30++ 1120s income calculation worksheet Information

Home » Worksheets Online » 30++ 1120s income calculation worksheet InformationYour 1120s income calculation worksheet images are available. 1120s income calculation worksheet are a topic that is being searched for and liked by netizens today. You can Download the 1120s income calculation worksheet files here. Get all free images.

If you’re searching for 1120s income calculation worksheet images information connected with to the 1120s income calculation worksheet interest, you have come to the right site. Our site always provides you with hints for downloading the highest quality video and image content, please kindly hunt and locate more informative video content and graphics that fit your interests.

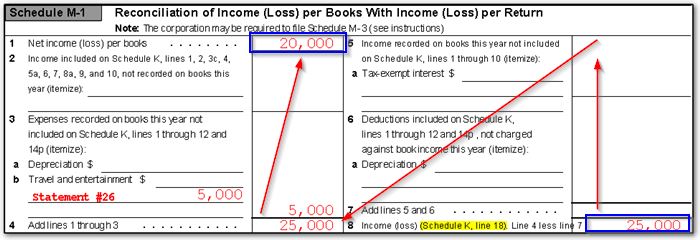

1120s Income Calculation Worksheet. This worksheet appears in. Form 1120 Taxable Income Corporation. Our editable auto-calculating worksheets help you to analyze. Expenses Cost of Goods Sold Total Deductions Schedule C Net Profit or Loss Sole Proprietorship.

See Part II Section 6. Tax Projection Worksheet Qualified Business Income Worksheet. Name Self-Employed Individual. Section 199A Information Worksheet. Our session today will focus only on her 1120S Income from Smith and Firstimer Other sources may be used to qualify but our. Expenses Cost of Goods Sold Total Deductions Schedule C Net Profit or Loss Sole Proprietorship.

The primary source of income for an owner of an S corporation comes from W-2 wages which can be traced to the compensation of officers line in IRS Form 1120S and is transferred to the individual owners IRS Form 1040.

Other Income Self Employed Income Rental Income Rental Loss YTD Year Borrower 2 Total Qualifying Income. Taxable income expected for the tax year. See Part II Section 6. All completed worksheets must be retained in the individuals case record. Tax return Series Form 1120 with K1 The Case Study The Case Study Alice Firstimer Alice is a 50 shareholder of an 1120S. See Part II Section 1a 1b 1c or 1d seasonal worker 2 Weekly.

Source: fannie-mae-income-worksheet.pdffiller.com

Source: fannie-mae-income-worksheet.pdffiller.com

Primary PITI Qualifying Income Paid Monthly Paid Semi-Monthly HOAFloodMI Notes. Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. Name Self-Employed Individual. Depreciation Depletion Amortization or casualty loss Net operating loss Taxable income or loss - -. This worksheet lists each activitys qualified business income items W-2 Wages and other information when you enter 1 in the Qualifies as trade or business for Section 199A field on Screen QBI in each applicable activity.

Source: in.pinterest.com

Source: in.pinterest.com

Primary PITI Qualifying Income Paid Monthly Paid Semi-Monthly HOAFloodMI Notes. See Part II Section 5a or 5b 6 Commissioned. All completed worksheets must be retained in the individuals case record. Name Business. See Part II Section 4 5 OvertimeBonuses.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

Her reported taxable Income is several sources as evidenced by her 1040. Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1037 Principal Residence 2- to 4-unit Property Fannie Mae Rental Guide Calculator 1039 Calculate qualifying rental income for Fannie Mae Form 1039 Business Rental Income from Investment Property. Form 1120S Taxable Income S Corporation. Our cash flow analysis worksheets help you to easily and accurately determine a self-employed borrowers income. Capital Gains and W-2 income should also be analyzed separately.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

Tax return Series Form 1120 with K1 The Case Study The Case Study Alice Firstimer Alice is a 50 shareholder of an 1120S. If a field is blank and is not denoted with an asterisk the application uses the amount from the 2018 Schedule K. The individual owners US. Tax return Series Form 1120 with K1 The Case Study The Case Study Alice Firstimer Alice is a 50 shareholder of an 1120S. Depreciation Depletion Amortization or casualty loss Net operating loss Taxable income or loss - -.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

See Part II Section 2 3 Bi-Weekly. Subtract line 3 from line 2. Where does my Qualified Business Income calculation appear in the return. Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1037 Principal Residence 2- to 4-unit Property Fannie Mae Rental Guide Calculator 1039 Calculate qualifying rental income for Fannie Mae Form 1039 Business Rental Income from Investment Property. Cash flow and YTD profit and loss P.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

This worksheet is generated using the Screen QBIProj in the Review folder. Multiply line 1 by 21 021. Income Calculations from IRS Form 1120 10. W2 Income K1 Income S Corporation Schedule K-1 From 1120S Base Commission 2106 Expenses 2nd MtgHELOC Loan Number Bonus Income Monthly Earnings Overtime Borrower Name Primary PI. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you.

