42+ 1099 ssa worksheet Online

Home » Free Worksheets » 42+ 1099 ssa worksheet OnlineYour 1099 ssa worksheet images are available. 1099 ssa worksheet are a topic that is being searched for and liked by netizens now. You can Get the 1099 ssa worksheet files here. Download all royalty-free images.

If you’re looking for 1099 ssa worksheet images information connected with to the 1099 ssa worksheet interest, you have pay a visit to the right site. Our website frequently gives you suggestions for downloading the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

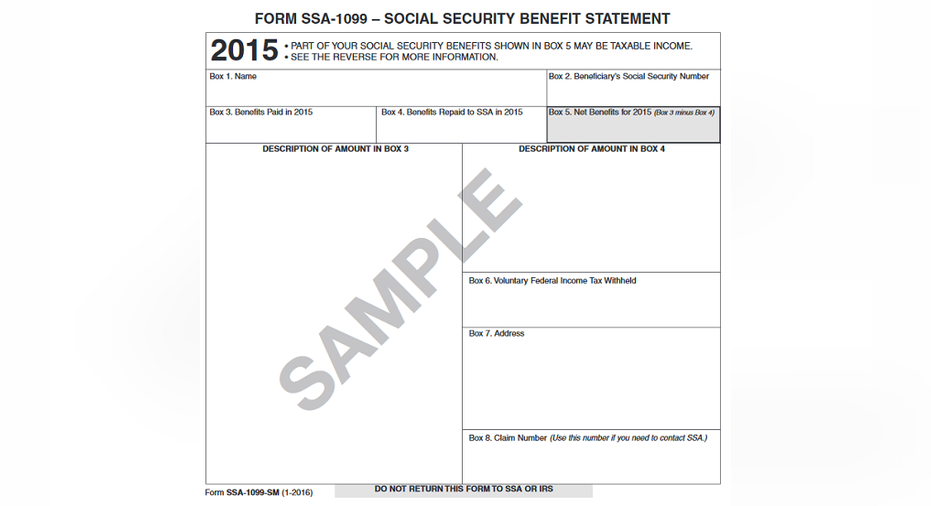

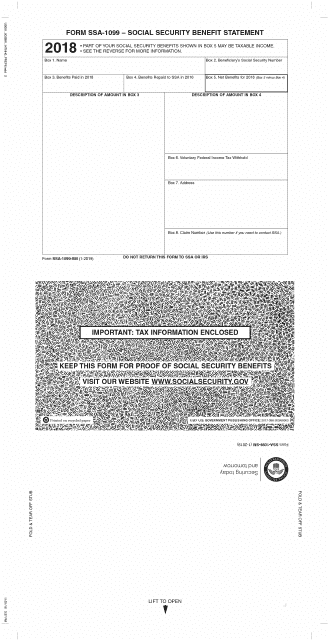

1099 Ssa Worksheet. TN 8 02-17 GN 05002310 Dual SSARRB SSA-1099 and 1042S Worksheet Exhibit. Displaying top 8 worksheets found for - Ssa 1099. If you received social security benefits but were not issued an SSA-1099 you can request a copy from the Social Security Administration. Some of the worksheets for this concept are 1099 work Irs form 1099 work 2019 form 1099 r 1099 work Lachowicz company llc accountants and consultants 1099 work year Form 1099 r rollovers and disability under minimum 2019 form 1099 s.

Assets And Liabilities Worksheet 50 Lovely Personal Financial Statement Template Free In 20 Personal Financial Statement Statement Template Financial Statement From pinterest.com

Assets And Liabilities Worksheet 50 Lovely Personal Financial Statement Template Free In 20 Personal Financial Statement Statement Template Financial Statement From pinterest.com

If more than one year has prior year payments use additional Lump-Sum worksheet. Social Security Benefits WorksheetLines 20a and 20b Keep for Your Records 1. 1099 information returns must be prepared for individuals you paid 600 or more during the tax year and filed with the IRS. John received Form SSA-1099 showing 3000 in box 5. Showing top 8 worksheets in the category - Ssa 1099. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

Showing top 8 worksheets in the category - Ssa 1099.

