41++ 1065 basis worksheet Online

Home » Live Worksheets » 41++ 1065 basis worksheet OnlineYour 1065 basis worksheet images are ready. 1065 basis worksheet are a topic that is being searched for and liked by netizens today. You can Get the 1065 basis worksheet files here. Get all free photos and vectors.

If you’re looking for 1065 basis worksheet images information linked to the 1065 basis worksheet topic, you have visit the right site. Our site frequently provides you with hints for viewing the highest quality video and image content, please kindly hunt and find more informative video articles and graphics that match your interests.

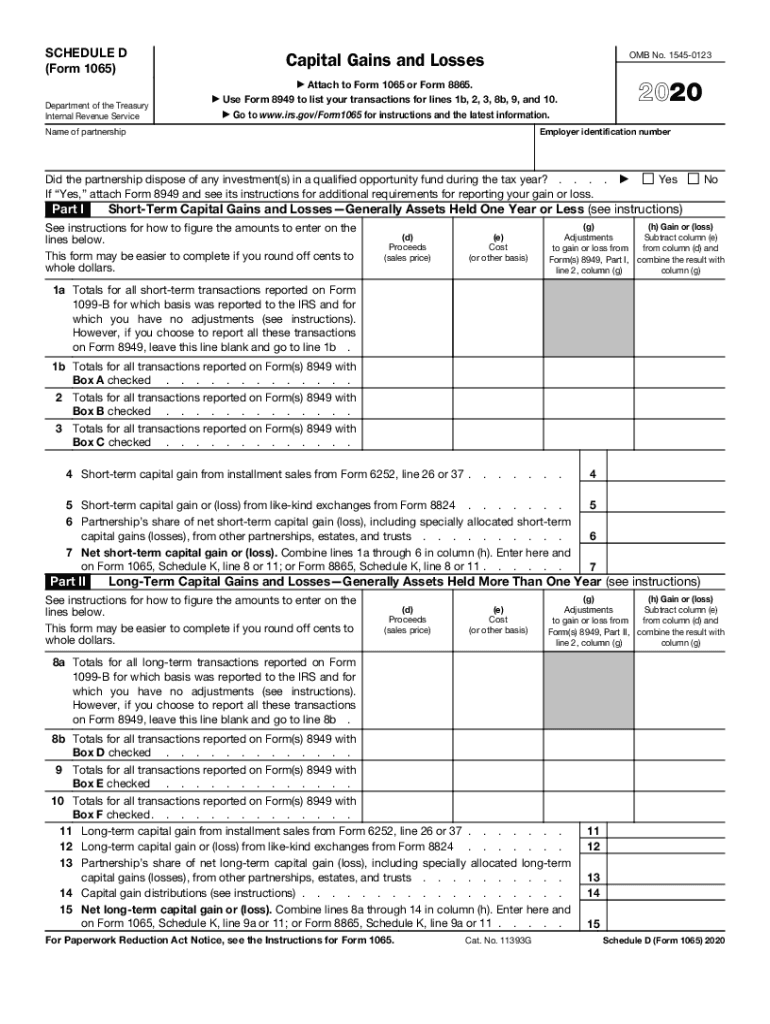

1065 Basis Worksheet. Get thousands of teacher-crafted activities that sync up with the school year. For Partners Use Only on page 2. Therefore for all partners UltraTax CS uses the total of all liabilities on Schedule K-1 item K regardless of type to determine the net increase or decrease for the basis worksheet. In addition basis may be adjusted under other provisions of the Internal Revenue Code.

Partners Adjusted Basis Excel Worksheet Jobs Ecityworks From ecityworks.com

Partners Adjusted Basis Excel Worksheet Jobs Ecityworks From ecityworks.com

The worksheet is available from screen K1 by using the Basis Wks tab at the top of the screen. This is a guide on entering the Adjusted Basis Worksheet Form 1065 into the. Do not attach the worksheet to Form 1065 or Form 1040. 1065 and the Partners Instructions for Schedule K-1 Form 1065 such as legislation enacted after they were. This is a guide on entering the Adjusted Basis Worksheet Form 1065 into the TaxSlayer. See Tab A for a blank worksheet.

Ad The most comprehensive library of free printable worksheets digital games for kids.

