24++ 2016 federal tax worksheet Live

Home » Free Worksheets » 24++ 2016 federal tax worksheet LiveYour 2016 federal tax worksheet images are ready in this website. 2016 federal tax worksheet are a topic that is being searched for and liked by netizens today. You can Get the 2016 federal tax worksheet files here. Find and Download all free photos.

If you’re looking for 2016 federal tax worksheet pictures information related to the 2016 federal tax worksheet interest, you have pay a visit to the right site. Our site frequently gives you suggestions for downloading the highest quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

2016 Federal Tax Worksheet. Simplified Method Worksheet Lines 16a and 16b. If you are married filing separately and you lived apart from your spouse for all of 2016 enter D to the right of the word benefits on Form 1040 line 20a or Form 1040A line 14a. Figure any write-in adjustments to be entered on the dotted line next to line 36 see the instructions for line 36. You received a federal tax refund in 2017.

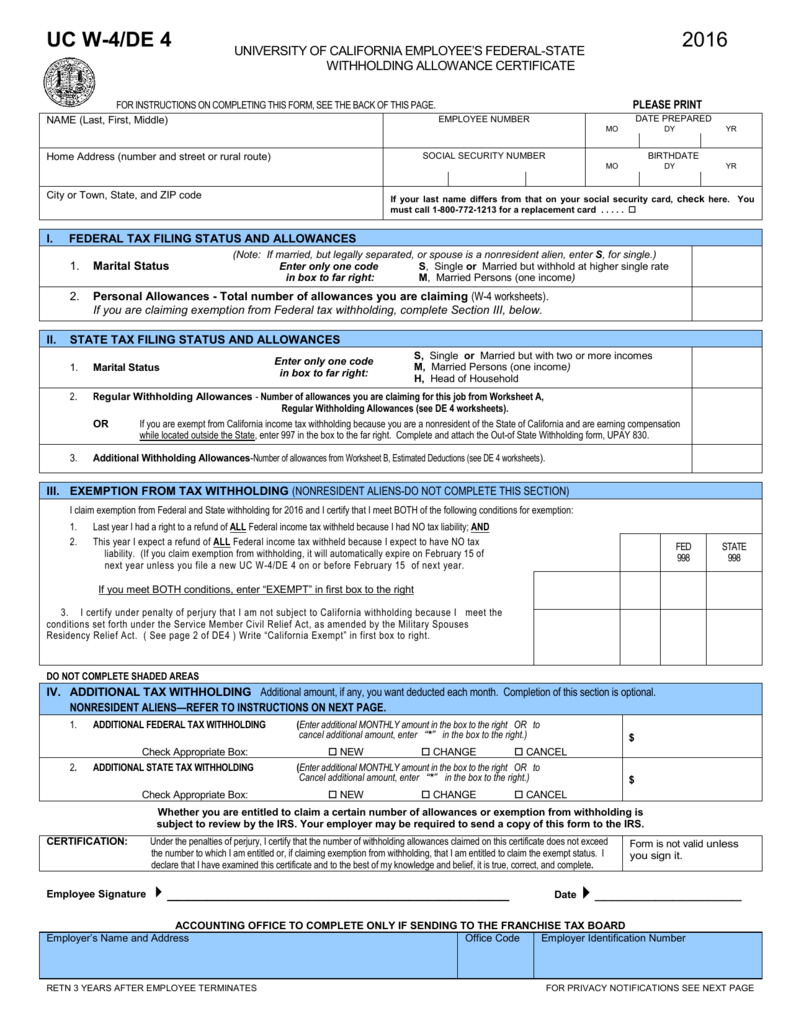

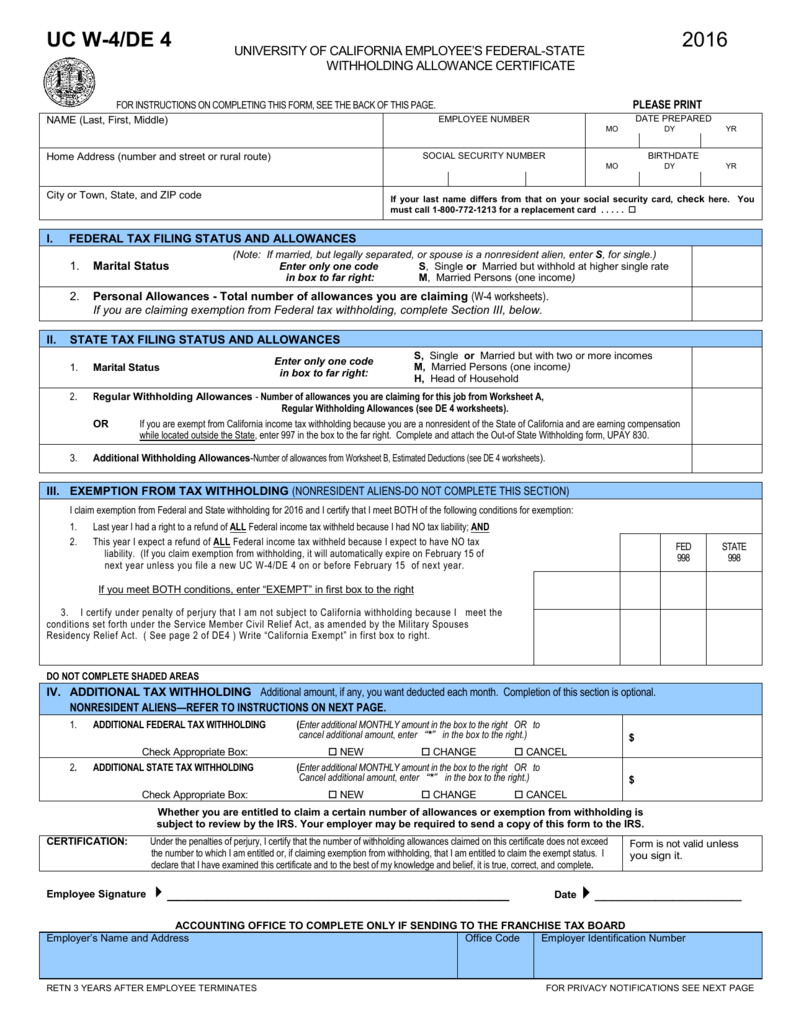

Uc W 4 De 4 University Of California Office Of The President From studylib.net

Uc W 4 De 4 University Of California Office Of The President From studylib.net

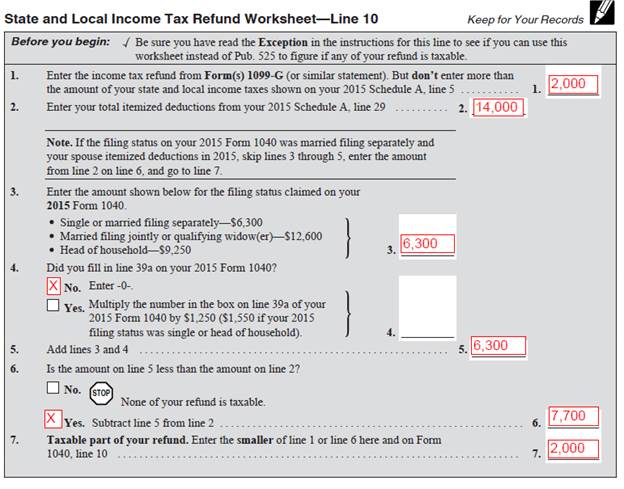

Line 12010 Taxable amount of dividends other than eligible dividends. Use this Worksheet for both Tax Computation Worksheet and Tax Table no need to manually search the long and fine printed tax table. Enter the amount 1. Some of the worksheets displayed are Federal income tax withholding authorization work Work to estimate federal tax withholding year 2019 2019 form 1040 es Work calculating marginal average taxes Work a b and c these are work 2016 net Tax and estimated withholding Tax withholding instructions and work Work. Foreign Earned Income Tax Worksheet. State and Local Income Tax Refund Worksheet.

