12++ 2017 tax computation worksheet line 44 Free Download

Home » Live Worksheets » 12++ 2017 tax computation worksheet line 44 Free DownloadYour 2017 tax computation worksheet line 44 images are available. 2017 tax computation worksheet line 44 are a topic that is being searched for and liked by netizens today. You can Get the 2017 tax computation worksheet line 44 files here. Download all royalty-free photos and vectors.

If you’re searching for 2017 tax computation worksheet line 44 pictures information linked to the 2017 tax computation worksheet line 44 keyword, you have pay a visit to the ideal site. Our site always provides you with suggestions for downloading the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

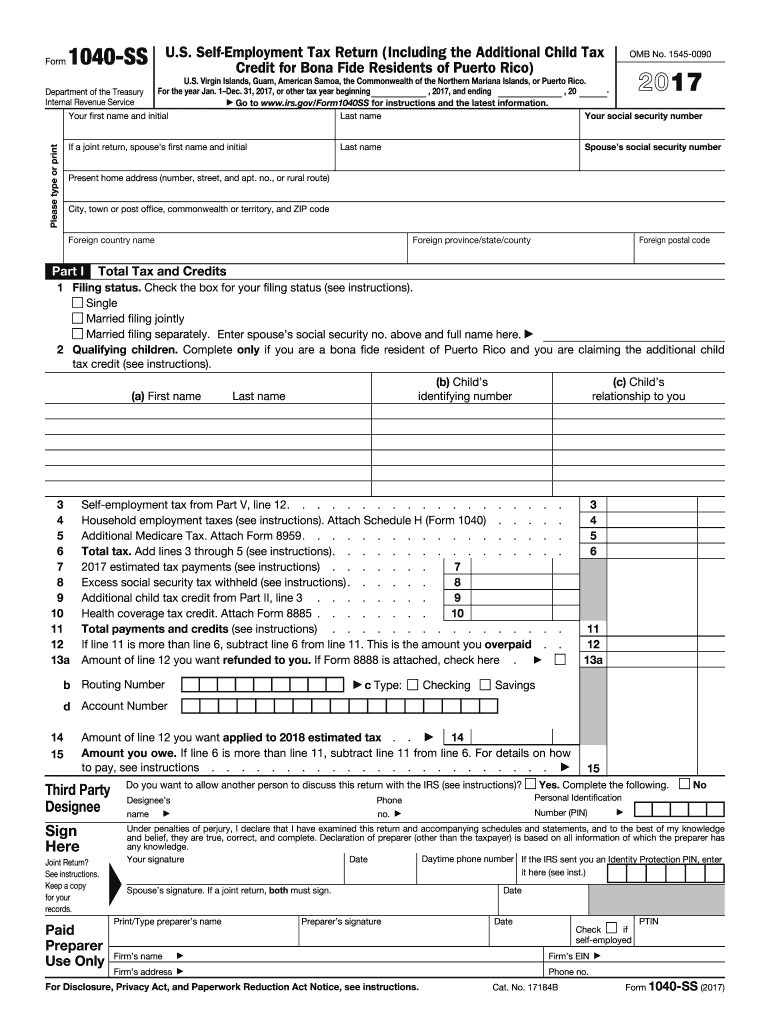

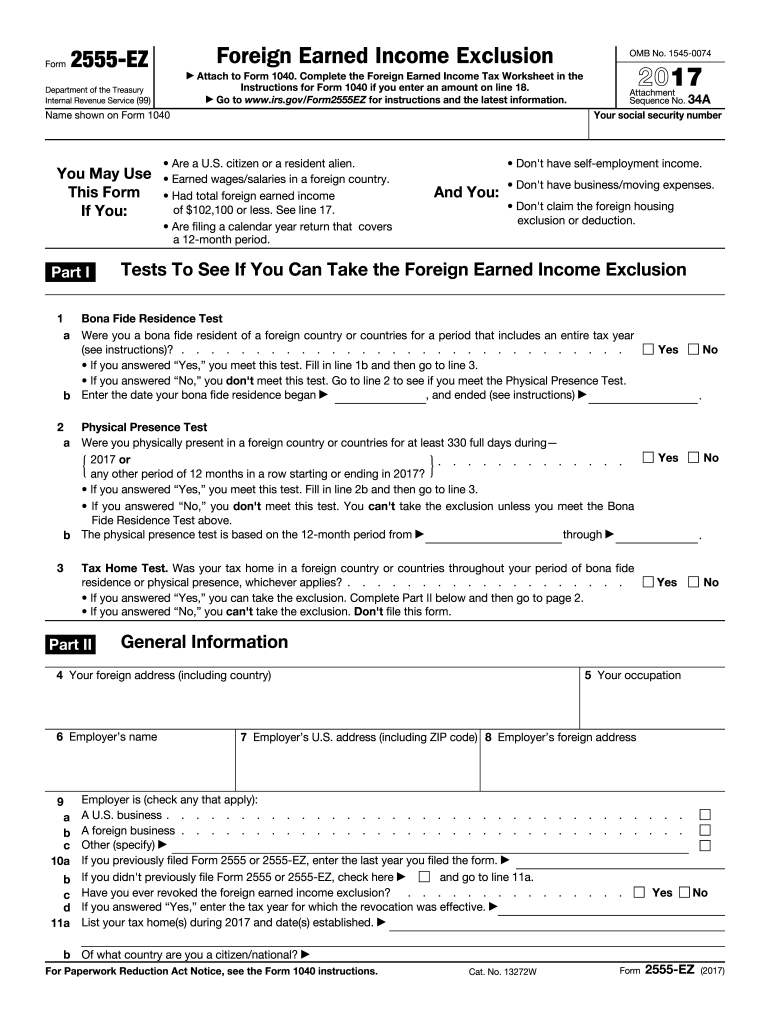

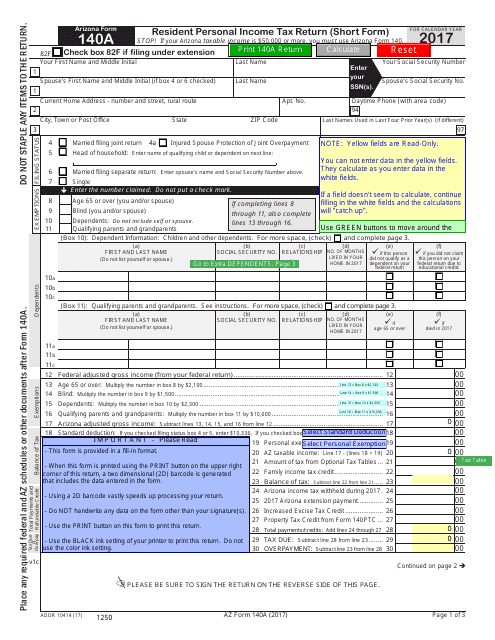

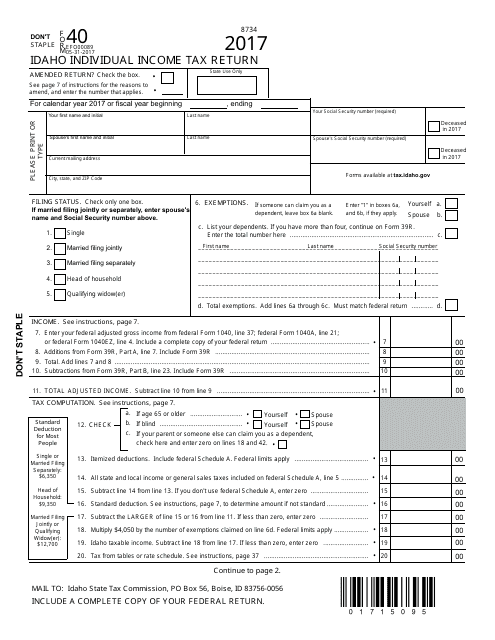

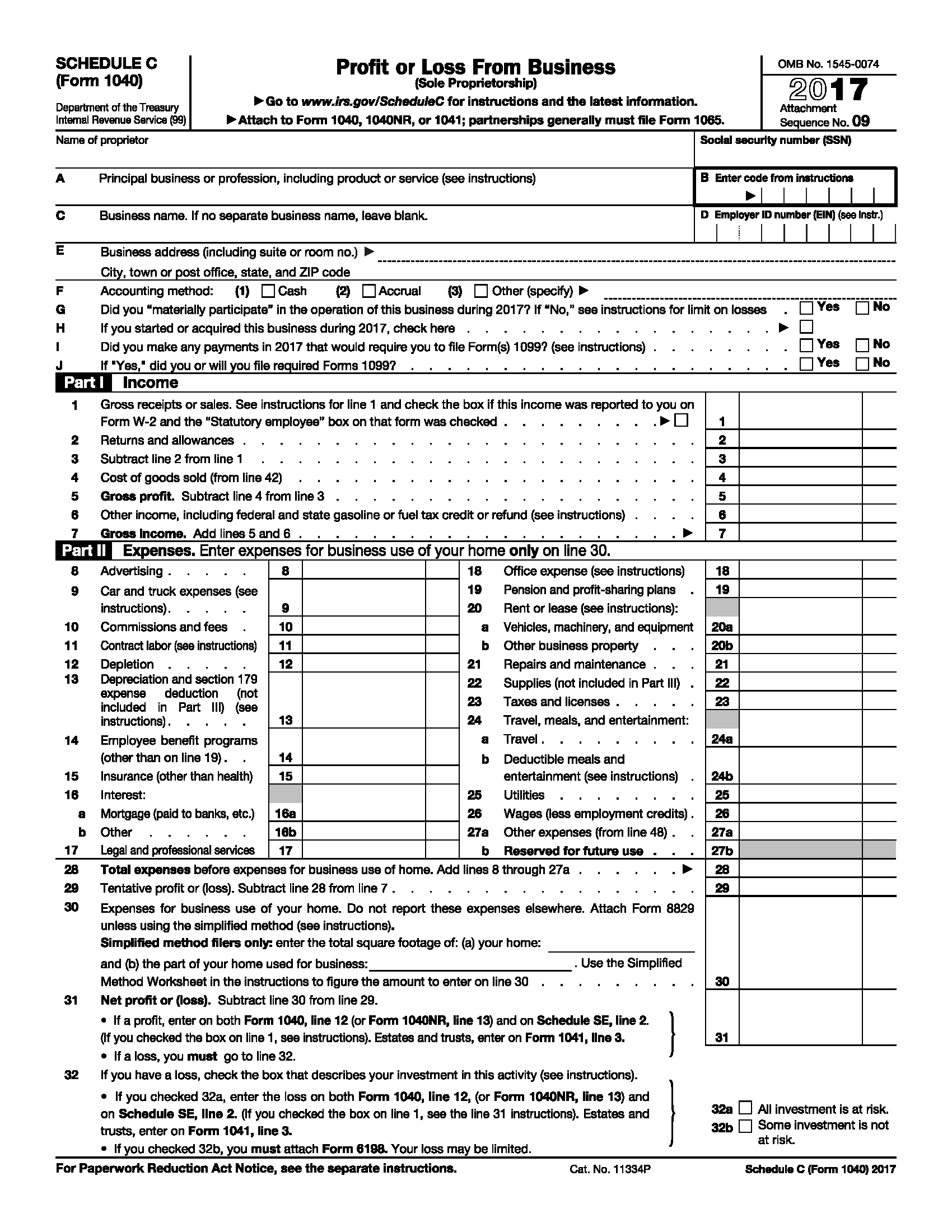

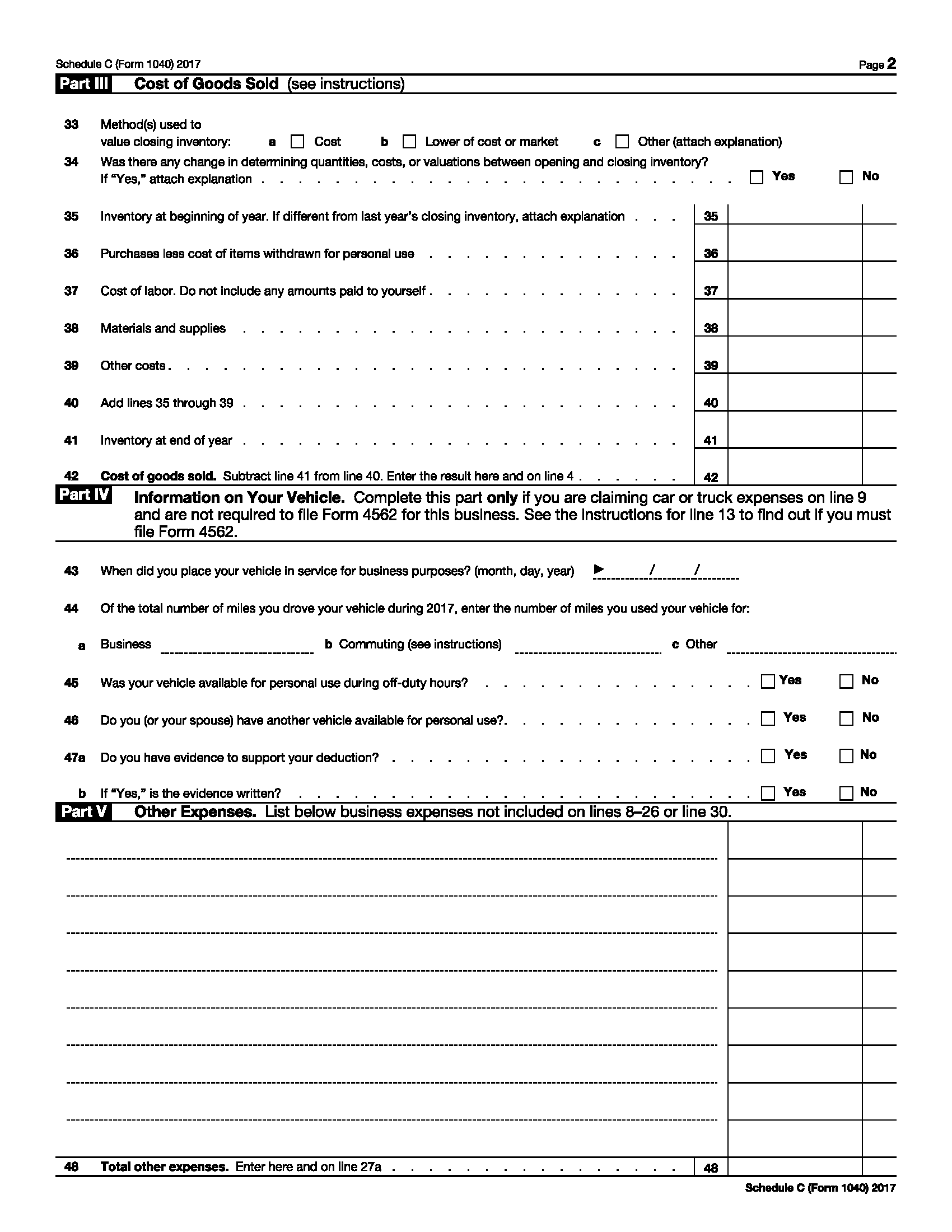

2017 Tax Computation Worksheet Line 44. Use this Worksheet for both Tax Computation Worksheet and Tax Table no need to manually search the long and fine printed tax table. Your social security number. If you are filing Form 2555 or 2555-EZ do not enter this amount on Form 1040 line 44. Tax Calculator for Tax Year 2017.

