42++ 2015 form 1040 line 44 worksheet Information

Home » Free Worksheets » 42++ 2015 form 1040 line 44 worksheet InformationYour 2015 form 1040 line 44 worksheet images are ready. 2015 form 1040 line 44 worksheet are a topic that is being searched for and liked by netizens today. You can Download the 2015 form 1040 line 44 worksheet files here. Find and Download all free photos and vectors.

If you’re searching for 2015 form 1040 line 44 worksheet images information linked to the 2015 form 1040 line 44 worksheet keyword, you have come to the ideal blog. Our website always gives you suggestions for seeking the highest quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

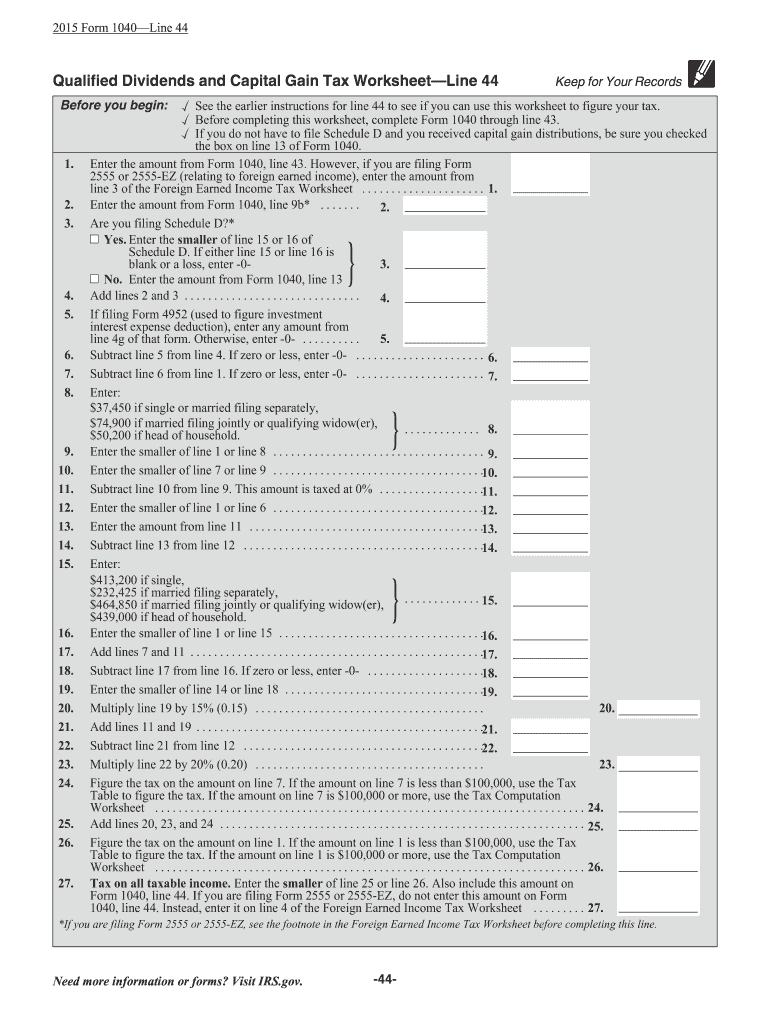

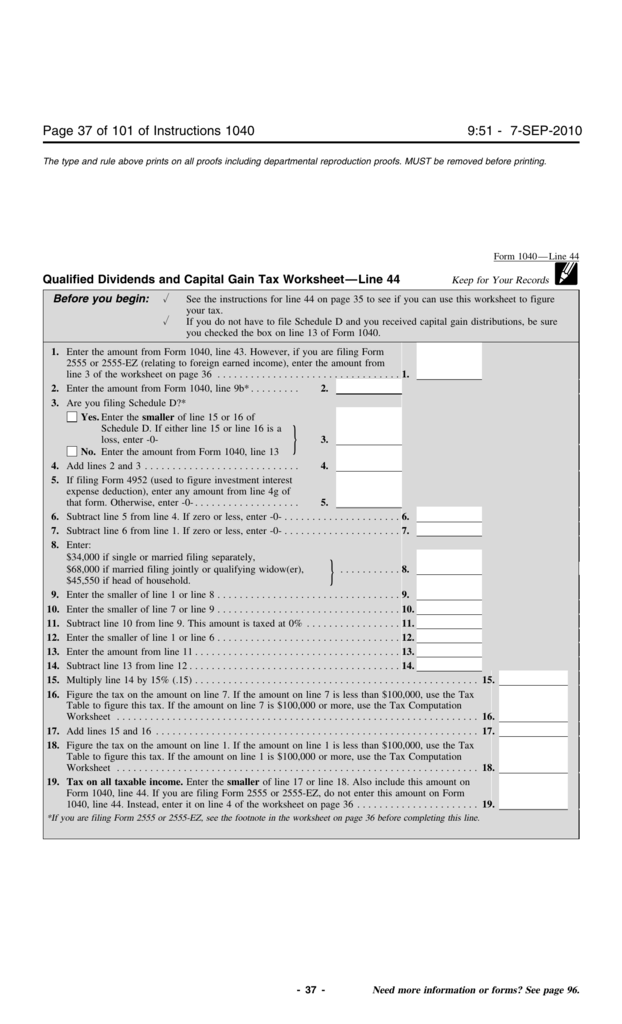

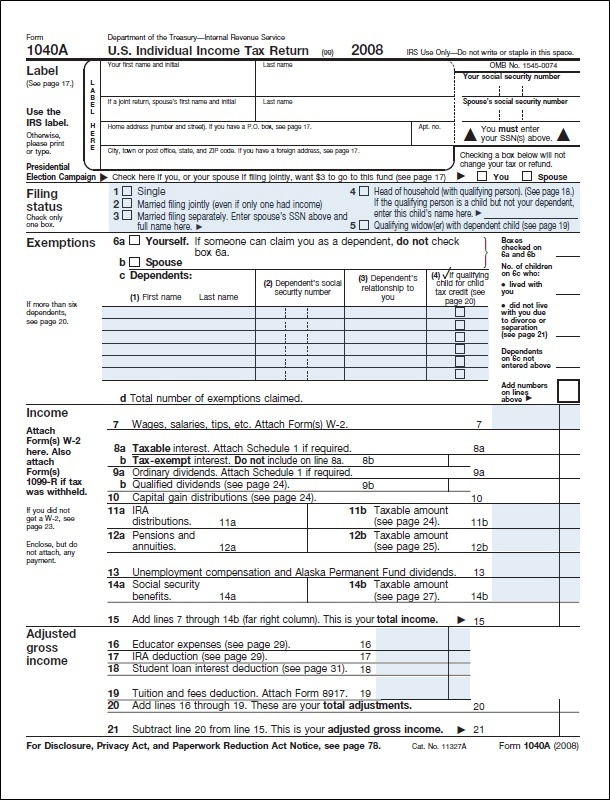

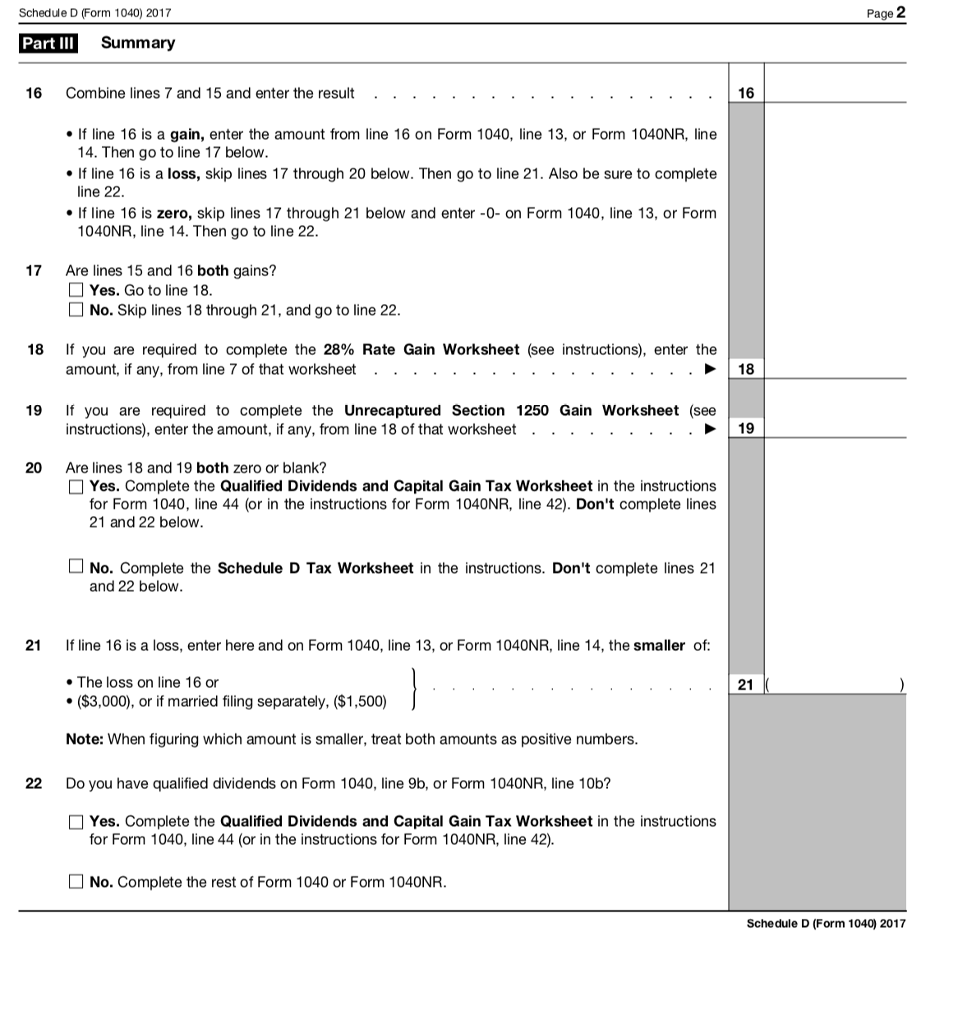

2015 Form 1040 Line 44 Worksheet. 2015 qualified dividends and capital gain tax worksheetline 44 see the earlier instructions for line 44 to see if you can use this worksheet. Instead enter it on line 4 of the Foreign Earned Income Tax Worksheet. Taxable income on Form 1040 line 43 is 25300. View Homework Help - Capital Gain Tax Worksheet from ACTG 4551 at University Of Denver.

Turbo Taxreturn From slideshare.net

Turbo Taxreturn From slideshare.net

Head of household Qualifying widower Part I Childs Net Unearned Income. If the amount on line 1 is 100000 or more use the Tax Computation Worksheet. If you do not have to file Schedule D and you received capital gain distributions be sure you checked the box on line 13 of Form 1040. If the amount on line 1 is less than 100000 use the tax table to figure this tax. Also include this amount on Form 1040 line 44. Opments affecting Form 1040 or its instructions go to wwwirsgovform1040.

Qualified dividends and capital gain tax worksheet form 1040 instructions page 44.

