41++ 2019 california estimated tax worksheet Info

Home » Live Worksheets » 41++ 2019 california estimated tax worksheet InfoYour 2019 california estimated tax worksheet images are available in this site. 2019 california estimated tax worksheet are a topic that is being searched for and liked by netizens today. You can Download the 2019 california estimated tax worksheet files here. Get all royalty-free vectors.

If you’re looking for 2019 california estimated tax worksheet pictures information linked to the 2019 california estimated tax worksheet topic, you have pay a visit to the ideal blog. Our site frequently provides you with hints for downloading the highest quality video and picture content, please kindly search and locate more informative video content and images that match your interests.

2019 California Estimated Tax Worksheet. Mental Health Services Tax Multiply line E by line F. Make your check or money order payable to the Franchise Tax Board. Return as a guide for figuring your 2020 estimated tax. Note that if have too much tax includes withheld UC you will receive a refund when you file your tax return.

Taxes For The Self Employed How To File The Perfect Income Tax Return Youtube Income Tax Return Estimated Tax Payments Tax Forms From pinterest.com

Taxes For The Self Employed How To File The Perfect Income Tax Return Youtube Income Tax Return Estimated Tax Payments Tax Forms From pinterest.com

To calculate your estimated taxes you will add up your total tax liability for the yearincluding self-employment tax income tax and any other taxesand divide that number by four. In this case estimated tax payments are not due for 2018. File Form 1041 for 2019 by March 1 2020 and pay the total tax due. Make your check or money order payable to the Franchise Tax Board. Fraction of 1000 by which you expect your estimated deductions for the year to exceed your allowable standard deduction. Use 100 last years amount from the line above.

Make your check or money order payable to the Franchise Tax Board.

Discover learning games guided lessons and other interactive activities for children. California Use Tax Information. Additional amount of state income tax to be withheld each pay period if employer agrees Worksheet C OR 3. Refund from prior year designated as an estimated payment. The Instructions for the 2019 Estimated Tax Worksheet. Fraction of 1000 by which you expect your estimated deductions for the year to exceed your allowable standard deduction.

Source: pinterest.com

Source: pinterest.com

The Lookup Table below may be used to pay estimated use tax for personal items purchased for less than 1000 each. If you use the calculator you dont need to complete any of the worksheets for the UC W -4DE 4. Adjusted Gross Income Range. You can calculate your estimated taxes on the IRS Estimated Tax Worksheet found in Form 1040-ES for individuals or Form 1120-W for corporations will guide. In this case estimated tax payments are not due for 2018.

Source: pinterest.com

Source: pinterest.com

Additional amount of state income tax to be withheld each pay period if employer agrees Worksheet C OR 3. Fraction of 1000 by which you expect your estimated deductions for the year to exceed your allowable standard deduction. 2019 California Estimated Tax The 2019 Estimated Tax 2018 Estimated Tax Estimated Tax 2 10 Tax 2019 Estimated Product Estimated Quotients Tax Computation 2019 Exact And Estimated Data Estimated Products For Grade 4 2019 2 2019 Qualified Dividends And Capital Gain Tax Problem Solving Skills Estimated Or Exact Amounts 2019 51 2019 Calendars. The 2019 Estimated Tax Worksheet by January 15 2020. Adjusted Gross Income Range.

Source: investopedia.com

Source: investopedia.com

Refund from prior year designated as an estimated payment. Balance override if a different amount is. Discover learning games guided lessons and other interactive activities for children. Return as a guide for figuring your 2020 estimated tax. Use 100 last years amount from the line above.

