subtract line 8 from line 7. Worksheet instead of a publication to find out if any of your benefits are taxable. If you are married filing separately and you lived apart from your spouse for all of 2018 be sure you entered D to the right of the word benefits on line 5a.

Source: pinterest.com

Source: pinterest.com

Ray and Alice have two savings accounts with a total of 250 in taxable interest income. Worksheet instead of a publication to find out if any of your benefits are taxable. 915 Social Security and Equivalent Railroad Retirement Benefits. Once completed you can sign your fillable form or send for signing. Social security benefits worksheet 2019 form social security benefit sheet 2018 line 5a and 5b Conclusion.

Source: calamityjanetheshow.com

Source: calamityjanetheshow.com

If you are Married Filing separately and you lived apart from your spouse for all of 2019 enter D to the right of the word benefits on Form 1040 or 1040-SR line 5a. 915 Social Security and Equivalent Railroad Retirement Benefits. Social security benefits worksheet 2019 form social security benefit sheet 2018 line 5a and 5b Conclusion. Fill in lines A through E. If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security benefits.

Source: in.pinterest.com

Source: in.pinterest.com

If anyone is receiving social security benefits and he is receiving income from other sources too then it is possible that a portion of his income can be taxable. Social security benefits worksheet 2019 form social security benefit sheet 2018 line 5a and 5b Conclusion. As your gross income increases a higher percentage of your Social Security benefits become taxable up to a maximum of 85 of your total benefitsThe TaxAct program will automatically calculate the taxable amount of your Social Security income if any. The Form 1040 Social Security Benefits Worksheet IRS 2018 form is 1 page long. Discover learning games guided lessons and other interactive activities for children.

Source: calamityjanetheshow.com

Source: calamityjanetheshow.com

Enter the total amount from box 5 of all your Forms SSA1099 and. Instead go directly to IRS Pub. Do not use the worksheet below if any of the following apply to you. If you are Married Filing separately and you lived apart from your spouse for all of 2019 enter D to the right of the word benefits on Form 1040 or 1040-SR line 5a. None of your social security benefits are taxable.

Source: pinterest.com

Source: pinterest.com

Fill out securely sign print or email your 1040 social security worksheet 2014-2020 form instantly with SignNow. Enter the total amount from box 5 of all your Forms SSA1099 and. More specifically if your total taxable income wages pensions interest dividends etc plus any tax-exempt income plus half of your Social Security benefits exceed. Start a free trial now to save yourself time and money. If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security benefits.

Source: pinterest.com

Source: pinterest.com

All forms are printable and downloadable. Social security benefits worksheet 2019 form social security benefit sheet 2018 line 5a and 5b Conclusion. Instead go directly to IRS Pub. 3 Enter taxable income excluding SS benefits IRS Form 1040 lines 7 8a 8b 9-14 15b 16b 17-19. Worksheet instead of a publication to find out if any of your benefits are taxable.

Source: pinterest.com

Source: pinterest.com

Social Security Worksheet 2019. On average this form takes 5 minutes to complete. Social Security Benefits Worksheet Before you begin. Worksheet to Figure Taxable Social Security Benefits. WK_SSBLD Names as shown on return Tax ID Number.

Source: pinterest.com

Source: pinterest.com

Enter the total amount from box 5 of all your Forms SSA1099 and. Enter the total amount from box 5 of all your Forms SSA1099 and. Enter one-half of line 1. If you are married filing separately and you lived apart from your spouse for all of 2018 be sure you entered D to the right of the word benefits on line 5a. We developed this worksheet for you to see if your benefits may be taxable for 2020.

Source: chegg.com

Source: chegg.com

The Form 1040 Social Security Benefits Worksheet IRS 2018 form is 1 page long. Worksheet April 18 2019 1536. The Form 1040 Social Security Benefits Worksheet IRS 2018 form is 1 page long. Also enter this amount on Form 1040 line 20a. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

Source: chegg.com

Source: chegg.com

Fill in lines A through E. Fill out securely sign print or email your 1040 social security worksheet 2014-2020 form instantly with SignNow. They find none of Rays social security benefits are taxable. This calculator figures your taxable social security benefits based upon the IRSs 2019 Form 1040 2019 Schedule 1 and 2019 Publication 915 Worksheet 1 which was published January 10 2020 and made no substantive changes to the 2018 worksheet calculations. Enter the smaller of line 17 or line 18.

Source: chegg.com

Source: chegg.com

Discover learning games guided lessons and other interactive activities for children. Start a free trial now to save yourself time and money. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Instead go directly to IRS Pub. On Form 1040 they enter 5600 on line 6a and -0-.

Source: calamityjanetheshow.com

Source: calamityjanetheshow.com

More specifically if your total taxable income wages pensions interest dividends etc plus any tax-exempt income plus half of your Social Security benefits exceed. Enter the total amount from box 5 of all your Forms SSA1099 and. Subtract line 8 from line 7. Fill in lines A through E. Also enter this amount on Form 1040 line 20a.

Source: calamityjanetheshow.com

Source: calamityjanetheshow.com

Do not use the worksheet below if any of the following apply to you. This calculator figures your taxable social security benefits based upon the IRSs 2019 Form 1040 2019 Schedule 1 and 2019 Publication 915 Worksheet 1 which was published January 10 2020 and made no substantive changes to the 2018 worksheet calculations. Social Security Benefits Worksheet Before you begin. Discover learning games guided lessons and other interactive activities for children. Fill in lines A through E.

Source: pinterest.com

Source: pinterest.com

They complete Worksheet 1 shown below entering 29750 15500 14000 250 on line 3. Discover learning games guided lessons and other interactive activities for children. Form 1040 Social Security Benefits Worksheet IRS 2018. Social Security Benefits Worksheet - Taxable Amount If your income is modest it is likely that none of your Social Security benefits are taxable. You received Form RRB-1099 Form SSA-1042S or Form RRB-1042S.

Source: pinterest.com

Source: pinterest.com

If anyone is receiving social security benefits and he is receiving income from other sources too then it is possible that a portion of his income can be taxable. Many of those who receive Social Security retirement benefits will have to pay income tax on some or all of those payments. Instead go directly to IRS Pub. You exclude income from sources outside the United. The Form 1040 Social Security Benefits Worksheet IRS 2018 form is 1 page long.

Source: pinterest.com

Source: pinterest.com

They complete Worksheet 1 shown below entering 29750 15500 14000 250 on line 3. Worksheet April 18 2019 1536. 915 Social Security and Equivalent Railroad Retirement Benefits. 2019 Social Security Taxable Benefits. Enter the total amount from box 5 of all your Forms SSA1099 and.

Source: pinterest.com

Source: pinterest.com

Once completed you can sign your fillable form or send for signing. Do not use this worksheet if any of the following apply. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Do not use the worksheet below if any of the following apply to you. None of your social security benefits are taxable.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 2019 social security taxable benefits worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.