25++ 2017 education expense worksheet Free Download

Home » Worksheets Online » 25++ 2017 education expense worksheet Free DownloadYour 2017 education expense worksheet images are ready. 2017 education expense worksheet are a topic that is being searched for and liked by netizens now. You can Download the 2017 education expense worksheet files here. Get all free photos and vectors.

If you’re searching for 2017 education expense worksheet images information connected with to the 2017 education expense worksheet topic, you have visit the ideal site. Our website frequently provides you with hints for downloading the maximum quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

2017 Education Expense Worksheet. School budgets are immensely important to track where the funds are being invested and for what they are being used. Qualified education expenses defined later paid for each student who qualifies for the American opportunity credit. Keep the cash and write a personal check for that amount payable to the MIT Club of _____. LA and school expenditure 2017 to 2018.

Pin Di Resumes From id.pinterest.com

Pin Di Resumes From id.pinterest.com

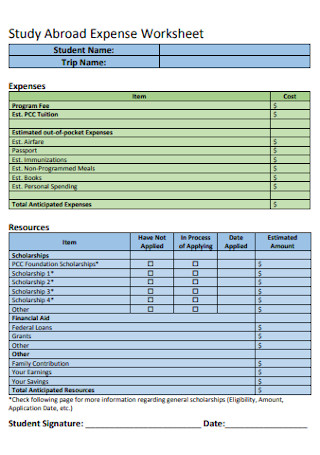

A third party including relatives or friends. Study Abroad Expense Worksheet Student Name. Qualified education expenses are amounts paid for tuition fees and other related expenses for an eligible student. The 3000 Pell Grant will be entered on line 2a. Type in the month of your budget in cell C3 of the Personal Budget Worksheet and that month will display in each of the Weekly Expense worksheets. The line 3 amount is 3000.

The 3000 Pell Grant will be entered on line 2a.

April 2017 MONTHYEAR_____ Page ___ of ____ Check No. Required fees include amounts for books supplies and equipment used in a course of study if required to be paid to the institution as a. Keep the cash and write a personal check for that amount payable to the MIT Club of _____. Type in the month of your budget in cell C3 of the Personal Budget Worksheet and that month will display in each of the Weekly Expense worksheets. American Opportunity Credit Lifetime Learning Credit. Expenses Item Cost Program Fee Est.

Source: sample.net

Source: sample.net

Education Expenses Worksheet for 2017 Tax Year. Education Expenses Worksheet for 2017 Tax Year To be used in determining potential education credits on 2016 tax return American Opportunity Credit Lifetime Learning Credit Attach a copy of the students account summary for each semester accessible via schools online portal to this worksheet. Attach a copy of the students account summary for each semester accessible via schools online portal to this worksheet. Know the purpose on why the business needs the expense sheet. If the resulting qualified expenses are less than 4000 the student may choose to treat some of the grant as income to make more of the expenses eligible for the credit.

Source: pinterest.com

Source: pinterest.com

PCC Tuition Estimated out-of-pocket Expenses Est. The facts are the same as in 9701 except that Bill was awarded a 5600 scholarship. Expenses Item Cost Program Fee Est. However this is always simplified using budget templates. However you only need to make the change on the Personal Budget Worksheet and the change will filter through to each of the Weekly Expense worksheets.

Source: pinterest.com

Source: pinterest.com

April 2017 MONTHYEAR_____ Page ___ of ____ Check No. For many making a school budget can be difficult. Who Must Pay Qualified education expenses must be paid by. Just like rate sheet templates and contact sheet templates a business expense sheet can be used in different phases of the business operations. School budgets are immensely important to track where the funds are being invested and for what they are being used.

Source: id.pinterest.com

Source: id.pinterest.com

Education Expenses Worksheet for 2017 Tax Year To be used in determining potential education credits on 2016 tax return American Opportunity Credit Lifetime Learning Credit Attach a copy of the students account summary for each semester accessible via schools online portal to this worksheet. Subtracting line 3 from line 1 you get qualified education expenses of 4500. The 3000 Pell Grant will be entered on line 2a. Keep the cash and write a personal check for that amount payable to the MIT Club of _____. To be used in determining potential education credits on 2017 tax return.

Source: id.pinterest.com

Source: id.pinterest.com

Education expenses of 4000 which results in a credit of 2500. Do not enclose cash. MS Excel Spreadsheet 714MB. Education Expenses Worksheet for 2017 Tax Year. Subtracting line 3 from line 1 you get qualified education expenses of 4500.

Source: pinterest.com

Source: pinterest.com

Qualified education expenses defined later paid for each student who qualifies for the American opportunity credit. The amount of your credit for 2017. CACFP MONTHLY EXPENSES NS-413-G Rev. Education Expenses Worksheet for 2017 Tax Year To be used in determining potential education credits on 2016 tax return American Opportunity Credit Lifetime Learning Credit Attach a copy of the students account summary for each semester accessible via schools online portal to this worksheet. The facts are the same as in 9701 except that Bill was awarded a 5600 scholarship.