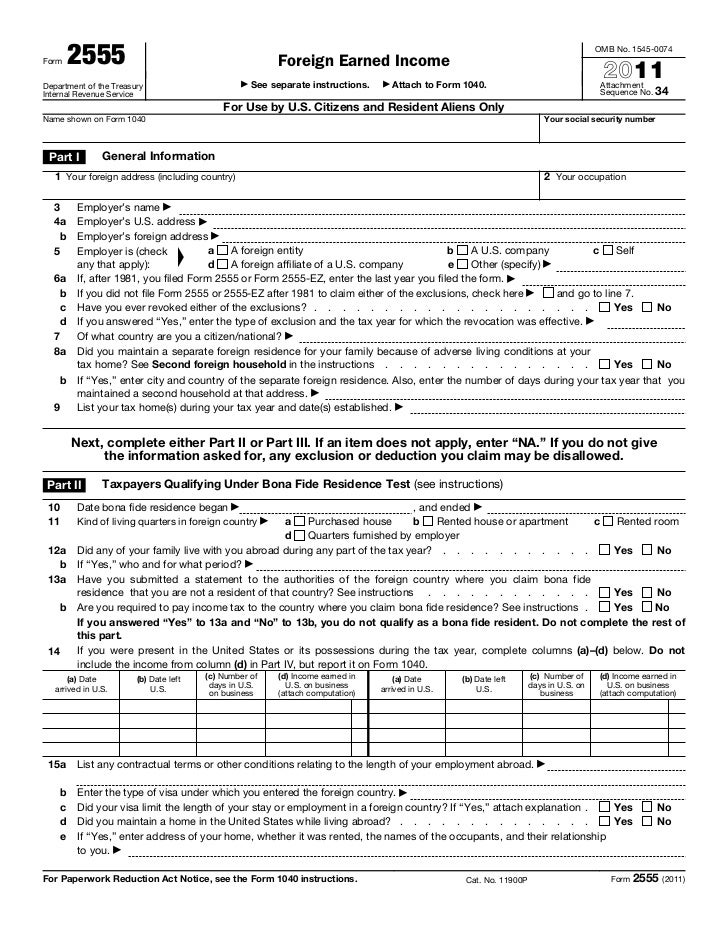

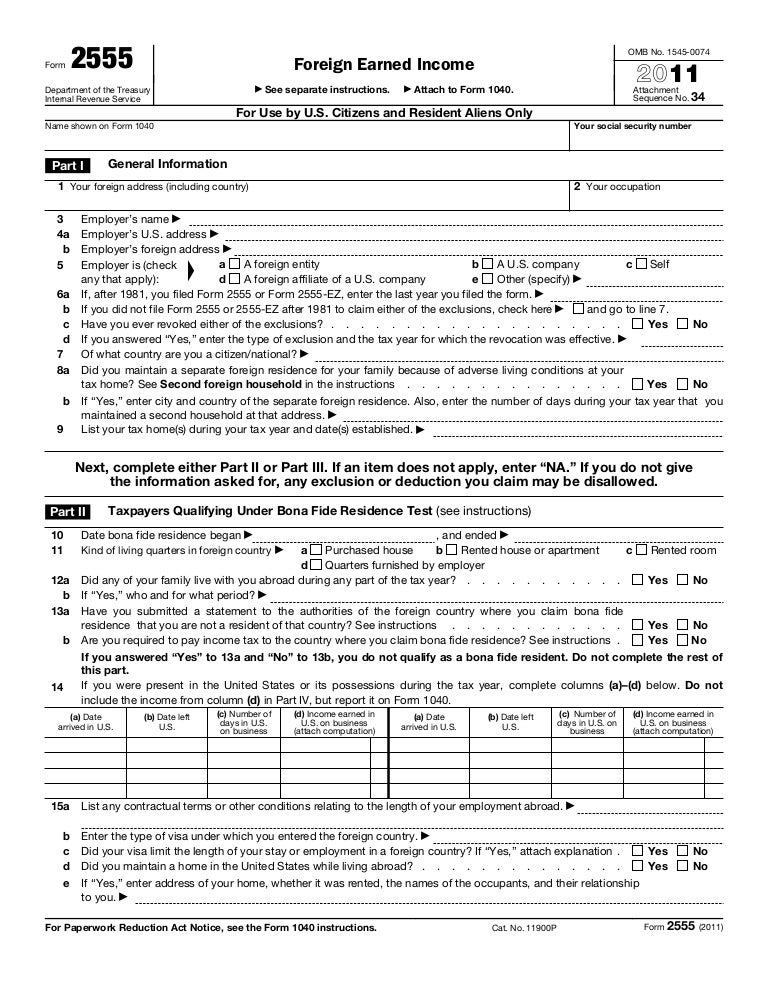

Instead enter it on line 4 of the Foreign Earned Income Tax Worksheet. Enter the amount from Form 1040 line 3a. Also include this amount on Form 1040 line 44. If you are filing Form 2555 or 2555-EZ do not enter this amount on Form 1040 line 44. The Schedule D Tax Worksheet is used to calculate tax on lump sum distributions and capital gains when lines 18. Use Form 8615 to calculate the tax for dependent child income over 2000.