Source: pinterest.com

Source: pinterest.com

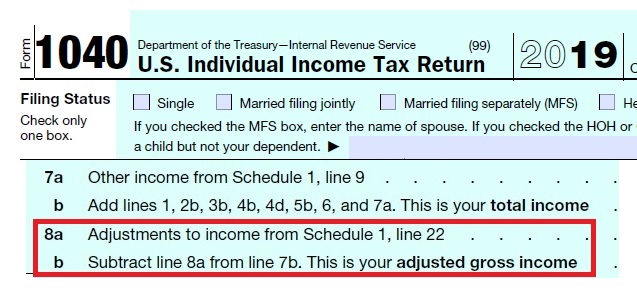

The Instructions for the 2019 Estimated Tax Worksheet. Be sure that the amount shown on line 21 of the CA Estimated Tax Worksheet has been reduced by any overpaid tax on your 2018 tax return which you chose to apply toward your 2019 estimated tax payment. For fiscal year estates pay the total estimated tax by the 15th day of the 1st month following the close of the tax. Write your SSN or ITIN and 2021 Form 540-ES on. Enter the amount here and on line 10 of the 2019 Estimated Tax Worksheet on the next page.

Source: pinterest.com

Source: pinterest.com

Balance override if a different amount is. Make your check or money order payable to the Franchise Tax Board. Please use the California Estimated Tax worksheet in the Instructions for Form 540-ES Estimated Tax for Individuals 540ES Form Instructions to figure your estimated tax payments. Mental Health Services Tax Multiply line E by line F. To your projected total tax for 2019.

Source: insuremekevin.com

Source: insuremekevin.com

Additional amount of state income tax to be withheld each pay period if employer agrees Worksheet C OR 3. The Instructions for the 2019 Estimated Tax Worksheet. The 2019 Estimated Tax Worksheet by January 15 2020. Return as a guide for figuring your 2020 estimated tax. In this case dont make estimated tax payments for 2019.

Source: insuremekevin.com

Source: insuremekevin.com

Number of allowances from the Estimated Deductions Worksheet B Total Number of Allowances A B when using the California Withholding Schedules for 2016 OR 2. Mental Health Services Tax Multiply line E by line F. Be sure that the amount shown on line 21 of the CA Estimated Tax Worksheet has been reduced by any overpaid tax on your 2018 tax return which you chose to apply toward your 2019 estimated tax payment. Please use the California Estimated Tax worksheet in the Instructions for Form 540-ES Estimated Tax for Individuals 540ES Form Instructions to figure your estimated tax payments. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

This table can only be used to report use tax on your 2020 California Income Tax Return. If you are required to use this worksheet to figure the tax on an amount from another form or worksheet such as the Qualified Dividends. Pay the total estimated tax by January 15 2019. For more information about Use Tax please visit. WORKSHEET B ESTIMATED DEDUCTIONS 1.

Source: investopedia.com

Source: investopedia.com

2019 California Estimated Tax The 2019 Estimated Tax 2018 Estimated Tax Estimated Tax 2 10 Tax 2019 Estimated Product Estimated Quotients Tax Computation 2019 Exact And Estimated Data Estimated Products For Grade 4 2019 2 2019 Qualified Dividends And Capital Gain Tax Problem Solving Skills Estimated Or Exact Amounts 2019 51 2019 Calendars. To your projected total tax for 2019. Use the CA Estimated Tax Worksheet and your 2019 California income tax. Use the CA Estimated Tax Worksheet and your 2018 California income tax return as a guide for figuring your 2019 estimated tax. You can calculate your estimated taxes on the IRS Estimated Tax Worksheet found in Form 1040-ES for individuals or Form 1120-W for corporations will guide.

Source: pinterest.com

Source: pinterest.com

Enter the amount here and on line 10 of the 2019 Estimated Tax Worksheet on the next page. File Form 541 California Fiduciary Income Tax Return for 2018 on or before March 1 2019 and pay the total tax due. To your projected total tax for 2019. The 2019 Estimated Tax Worksheet. The Lookup Table below may be used to pay estimated use tax for personal items purchased for less than 1000 each.