Worksheet for the return.

Late payment penalties apply until you have paid all your taxes. Do not use this worksheet if you repaid benefits in 2016 and your total repayments box 4 of Forms SSA-1099 and RRB-1099 were. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. 2016 Federal Tax Tax Computation Worksheet for Line44. If all three conditions do not exist you need to use Worksheet IX Tax. You claimed itemized deductions on your 2016 Montana return.

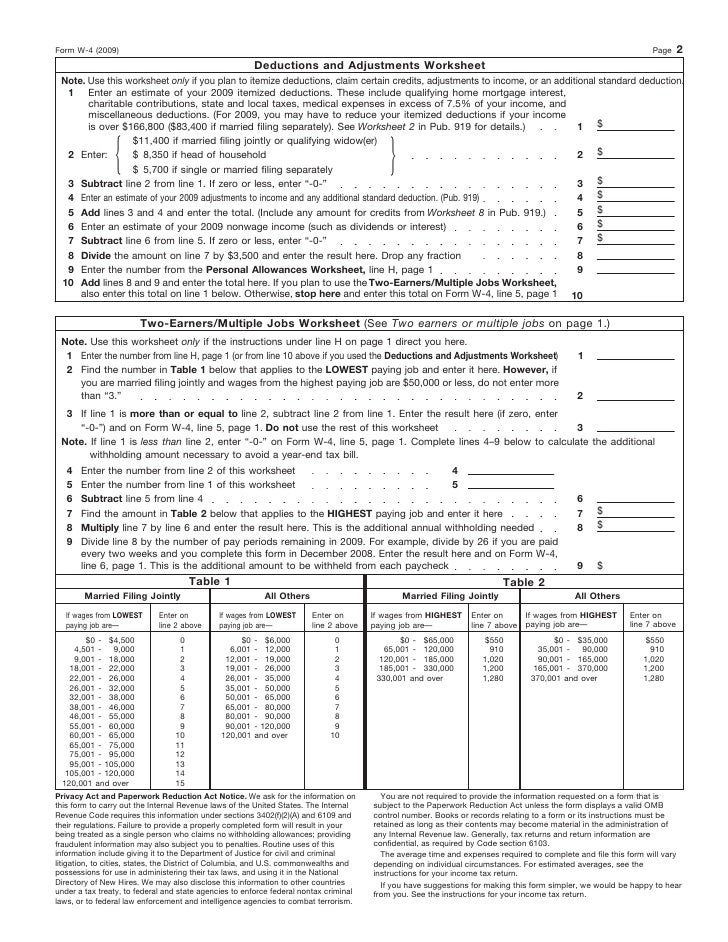

Source: slideshare.net

Source: slideshare.net

89 rows Printable 2016 federal tax forms are listed below along with their most commonly filed supporting IRS schedules worksheets 2016 tax tables and instructions for easy one page access. ARCHIVED - 5013-D1 T1 General 2016 - Federal Worksheet - Non-Residents and Deemed Residents of Canada We have archived this page and will not be updating it. Worksheet for the return. Enter the year 2. Use this Worksheet for both Tax Computation Worksheet and Tax Table no need to manually search the long and fine printed tax table.

Source: peoplestax.com

Source: peoplestax.com

OPTIONAL WORKSHEET FOR CALCULATING CALL REPORT APPLICABLE INCOME TAXES Not to be submitted with your institutions Call Report For March 31 2016. ARCHIVED - 2016 General income tax and benefit package ARCHIVED - 5000-D1 T1 General 2016 - Federal Worksheet - Common to all EXCEPT for QC and non-residents We have archived this page and will not be updating it. Select your filing status 3. Discover learning games guided lessons and other interactive activities for children. Standard Deduction Worksheet for Dependents Line 40.

Source: pinterest.com

Source: pinterest.com

And Your only tax benefit recovery in 2017 was a refund of federal taxes you claimed as a deduction on your 2016 Montana return. Worksheet for the return. Social Security Benefits Worksheet Lines 20a 20b. Line 12000 Taxable amount of dividends eligible and other than eligible from taxable Canadian corporations. Use this Worksheet for both Tax Computation Worksheet and Tax Table no need to manually search the long and fine printed tax table.