Source: pinterest.com

Source: pinterest.com

If the resulting qualified expenses are less than 4000 the student may choose to treat some of the grant as income to make more of the expenses eligible for the credit. Qualified education expenses are amounts paid for tuition fees and other related expenses for an eligible student. Education expenses of 4000 which results in a credit of 2500. School budgets are immensely important to track where the funds are being invested and for what they are being used. Subtracting line 3 from line 1 you get qualified education expenses of 4500.

Source: id.pinterest.com

Source: id.pinterest.com

The 3000 Pell Grant will be entered on line 2a. PCC Tuition Estimated out-of-pocket Expenses Est. Do not enclose cash. Type in the month of your budget in cell C3 of the Personal Budget Worksheet and that month will display in each of the Weekly Expense worksheets. American Opportunity Credit Lifetime Learning Credit.

Source: pinterest.com

Source: pinterest.com

Do not enclose cash. You or your spouse if you file a joint return A student you claim as a dependent on your return or. The 3000 Pell Grant will be entered on line 2a. Do not enclose cash. Generally qualified education expenses are amounts paid in 2017 for tuition and fees required for the students enrollment or attendance at an eligible educational institution.

Source: pinterest.com

Source: pinterest.com

Qualified education expenses are amounts paid for tuition fees and other related expenses for an eligible student. Education expenses of 4000 which results in a credit of 2500. These budget expenses include salaries utilities tuition fees books library expenses to mention a few. Who Must Pay Qualified education expenses must be paid by. Required fees include amounts for books supplies and equipment used in a course of study if required to be paid to the institution as a.

Source: pinterest.com

Source: pinterest.com

Personal Spending Total Anticipated Expenses Resources Item Have Not Applied In Process of Applying. Do not enclose cash. Know the purpose on why the business needs the expense sheet. Under the terms of his scholarship it may be used to pay any educational expensescludingin room and board. Financial Aid in excess of tuition and fees can be used to cover room board transportation and miscellaneous education expenses.

Source: pinterest.com

Source: pinterest.com

Education Expenses Worksheet for 2017 Tax Year To be used in determining potential education credits on 2016 tax return American Opportunity Credit Lifetime Learning Credit Attach a copy of the students account summary for each semester accessible via schools online portal to this worksheet. Attach a copy of the students account summary for each semester accessible via schools online portal to this worksheet. Education Expenses Worksheet for 2017 Tax Year To be used in determining potential education credits on 2017 tax return American Opportunity Credit Lifetime Learning Credit Attach a copy of the students account summary for each semester accessible via schools online portal to this worksheet. Under the terms of his scholarship it may be used to pay any educational expensescludingin room and board. The line 3 amount is 3000.

Source: id.pinterest.com

Source: id.pinterest.com

A third party including relatives or friends. Qualified education expenses defined later paid for each student who qualifies for the American opportunity credit. Know the purpose on why the business needs the expense sheet. Under the terms of his scholarship it may be used to pay any educational expensescludingin room and board. Please send to the Treasurer all of the checks expense invoicesreceipts and this finance report form.

Source: id.pinterest.com

Source: id.pinterest.com

Subtracting line 3 from line 1 you get qualified education expenses of 4500. Expenses Item Cost Program Fee Est. However you only need to make the change on the Personal Budget Worksheet and the change will filter through to each of the Weekly Expense worksheets. You can create a comprehensive expense sheet template in Word PDF or Excel used by businesses by following these steps. Subtracting line 3 from line 1 you get qualified education expenses of 4500.

Source: pinterest.com

Source: pinterest.com

The 3000 Pell Grant will be entered on line 2a. American Opportunity Credit Lifetime Learning Credit. For many making a school budget can be difficult. Type in the month of your budget in cell C3 of the Personal Budget Worksheet and that month will display in each of the Weekly Expense worksheets. A third party including relatives or friends.

Source: pinterest.com

Source: pinterest.com

This credit equals 100 of the first 2000 and 25 of the next 2000 of adjusted qualified education expenses paid for each eligible student. The 3000 Pell Grant will be entered on line 2a. Education Expenses Worksheet for 2017 Tax Year. Generally qualified education expenses are amounts paid in 2017 for tuition and fees required for the students enrollment or attendance at an eligible educational institution. Under the terms of his scholarship it may be used to pay any educational expensescludingin room and board.

Source: id.pinterest.com

Source: id.pinterest.com

If the resulting qualified expenses are less than 4000 the student may choose to treat some of the grant as income to make more of the expenses eligible for the credit. Subtracting line 3 from line 1 you get qualified education expenses of 4500. Graduate students must be enrolled at least half-time 3 credits to be eligible for Direct Loans and Federal Work Study. Non-Programmed Meals Est. For many making a school budget can be difficult.

Source: pinterest.com

Source: pinterest.com

If the resulting qualified expenses are less than 4000 the student may choose to treat some of the grant as income to make more of the expenses eligible for the credit. Do not offset your out of pocket expenses with cash receipts we need an accurate accountingaudit trail of income and expenses. MS Excel Spreadsheet 714MB. Generally a school budget template is used to assist in the organization of a schools budget. For many making a school budget can be difficult.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 2017 education expense worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.