Elections Cdn Sos Ca Gov From

Your social security number. If the amount on line 1 is 100000 or more use the Tax Computation Worksheet. Standard Deduction Worksheet for Dependents Line 40. You must use the Foreign Earned Income Include in the total on line 44 all of theHowever do not use the Tax Table orTax Worksheet on page 36 instead. Enter the smaller of line 25 or line 26. If its 100000 or more use the Tax Computation Worksheet.

Instead enter it on line 4 of the Foreign Earned Income Tax Worksheet 27.

Simplified Method Worksheet Lines 16a and 16b. Ad The most comprehensive library of free printable worksheets digital games for kids. Standard Deduction Worksheet for Dependents Line 40. Ad The most comprehensive library of free printable worksheets digital games for kids. See the instructions for line 44 to see which tax computation method applies. Tax Calculator for Tax Year 2017.

Source:

Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10. Names shown on return. Tax Computation Worksheet for Line44 Before you begin. Estimate prepare and e-File your 2019 Taxes now. Hi and welcome to JustAnswer.

Source: oreilly.com

Source: oreilly.com

Enter the amount from line 7 of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line 44 or the amount from line 19 of the Schedule D Tax Worksheet whichever applies as figured for the regular tax. If your taxable income is under 100000 use the IRS Tax Table to determine the tax rate for line 44. Tax Computation Worksheet for Line44 Before you begin. Tax Calculator for Tax Year 2017. Be relevant if you purchased health insurance coverage for 2017 through the Health Insurance Marketplace and wish to claim the premium tax credit on line 69.

Source: marottaonmoney.com

Source: marottaonmoney.com

This Tax Calculator lets you calculate your 2017 IRS Taxes. You can no longer e-File your 2017 Tax Return. Standard Deduction Worksheet for Dependents Line 40. However you don t need to wait to receive this form to file your return. If you did not complete either worksheet.

Source: oreilly.com

Source: oreilly.com

Tax on the amount on line 2. You may rely on other information received from your employer. Do not use a second Foreign Earned Income Tax Worksheet to figure the tax on this line 4. State and Local Income Tax Refund Worksheet. The IRS instructions for Form 1040 line 44 starting in the right column on page 41 explain the conditions for using each of the 7 methods.

Source: oreilly.com

Source: oreilly.com

Use Form 8615 to calculate the tax for dependent child income over 2000. Ad The most comprehensive library of free printable worksheets digital games for kids. Line 44 taxable income is 100000 or more use amount to enter on Form 1040 line 44. Social Security Benefits Worksheet Lines 20a 20b. The Schedule D Tax Worksheet is used to calculate tax on lump sum distributions and capital gains when lines 18 or 19 exceed zero.

Source: pdffiller.com

Source: pdffiller.com

If its 100000 or more use the Tax Computation Worksheet. If you don t wish to claim the. Tax on all taxable income. Social Security Benefits Worksheet Lines 20a 20b. If the amount on line 1 is 100000 or more use the Tax Computation Worksheet.

Source: support.ultimatetax.com

Source: support.ultimatetax.com

Tax on all taxable income. Student Loan Interest Deduction Worksheet Line 33. There are situations when taxes are calculated differently. Tax on the amount on line 2. The box that is.

Source: pdfprof.com

Source: pdfprof.com

Social Security Benefits Worksheet Lines 20a 20b. The Schedule D Tax Worksheet is used to calculate tax on lump sum distributions and capital gains when lines 18 or 19 exceed zero. Use this Worksheet for both Tax Computation Worksheet and Tax Table no need to manually search the long and fine printed tax table. Local earned income credit from Local Earned Income Credit Worksheet in Instruction 19. You must use the Foreign Earned Income Include in the total on line 44 all of theHowever do not use the Tax Table orTax Worksheet on page 36 instead.