Source: nidecmege.blogspot.com

Source: nidecmege.blogspot.com

Yes you can complete 2016 federal income tax returns in Microsoft Excel. Enter the year 2. Schedule D Tax Worksheet 2016 Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero. For more information on tax benefits for education see Pub. Yes you can complete 2016 federal income tax returns in Microsoft Excel.

Source: templateroller.com

Source: templateroller.com

2016 Federal Tax Before you begin. ARCHIVED - 5013-D1 T1 General 2016 - Federal Worksheet - Non-Residents and Deemed Residents of Canada We have archived this page and will not be updating it. All of the worksheets included in the 1040 workbook are. Do not use this worksheet if you repaid benefits in 2016 and your total repayments box 4 of Forms SSA-1099 and RRB-1099 were. If you are married filing separately and you lived apart from your spouse for all of 2016 enter D to the right of the.

Source: slidetodoc.com

Source: slidetodoc.com

Five additional worksheets complete the tool. You received a federal tax refund in 2017. This optional worksheet is designed to assist certain institutions in the calculation of applicable income taxes for the year-to-date reporting period ending March 31 2016. Some of the worksheets displayed are Federal income tax withholding authorization work Work to estimate federal tax withholding year 2019 2019 form 1040 es Work calculating marginal average taxes Work a b and c these are work 2016 net Tax and estimated withholding Tax withholding instructions and work Work. You claimed itemized deductions on your 2016 Montana return.

Source: studylib.net

Source: studylib.net

You claimed itemized deductions on your 2016 Montana return. Be eligible for a tax credit or deduction that you must claim on Form 1040A or Form 1040. 2016 Federal Tax Before you begin. For more information on tax benefits for education see Pub. Enter the year 2.

Source: backalleytaxes.com

Source: backalleytaxes.com

2016 Federal Tax Before you begin. Some of the worksheets displayed are Federal income tax withholding authorization work Work to estimate federal tax withholding year 2019 2019 form 1040 es Work calculating marginal average taxes Work a b and c these are work 2016 net Tax and estimated withholding Tax withholding instructions and work Work. Five additional worksheets complete the tool. Simplified Method Worksheet Lines 16a and 16b. You claimed itemized deductions on your 2016 Montana return.

Source: slideshare.net

Source: slideshare.net

Qualified Dividends and Capital Gain Tax Worksheet. Five additional worksheets complete the tool. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. This optional worksheet is designed to assist certain institutions in the calculation of applicable income taxes for the year-to-date reporting period ending March 31 2016. 89 rows Printable 2016 federal tax forms are listed below along with their most commonly filed supporting IRS schedules worksheets 2016 tax tables and instructions for easy one page access.

Source:

Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line 44 or in the instructions for Form 1040NR line 42 to figure your tax. The 2016 version of the spreadsheet includes both pages of Form 1040 as well as these supplemental schedules. 89 rows Printable 2016 federal tax forms are listed below along with their most commonly filed supporting IRS schedules worksheets 2016 tax tables and instructions for easy one page access. OPTIONAL WORKSHEET FOR CALCULATING CALL REPORT APPLICABLE INCOME TAXES Not to be submitted with your institutions Call Report For March 31 2016. Deduction for Exemptions Worksheet Line 42.

Source: incometaxpro.net

Source: incometaxpro.net

To be a qualifying child for the child tax credit the child must be under age 17 at the end of 2016 and meet the other. Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line 44 or in the instructions for Form 1040NR line 42 to figure your tax. Foreign Earned Income Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. ARCHIVED - 5013-D1 T1 General 2016 - Federal Worksheet - Non-Residents and Deemed Residents of Canada We have archived this page and will not be updating it.