John and Mary file a joint return for 2020. 1099 information returns must be prepared for individuals you paid 600 or more during the tax year and filed with the IRS. You may receive more than one of these forms for the same tax year. Multiply line 1 by 50 050. If the prior year return was MFJ include social security payments received that year by BOTH taxpayer and spouse. The IRS routinely verifies the name and payer ID numbers on all 1099s filed.

Source: in.pinterest.com

Source: in.pinterest.com

Discover learning games guided lessons and other interactive activities for children. Social Security Benefits Worksheet 2019 Caution. If there are. John and Mary will use 2500 3000 minus 500 as the amount of their net benefits when figuring if. If you received social security benefits but were not issued an SSA-1099 you can request a copy from the Social Security Administration.

Source: in.pinterest.com

Source: in.pinterest.com

Please only include your company information and information for those you have paid only list people that have been paid more than 600 for the year or more than 10 for royalties. If the prior year return was MFJ include social security payments received that year by BOTH taxpayer and spouse. You may receive more than one of these forms for the same tax year. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. See the Appendix later for more information.

Combine the amounts from Form 1040 lines 1 2b 3b 4b. It is mailed out each January to people who receive benefits and tells you how much Social Security income to report to the IRS on your tax return. Mary also received Form SSA-1099 and the amount in box 5 was 500. John and Mary will use 2500 3000 minus 500 as the amount of their net benefits when figuring if. Do not use this worksheet if any of the following apply.

Source: pinterest.com

Source: pinterest.com

Some of the worksheets displayed are Benefits retirement reminders railroad equivalent 1 30 of 107 Form ssa 1099 distributions Irs form 1099 work Appendix work for social security recipients who 1099 work Social security lump sum payments Notice 703 september 2017. Your annual Social Security benefits statement. Enter the total amount from. Displaying top 8 worksheets found for - Ssa 1099. See the Appendix later for more information.

Source: pinterest.com

Source: pinterest.com

Add lines 2 3 and 4 4. Form SSA-1099 Lump-Sum Distributions Enter relevant year as shown on Form SSA-1099. This calculation is derived from the IRS Social Security Benefits Worksheet. Add lines 2 3 and 4 4. Some of the worksheets for this concept are 1099 work Irs form 1099 work 2019 form 1099 r 1099 work Lachowicz company llc accountants and consultants 1099 work year Form 1099 r rollovers and disability under minimum 2019 form 1099 s.

Source: pinterest.com

Source: pinterest.com

These forms tax state-ments report the amounts paid and repaid and taxes withheld for a tax year. 1099 information returns must be prepared for individuals you paid 600 or more during the tax year and filed with the IRS. If there are. This calculation is derived from the IRS Social Security Benefits Worksheet. Social Security Benefits Worksheet 2019 Caution.

Source: foxbusiness.com

Source: foxbusiness.com

Some of the worksheets for this concept are Form ssa 1099 lump sum distributions 1099 work Social security lump sum payments Appendix work for social security recipients who 915 such as legislation enacted after it was Income social security benefits Benefits this publication on that would otherwise be Social security. Worksheet instead of a publication to find out if any of your benefits are taxable. Enter the total amount from box 5 of all your Forms SSA-1099 and RRB-1099 Add the amounts on Form 1040 lines 7 8a 9 through 14 15b 16b 17 through 19 and 21. Some of the worksheets displayed are Benefits retirement reminders railroad equivalent 1 30 of 107 Form ssa 1099 distributions Irs form 1099 work Appendix work for social security recipients who 1099 work Social security lump sum payments Notice 703 september 2017. Also enter this amount on Form 1040 line 5a.

Source: pinterest.com

Source: pinterest.com

Do not include amounts from box 5 of Forms SSA-1099 or RRB-1099 3. Discover learning games guided lessons and other interactive activities for children. These forms tax state-ments report the amounts paid and repaid and taxes withheld for a tax year. Please only include your company information and information for those you have paid only list people that have been paid more than 600 for the year or more than 10 for royalties. Displaying top 8 worksheets found for - Ssa 1099.

Source: pinterest.com

Source: pinterest.com

Do not include amounts from box 5 of Forms SSA-1099 or RRB-1099 3. 1 If the taxpayer made a 2019 traditional IRA contribution and was covered or spouse was covered by a qualified retirement plan. Dropdown menu is available for prior year Filing Status. Displaying top 8 worksheets found for - Ssa 1099. Worksheet instead of a publication to find out if any of your benefits are taxable.