Source: pdffiller.com

Source: pdffiller.com

If its 100000 or more use the Tax Computation Worksheet. You can no longer e-File your 2017 Tax Return. You may rely on other information received from your employer. Your social security number. This Tax Calculator lets you calculate your 2017 IRS Taxes.

Source: oreilly.com

Source: oreilly.com

If the amount on line 2 is less than 100000 use the Tax Table to figure this tax. Names shown on return. Tax Computation Worksheet for Line44 Before you begin. Since you are using the CD or download TurboTax software you can look at Form 1040 in forms mode to see which method TurboTax used. Get thousands of teacher-crafted activities that sync up with the school year.

Source: pdfprof.com

Source: pdfprof.com

_____ COLUMN 1 COLUMN 2 COLUMN 3 Originally ReportedAdjusted Net Change Correct Amount COMPUTATION OF GENERAL CORPORATION TAX GENERAL CORPORATION TAX WORKSHEET OF CHANGES IN TAX BASE. Hi and welcome to JustAnswer. Since you are using the CD or download TurboTax software you can look at Form 1040 in forms mode to see which method TurboTax used. If the amount on line 2 is less than 100000 use the Tax Table to figure this tax. Line 44 taxable income is 100000 or more use amount to enter on Form 1040 line 44.

Source:

But the Tax Computation Worksheet on if you are filing Form 2555 or 2555-EZ Tax page 86. Instead enter it on line 4 of the Foreign Earned Income Tax Worksheet 27. State and Local Income Tax Refund Worksheet. And tax relief for those affec-ted by other 2017 disasters such as the California wild-fires. Enter the smaller of line 25 or line 26.

Source: oreilly.com

Source: oreilly.com

Multiply line 20 by your local tax rate0 or use the Local Tax Worksheet. Use this Worksheet for both Tax Computation Worksheet and Tax Table no need to manually search the long and fine printed tax table. The credit for nonbusi-ness energy property b. But the Tax Computation Worksheet on if you are filing Form 2555 or 2555-EZ Tax page 86. If you don t wish to claim the.

Source: templateroller.com

Source: templateroller.com

If your taxable income is under 100000 use the IRS Tax Table to determine the tax rate for line 44. However you don t need to wait to receive this form to file your return. Tax Calculator for Tax Year 2017. The box that is. State and Local Income Tax Refund Worksheet.

Source:

Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10. You can no longer e-File your 2017 Tax Return. Ad The most comprehensive library of free printable worksheets digital games for kids. There are situations when taxes are calculated differently. If you did not complete either worksheet.

Source: templateroller.com

Source: templateroller.com

Local earned income credit from Local Earned Income Credit Worksheet in Instruction 19. Extend certain tax benefits that expired at the end of 2016 and that currently cant be claimed on your 2017 tax return such as. Your social security number. Parts of the credit for res-idential energy property c. Since you are using the CD or download TurboTax software you can look at Form 1040 in forms mode to see which method TurboTax used.

Source: taxchanges.us

Source: taxchanges.us

If you don t wish to claim the. Student Loan Interest Deduction Worksheet Line 33. Do not use a second Foreign Earned Income Tax Worksheet to figure the tax on this line 4. But the Tax Computation Worksheet on if you are filing Form 2555 or 2555-EZ Tax page 86. Ad The most comprehensive library of free printable worksheets digital games for kids.

Source: taxchanges.us

Source: taxchanges.us

Since you are using the CD or download TurboTax software you can look at Form 1040 in forms mode to see which method TurboTax used. Parts of the credit for res-idential energy property c. Your social security number. Line 44 taxable income is 100000 or more use amount to enter on Form 1040 line 44. Also include this amount on Form 1040 line 44.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 2017 tax computation worksheet line 44 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.