Source: fill.io

Source: fill.io

Yes you can complete 2016 federal income tax returns in Microsoft Excel. Qualified Dividends and Capital Gain Tax Worksheet. You can no longer eFile a 2016 Federal or State Income Tax ReturnsMail-in instructions are below. If you are married filing separately and you lived apart from your spouse for all of 2016 enter D to the right of the word benefits on Form 1040 line 20a or Form 1040A line 14a. The 2016 version of the spreadsheet includes both pages of Form 1040 as well as these supplemental schedules.

Source: teacherspayteachers.com

Source: teacherspayteachers.com

Qualified Dividends and Capital Gain Tax Worksheet. Standard Deduction Worksheet for Dependents Line 40. Prepare and eFile your 2020 Taxes by April 15 2021 or until Oct. Enter the year 2. For more information on tax benefits for education see Pub.

Source: youtube.com

Source: youtube.com

You can no longer eFile a 2016 Federal or State Income Tax ReturnsMail-in instructions are below. Standard Deduction Worksheet for Dependents Line 40. All of the worksheets included in the 1040 workbook are. For most US individual tax payers your 2016 federal income tax forms were due on April 18 2017 for income earned from January 1 2016 through December 31 2016. Yes you can complete 2016 federal income tax returns in Microsoft Excel.

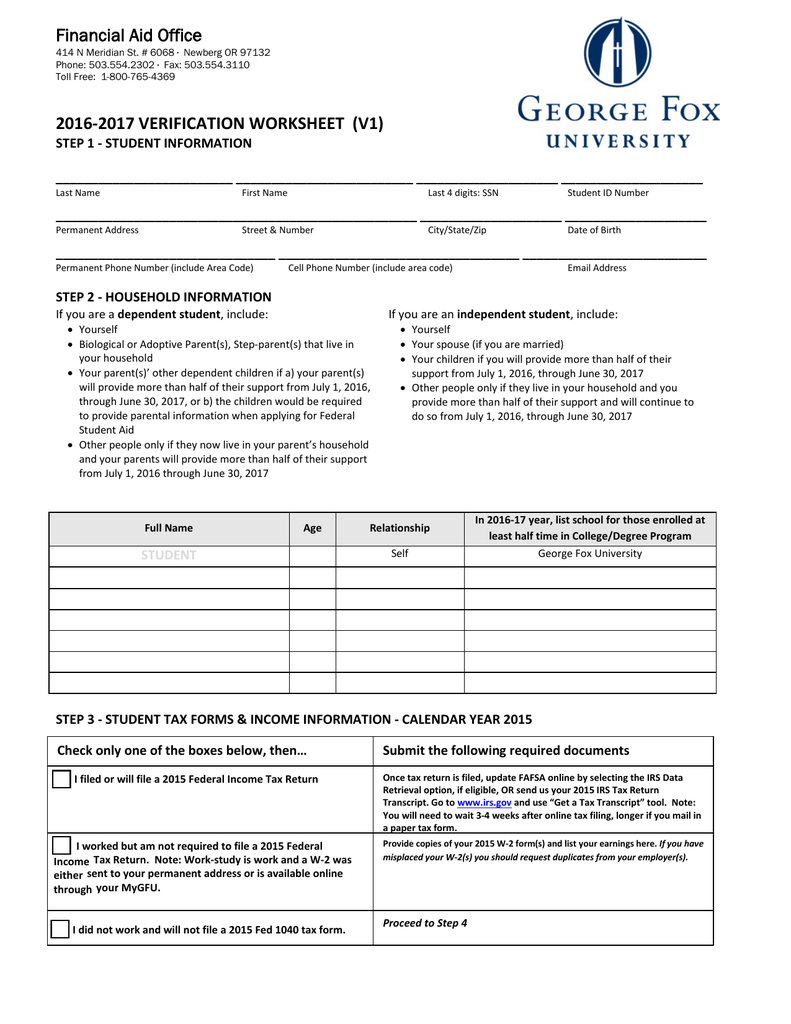

Source: studylib.net

Source: studylib.net

OPTIONAL WORKSHEET FOR CALCULATING CALL REPORT APPLICABLE INCOME TAXES Not to be submitted with your institutions Call Report For March 31 2016. If you are married filing separately and you lived apart from your spouse for all of 2016 enter D to the right of the word benefits on Form 1040 line 20a or Form 1040A line 14a. Showing top 8 worksheets in the category - Federal Tax. OPTIONAL WORKSHEET FOR CALCULATING CALL REPORT APPLICABLE INCOME TAXES Not to be submitted with your institutions Call Report For March 31 2016. Keep for your records Figure the amount of any credits you are claiming on Form 5695 Part II line 30.