Basis of your stock generally its cost is adjusted annually as follows and except as noted in the order listed. Go to the Partners Partner Basis worksheet. H Investment interest expense Form 4952 Line 1 I Deductions - royalty income Sch E Line 18 with From Schedule K-1 Form 1065 literal J. 1065 and the Partners Instructions for Schedule K-1 Form 1065 such as legislation enacted after they were. This is a guide on entering the Adjusted Basis Worksheet Form 1065 into the TaxSlayer. See Tab A for a blank worksheet.

Source: jdunman.com

Source: jdunman.com

1065 and the Partners Instructions for Schedule K-1 Form 1065 such as legislation enacted after they were. The shareholder basis worksheet does not print automatically. See Tab A for a blank worksheet. Ad The most comprehensive library of free printable worksheets digital games for kids. This is a guide on entering the Adjusted Basis Worksheet Form 1065 into the.

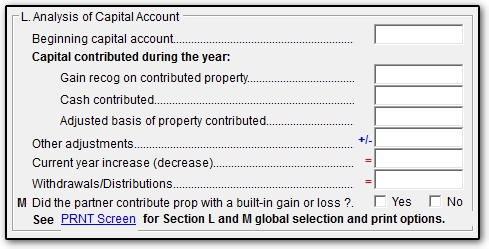

UltraTax CS automatically completes this worksheet based on the returns data entry. Partners Adjusted Basis Worksheet. Go to the Partners Partner Basis worksheet. 1065 and the Partners Instructions for Schedule K-1 Form 1065 such as legislation enacted after they were. Partner basis is entered by accessing Screen Basis located under the Partner Info Basis folder.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

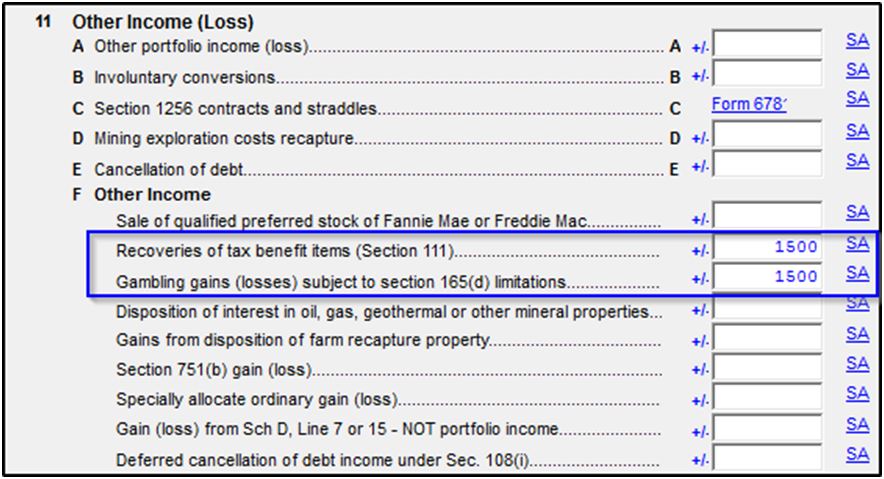

At the Adjusted Basis Worksheet menu the user will be able to enter based on the accounting records of the partnership any of the above referenced items that will either increase or decrease the partners basis. Basis of your stock generally its cost is adjusted annually as follows and except as noted in the order listed. 1065 and the Partners Instructions for Schedule K-1 Form 1065 such as legislation enacted after they were. This is a guide on entering the Adjusted Basis Worksheet Form 1065 into the TaxSlayer. G Contributions 100 Basis worksheet andor at-risk limitation worksheet only.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

1065 and the Partners Instructions for Schedule K-1 Form 1065 such as legislation enacted after they were. G Contributions 100 Basis worksheet andor at-risk limitation worksheet only. Lacerte also produces a Schedule of Loss Limitations worksheet to help identify where losses are being suspendedThis worksheet will be listed under Basis Limitation in the forms view as an additional worksheet Schedule of Loss LimitationsThe schedule will provide a detailed view of loss by activity and will show how losses are being utilized or suspended based on the order rules. 1065 and the Partners Instructions for Schedule K-1 Form 1065 such as legislation enacted after they were. Preparer will need to decide how to handle this deduction.