Source: issuu.com

Source: issuu.com

2015 Form 1040Line 44 Qualified Dividends and Capital Gain Tax WorksheetLine 44 Keep for Your Records Before Study Resources. Discover learning games guided lessons and other interactive activities for children. Married filing jointly Married filing separately. If the amount on line 1 is 100000 or more use the Tax Computation Worksheet. However if you are filing Form 2555 or 2555-EZ relating to foreign earned income enter the amount from line 3 of the Foreign Earned Income Tax Worksheet 1.

Source: qualified-dividends-tax-worksheet.pdffiller.com

Source: qualified-dividends-tax-worksheet.pdffiller.com

Parents social security number. Enter the amount from Form 1040 line 3a. Schedule D Tax Worksheet. If you or someone in your family had health coverage in 2015 the provider of that coverage is required to send you a Form 1095-A 1095-B or 1095-C with Part III completed that lists individuals in your family who. You must use the Foreign Earned Income Include in the total on line 44 all of theHowever do not use the Tax Table orTax Worksheet on page 36 instead.

Source: slideshare.net

Source: slideshare.net

Tax on all taxable income. Next they find the column for married filing jointly and read down the column. See instructions before completing. Enter the amount from line 3 above on line 1 of the qualified dividends and capital gain tax worksheet or schedule d tax worksheet if you use either of those worksheets to figure the tax on line. 2015 qualified dividends and capital gain tax worksheetline 44 see the earlier instructions for line 44 to see if you can use this worksheet.

Source: studylib.net

Source: studylib.net

Schedule D Tax Worksheet. Also include this amount on Form 1040 line 44. Qualified dividends and capital gain tax worksheetline 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. First they find the 25300-25350 taxable income line. Married filing jointly Married filing separately.

Source: wildcountryfinearts.com

Source: wildcountryfinearts.com

Tools or tax ros ea 2015 qualified dividends and capital gain tax worksheetline 44 see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Discover learning games guided lessons and other interactive activities for children. Include Form 8962 with your Form 1040 Form 1040-SR or Form 1040-NR. Married filing jointly Married filing separately. If you or someone in your family had health coverage in 2015 the provider of that coverage is required to send you a Form 1095-A 1095-B or 1095-C with Part III completed that lists individuals in your family who.

Source: justan.net

Source: justan.net

Combine lines 1 and 2 add net increases or. 2015 qualified dividends and capital gain tax worksheetline 44 see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Use Form 8615 to calculate the tax for dependent child income over 2000. Tools or tax ros ea 2015 qualified dividends and capital gain tax worksheetline 44 see the. Schedule J Form 1040.

Source: slideshare.net

Source: slideshare.net

The Schedule D Tax Worksheet is used to calculate tax on lump sum distributions and capital gains when lines 18. If you are filing Form 2555 or 2555-EZ do not enter this amount on Form 1040 line 44. Line 44 taxable income is 100000 or more use amount to enter on Form 1040 line 44. Use Form 8615 to calculate the tax for dependent child income over 2000. See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.

Source: hairstyle-artist-indonesia.blogspot.com

Source: hairstyle-artist-indonesia.blogspot.com

If the amount on line 1 is 100000 or more use the Tax Computation Worksheet. If you are filing Form 2555 or 2555-EZ do not enter this amount on Form 1040 line 44. 2015 Form 1040Line 44 Qualified Dividends and Capital Gain Tax WorksheetLine 44 Keep for Your Records Before Study Resources. 2015 Form 1040Line 44 Qualified Dividends and Capital Gain Tax WorksheetLine 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Discover learning games guided lessons and other interactive activities for children.