Source: pinterest.com

Source: pinterest.com

If the prior year return was MFJ include social security payments received that year by BOTH taxpayer and spouse. Do not use this worksheet if any of the following apply. Enter the total amount from box 5 of all Forms SSA-1099 and RRB-1099. Nonresident aliens who received social security benefits are issued. This calculation is derived from the IRS Social Security Benefits Worksheet.

Source: pinterest.com

Source: pinterest.com

Some of the worksheets for this concept are Benefits retirement reminders railroad equivalent 1 30 of 107 Form ssa 1099 distributions Irs form 1099 work Appendix work for social security recipients who 1099 work Social security lump sum payments Notice 703 september 2017. John received Form SSA-1099 showing 3000 in box 5. If you received social security benefits but were not issued an SSA-1099 you can request a copy from the Social Security Administration. If the prior year return was MFJ include social security payments received that year by BOTH taxpayer and spouse. John and Mary will use 2500 3000 minus 500 as the amount of their net benefits when figuring if.

Source: templateroller.com

Source: templateroller.com

If more than one year has prior year payments use additional Lump-Sum worksheet. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Do not use this worksheet if any of the following apply. This worksheet serves as a vehicle in the exchange of benefit payment information between SSA. Some of the worksheets displayed on a form ssa 1099 online on your computer Benefits retirement reminders railroad equal 1 30 of 107 Form ssa 1099 distributions Appendix work for social safety recipients who Social security lump sum payments Social safety benefits work forms Irs form 1099 work.

Source: pinterest.com

Source: pinterest.com

Some of the worksheets for this concept are 1099 work Irs form 1099 work 2019 form 1099 r 1099 work Lachowicz company llc accountants and consultants 1099 work year Form 1099 r rollovers and disability under minimum 2019 form 1099 s. These forms tax state-ments report the amounts paid and repaid and taxes withheld for a tax year. Multiply line 1 by 50 050. This worksheet serves as a vehicle in the exchange of benefit payment information between SSA. Combine the amounts from Form 1040 lines 1 2b 3b 4b.

Source: in.pinterest.com

Source: in.pinterest.com

Discover learning games guided lessons and other interactive activities for children. If there are. 1099 information returns must be prepared for individuals you paid 600 or more during the tax year and filed with the IRS. Some of the worksheets displayed are Benefits retirement reminders railroad equivalent 1 30 of 107 Form ssa 1099 distributions Irs form 1099 work Appendix work for social security recipients who 1099 work Social security lump sum payments Notice 703 september 2017. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

Source: pinterest.com

Source: pinterest.com

Showing top 8 worksheets in the category - Ssa 1099. Mary also received Form SSA-1099 and the amount in box 5 was 500. Nonresident aliens who received social security benefits are issued. Some of the worksheets for this concept are 1099 work Irs form 1099 work 2019 form 1099 r 1099 work Lachowicz company llc accountants and consultants 1099 work year Form 1099 r rollovers and disability under minimum 2019 form 1099 s. John and Mary will use 2500 3000 minus 500 as the amount of their net benefits when figuring if.

Source: pinterest.com

Source: pinterest.com

Please only include your company information and information for those you have paid only list people that have been paid more than 600 for the year or more than 10 for royalties. Enter the total amount from box 5 of all Forms SSA-1099 and RRB-1099. These forms tax state-ments report the amounts paid and repaid and taxes withheld for a tax year. Some of the worksheets for this concept are Benefits retirement reminders railroad equivalent 1 30 of 107 Form ssa 1099 distributions Irs form 1099 work Appendix work for social security recipients who 1099 work Social security lump sum payments Notice 703 september 2017. Do not use this worksheet if any of the following apply.

Source: pinterest.com

Source: pinterest.com

Multiply line 1 by 50 050. 1099 S - Displaying top 8 worksheets found for this concept. This worksheet serves as a vehicle in the exchange of benefit payment information between SSA. You may receive more than one of these forms for the same tax year. Taxpayers generally receive Form SSA-1099 in January.

Source: pinterest.com

Source: pinterest.com

Enter the total amount from. Showing top 8 worksheets in the category - Ssa 1099. You may receive more than one of these forms for the same tax year. The RRB issues Form RRB-1099 and Form RRB-1042S. Discover learning games guided lessons and other interactive activities for children.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 1099 ssa worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.