Source: pinterest.com

Source: pinterest.com

Her reported taxable Income is several sources as evidenced by her 1040. Multiply line 1 by 21 021. Income Tax Return IRS Form 1040. Discover learning games guided lessons and other interactive activities for children. This worksheet appears in.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

Discover learning games guided lessons and other interactive activities for children. This worksheet derives only the self-employed income by analyzing Schedule C F K-1 E and 2106. Her reported taxable Income is several sources as evidenced by her 1040. This worksheet is generated using the Screen QBIProj in the Review folder. Tax Projection Worksheet Qualified Business Income Worksheet.

On the income tab choose the borrower the income is being evaluated for Click the magnifying glass next to the1065 income calculator Enter the most recent tax year being evaluated. See Part II Section 5a or 5b 6 Commissioned. Corporation Income Refer to Chapter 5304 Name of business. Primary PITI Qualifying Income Paid Monthly Paid Semi-Monthly HOAFloodMI Notes. This worksheet appears in.

Source: in.pinterest.com

Source: in.pinterest.com

Capital Gains and W-2 income should also be analyzed separately. A Using the IRS Tax Form 1120S to determine your self-employed borrowers income Your borrower should have 1120S self-employed income type for the calculator. Discover learning games guided lessons and other interactive activities for children. Section 199A Information Worksheet. Taxable income expected for the tax year.

Source: pinterest.com

Source: pinterest.com

See Part II Section 1a 1b 1c or 1d seasonal worker 2 Weekly. Form 1065 Ordinary Income or Loss Partnership. See Part II Section 3 4 Semi-Monthly. This worksheet lists each activitys qualified business income items W-2 Wages and other information when you enter 1 in the Qualifies as trade or business for Section 199A field on Screen QBI in each applicable activity. Depreciation and depletion from the S.

Source: pinterest.com

Source: pinterest.com

Expenses Cost of Goods Sold Total Deductions Schedule C Net Profit or Loss Sole Proprietorship. Her reported taxable Income is several sources as evidenced by her 1040. Tax Year Filing. Income Tax Return IRS Form 1040. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

Source: pinterest.com

Source: pinterest.com

Discover learning games guided lessons and other interactive activities for children. Depreciation Depletion Amortization or casualty loss Net operating loss Taxable income or loss - -. Subtract line 3 from line 2. Our editable auto-calculating worksheets help you to analyze. Form 1065 Ordinary Income or Loss Partnership.

Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you. Form 1120S Taxable Income S Corporation. The worksheet also lists the activity from each Screen K1QB1 in the K1. All completed worksheets must be retained in the individuals case record. See Part II Section 6.

The worksheet also lists the activity from each Screen K1QB1 in the K1. Discover learning games guided lessons and other interactive activities for children. On the income tab choose the borrower the income is being evaluated for Click the magnifying glass next to the1065 income calculator Enter the most recent tax year being evaluated. Our editable auto-calculating worksheets help you to analyze. Form 1120S Taxable Income S Corporation.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

Taxable income expected for the tax year. See Part II Section 5a or 5b 6 Commissioned. Form 1120S - Adjustments to Business Cash Flow a. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you. Percentage of Business Owned Schedule K-1 Form 1120S line F Number of Months Business Was in Operation During Tax Year Enter 12 unless otherwise specified Name Worker.

See Part II Section 1a 1b 1c or 1d seasonal worker 2 Weekly. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you. Discover learning games guided lessons and other interactive activities for children. Other Income Self Employed Income Rental Income Rental Loss YTD Year Borrower 2 Total Qualifying Income.

Source: pinterest.com

Source: pinterest.com

See Part II Section 1a 1b 1c or 1d seasonal worker 2 Weekly. This worksheet is generated using the Screen QBIProj in the Review folder. Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1037 Principal Residence 2- to 4-unit Property Fannie Mae Rental Guide Calculator 1039 Calculate qualifying rental income for Fannie Mae Form 1039 Business Rental Income from Investment Property. Our session today will focus only on her 1120S Income from Smith and Firstimer Other sources may be used to qualify but our. See Part II Section 6.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 1120s income calculation worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.