Source: wildcountryfinearts.com

Source: wildcountryfinearts.com

Qualified dividends and capital gain tax worksheetline 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Include Form 8962 with your Form 1040 Form 1040-SR or Form 1040-NR. Combine lines 1 and 2 add net increases or. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Use Form 8615 to calculate the tax for dependent child income over 2000.

Source: pdfprof.com

Source: pdfprof.com

Before completing this worksheet complete form 1040 through line 43. If its 100000 or more use the Tax Computation Worksheet. Before completing this worksheet complete form 1040 through line 43. Don t include Form 1095-A Health Coverage Reporting. Line 44 taxable income is 100000 or more use amount to enter on Form 1040 line 44.

Source: wildcountryfinearts.com

Source: wildcountryfinearts.com

Qualified dividends and capital gain tax worksheetline 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Combine lines 1 and 2 add net increases or. 2015 qualified dividends and capital gain tax worksheetline 44 see the earlier instructions for line 44 to see if you can use this worksheet. If you or someone in your family had health coverage in 2015 the provider of that coverage is required to send you a Form 1095-A 1095-B or 1095-C with Part III completed that lists individuals in your family who. See instructions before completing.

Source: slideshare.net

Source: slideshare.net

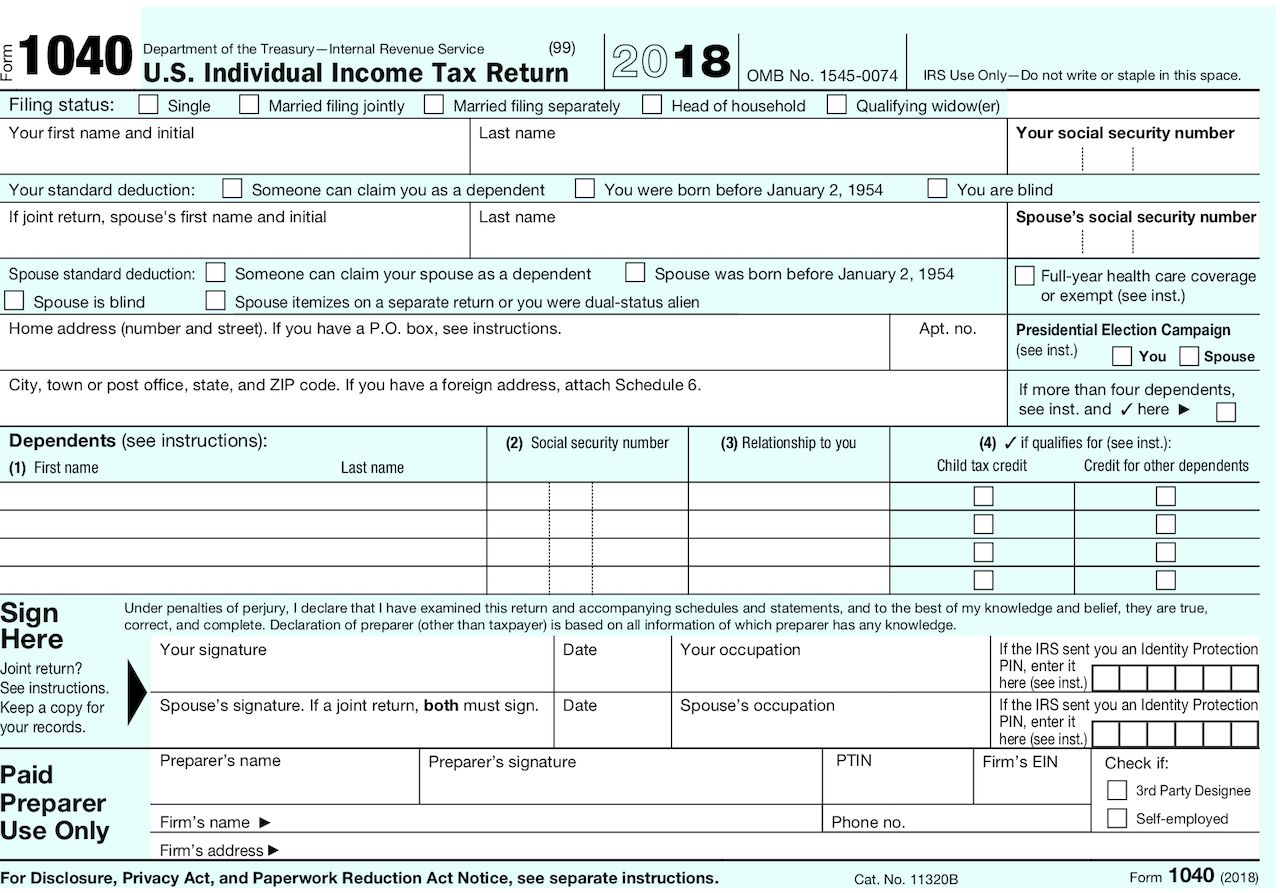

Include Form 8962 with your Form 1040 Form 1040-SR or Form 1040-NR. However if you are filing Form 2555 or 2555-EZ relating to foreign earned income enter the amount from line 3 of the Foreign Earned Income Tax Worksheet 1. 2017 qualified dividends and capital gain tax worksheet. The amount shown where the taxable income line and filing status column meet is 2876. Federal AGI from Federal Form 1040 line 37.

Source: slideshare.net

Source: slideshare.net

This is the tax amount they should enter on Form 1040 line 44. Tax on all taxable income. Before completing this worksheet complete Form 1040 through line 43. Enter the smaller of line 25 or line 26. Federal AGI from Federal Form 1040 line 37.

Source: irs.gov

Source: irs.gov