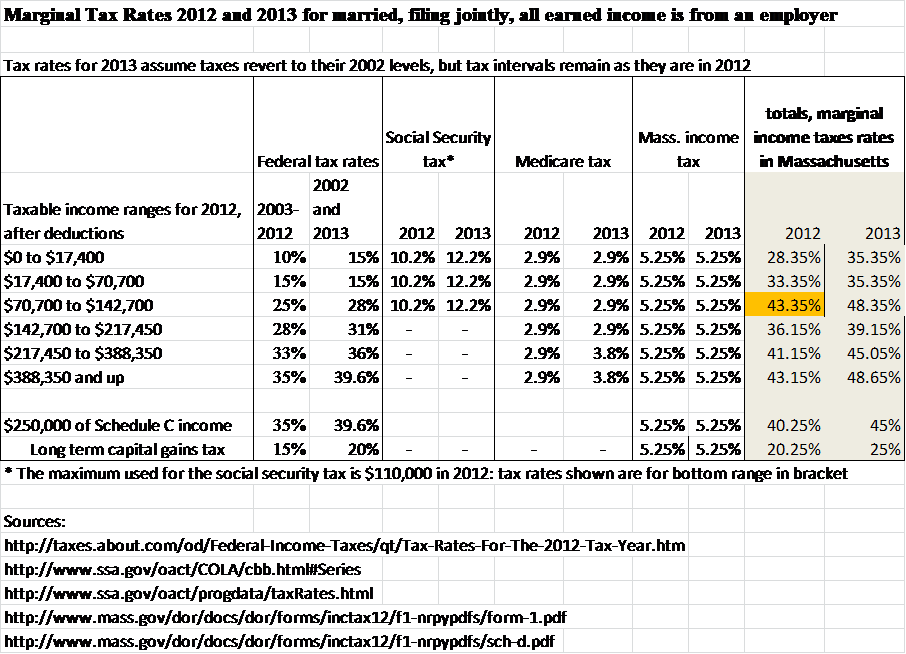

Source: blogs.bu.edu

Source: blogs.bu.edu

Standard Deduction Worksheet for Dependents Line 40. Discover learning games guided lessons and other interactive activities for children. If you owe Taxes you will face a late filing penalty unless you filed unless you eFile a tax extension by April 15 and eFile by Oct. You may also have to complete the Worksheet for the return for all provincesterritories to calculate the amount for the following lines. Enter the amount 1.

Source: wildcountryfinearts.com

Source: wildcountryfinearts.com

Version 102 12182016 fixed the federal NIIT state tax deduction calculation which could have under reported income tax owed for some high ordinary income earners Version 101 11252016 updated California spreadsheet with new CA FTB published rates and exemptions for 2016. Select your filing status 3. Five additional worksheets complete the tool. If all three conditions do not exist you need to use Worksheet IX Tax. Qualified Dividends and Capital Gain Tax Worksheet.

Source: oatc-oregon.org

Source: oatc-oregon.org

If you can claim the premium tax credit or you received any advance payment of the premium tax credit in 2016. 2016 Federal Tax Before you begin. If you are married filing separately and you lived apart from your spouse for all of 2016 enter D to the right of the word benefits on Form 1040 line 20a or Form 1040A line 14a. Use this Worksheet for both Tax Computation Worksheet and Tax Table no need to manually search the long and fine printed tax table. Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line 44 or in the instructions for Form 1040NR line 42 to figure your tax.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 2016 federal tax worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.