Source: ftb.ca.gov

Source: ftb.ca.gov

Be sure that the amount shown on line 21 of the CA Estimated Tax Worksheet has been reduced by any overpaid tax on your 2018 tax return which you chose to apply toward your 2019 estimated tax payment. Adjusted Gross Income Range. WORKSHEET B ESTIMATED DEDUCTIONS 1. California Use Tax Information. Enter an estimate of your itemized deductions for California taxes for this tax year as listed in.

Source: investopedia.com

Source: investopedia.com

If you are required to use this worksheet to figure the tax on an amount from another form or worksheet such as the Qualified Dividends. The Instructions for the 2019 Estimated Tax Worksheet. When figuring your required estimated tax payments you must pay the lesser of 100 percent of last years tax or 90 percent of your current years tax. Enter the amount here and on line 10 of the 2019 Estimated Tax Worksheet on the next page. See the instructions for line 12a to see if you must use the worksheet below to figure your tax.

Source: hrblock.com

Source: hrblock.com

You can calculate your estimated taxes on the IRS Estimated Tax Worksheet found in Form 1040-ES for individuals or Form 1120-W for corporations will guide. The Instructions for the 2019 Estimated Tax Worksheet. Pay the total estimated tax by January 15 2019. Be sure that the amount shown on line 21 of the CA Estimated Tax Worksheet has been reduced by any overpaid tax on your 2019 tax return which you chose to apply toward your 2020 estimated tax payment. Return as a guide for figuring your 2020 estimated tax.

Source: in.pinterest.com

Source: in.pinterest.com

The 2019 Tax Rate Schedules for your filing status Your 2018 tax return and instructions to use as a guide to figuring your income deductions and credits but be sure to consider the items listed under What. In this case estimated tax payments are not due for 2018. In this case dont make estimated tax payments for 2019. Discover learning games guided lessons and other interactive activities for children. This table can only be used to report use tax on your 2020 California Income Tax Return.

Source: pinterest.com

Source: pinterest.com

For fiscal year estates pay the total estimated tax by the 15th day of the 1st month following the close of the tax. Additional amount of state income tax to be withheld each pay period if employer agrees Worksheet C OR 3. 2019 California Estimated Tax The 2019 Estimated Tax 2018 Estimated Tax Estimated Tax 2 10 Tax 2019 Estimated Product Estimated Quotients Tax Computation 2019 Exact And Estimated Data Estimated Products For Grade 4 2019 2 2019 Qualified Dividends And Capital Gain Tax Problem Solving Skills Estimated Or Exact Amounts 2019 51 2019 Calendars. Vouchers to pay your estimated tax by mail. If you have too little tax withheld Deductionyou will owe tax when you file your tax return.

Source: pinterest.com

Source: pinterest.com

2019 Tax Computation WorksheetLine 12a k. Discover learning games guided lessons and other interactive activities for children. Use 100 of the 2021 estimated total tax. Use the Estimated Tax Worksheet on the next page and the 2018 Form 541 tax return as a guide for figuring the 2019 estimated tax payment. For fiscal year estates pay the total estimated tax by the 15th day of the 1st month following the close of the tax.

Source: investopedia.com

Source: investopedia.com

If you use the calculator you dont need to complete any of the worksheets for the UC W -4DE 4. California Use Tax Information. Vouchers to pay your estimated tax by mail. The 2019 Estimated Tax Worksheet. Be sure that the amount shown on line 21 of the CA Estimated Tax Worksheet has been reduced by any overpaid tax on your 2019 tax return which you chose to apply toward your 2020 estimated tax payment.

Source: communitytax.com

Source: communitytax.com

Use 100 of the 2021 estimated total tax. Mental Health Services Tax Multiply line E by line F. Refund from prior year designated as an estimated payment. Note that if have too much tax includes withheld UC you will receive a refund when you file your tax return. Fraction of 1000 by which you expect your estimated deductions for the year to exceed your allowable standard deduction.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 2019 california estimated tax worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.