Enter the amount from Form 1040 line 10. Don t include Form 1095-A Health Coverage Reporting. If you are filing Form 2555 or 2555-EZ do not enter this amount on Form 1040 line 44. But the Tax Computation Worksheet on if you are filing Form 2555 or 2555-EZ Tax page 86. 1 2 1 Net modifications to Federal AGI from RI Schedule M line 3.

Source: wildcountryfinearts.com

Source: wildcountryfinearts.com

If the amount on line 1 is 100000 or more use the Tax Computation Worksheet. Tax on all taxable income. Qualified dividends and capital gain tax worksheet form 1040 instructions page 44. Before completing this worksheet complete Form 1040 through line 43. If you or someone in your family was an employee in 2020 the employer may be required to send you Form 1095-C.

Source: wikiwand.com

Source: wikiwand.com

Head of household Qualifying widower Part I Childs Net Unearned Income. Enter the amount from line 3 above on line 1 of the qualified dividends and capital gain tax worksheet or schedule d tax worksheet if you use either of those worksheets to figure the tax on line. 2017 qualified dividends and capital gain tax worksheet. Line 44 taxable income is 100000 or more use amount to enter on Form 1040 line 44. 3 2 3 Modified Federal AGI.

Source: wildcountryfinearts.com

Source: wildcountryfinearts.com

The amount shown where the taxable income line and filing status column meet is 2876. Use Form 8615 to calculate the tax for dependent child income over 2000. 1 2 1 Net modifications to Federal AGI from RI Schedule M line 3. Enter the amount from line 3 above on line 1 of the qualified dividends and capital gain tax worksheet or schedule d tax worksheet if you use either of those worksheets to figure the tax on line. If your taxable income is under 100000 use the IRS Tax Table to determine the tax rate for line 44.

Source: studylib.net

Source: studylib.net

Federal AGI from Federal Form 1040 line 37. 2017 qualified dividends and capital gain tax worksheet. Part II of Form 1095-C shows whether your employer offered you health insurance coverage and if so information about the offer. Opments affecting Form 1040 or its instructions go to wwwirsgovform1040. Before completing this worksheet complete Form 1040 through line 43.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 2015 form 1040 line 44 worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.