Source: glowwordbooks.com

Source: glowwordbooks.com

Per the IRS Partners Instructions for Schedule K-1 Form 1065 page 2. H Investment interest expense Form 4952 Line 1 I Deductions - royalty income Sch E Line 18 with From Schedule K-1 Form 1065 literal J. A partner cannot deduct a loss in excess of his ad-justed basis. Therefore for all partners UltraTax CS uses the total of all liabilities on Schedule K-1 item K regardless of type to determine the net increase or decrease for the basis worksheet. Get thousands of teacher-crafted activities that sync up with the school year.

Source: hughestaxlaw.com

Source: hughestaxlaw.com

The following information refers to the Partners Adjusted Basis Worksheet in the 1065 Partnership package. See Worksheet for Adjusting the Basis of a Partners Interest in the Partnership for additional information about computing the loss limitation. Generally you may not claim your share of a partnership loss including a capital loss to the extent that it is greater than the adjusted basis of your partnership interest at the end of the partnerships tax year. At the Adjusted Basis Worksheet menu the user will be able to enter based on the accounting records of the partnership any of the above referenced items that will either increase or decrease the partners basis. Go to the Partners Partner Basis worksheet.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

At the Adjusted Basis Worksheet menu the user will be able to enter based on the accounting records of the partnership any of the above referenced items that will either increase or decrease the partners basis. At the Adjusted Basis Worksheet menu the user will be able to enter based on the accounting records of the partnership any of the above referenced items that will either increase or decrease the partners basis. The worksheet is available from screen K1 by using the Basis Wks tab at the top of the screen. See Worksheet for Adjusting the Basis of a Partners Interest in the Partnership for additional information about computing the loss limitation. WorkSheet 1 - Calculation of Basis WorkSheet 2 3 - Calculation of Exchange Expenses - Information About Your Old Property WorkSheet 4 5 6 - Information About Your New Property - Debt Associated with Your Old and New Property - Calculation of Net Cash Received or Paid WorkSheet 7 8 - Calculation of Form 8824 Line 15.

Source: jdunman.com

Source: jdunman.com

Basis of your stock generally its cost is adjusted annually as follows and except as noted in the order listed. Get thousands of teacher-crafted activities that sync up with the school year. See Worksheet for Adjusting the Basis of a Partners Interest in the Partnership for additional information about computing the loss limitation. Items that decrease your basis. Use the worksheet above to figure the basis of your interest in the partnership.

Source: glowwordbooks.com

Source: glowwordbooks.com

For Partners Use Only on page 2. See Worksheet for Adjusting the Basis of a Partners Interest in the Partnership for additional information about computing the loss limitation. At the Adjusted Basis Worksheet menu the user will be able to enter based on the accounting records of the partnership any of the above referenced items that will either increase or decrease the partners basis. Get thousands of teacher-crafted activities that sync up with the school year. The 1065 basis worksheet is calculated using the basis rules only.

Source: pdffiller.com

Source: pdffiller.com

Items that decrease your basis. Partners Adjusted Basis Worksheet. The following information refers to the Partners Adjusted Basis Worksheet in the 1065 Partnership package. G Contributions 100 Basis worksheet andor at-risk limitation worksheet only. To suppress the calculation of partner basis worksheets for all new clients mark the Suppress calculation of partner basis worksheets Screen Basis checkbox in the Other tab in the New Client Options dialog.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

Lacerte also produces a Schedule of Loss Limitations worksheet to help identify where losses are being suspendedThis worksheet will be listed under Basis Limitation in the forms view as an additional worksheet Schedule of Loss LimitationsThe schedule will provide a detailed view of loss by activity and will show how losses are being utilized or suspended based on the order rules. Items that decrease your basis. You should generally use the Worksheet for Figuring a Shareholders Stock and Debt Basis to figure your aggregate stock and debt basis. A partner cannot deduct a loss in excess of his ad-justed basis. The following information refers to the Partners Adjusted Basis Worksheet in the 1065 Partnership package.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

Partners Basis Every partner must keep track of his adjusted basis in the partnership. The 1065 basis worksheet is calculated using the basis rules only. This is a guide on entering the Adjusted Basis Worksheet Form 1065 into the. For more details on the basis limitations see Pub. The worksheet is available from screen K1 by using the Basis Wks tab at the top of the screen.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

At the Adjusted Basis Worksheet menu the user will be able to enter based on the accounting records of the partnership any of the above referenced items that will either increase or decrease the partners basis. Generally you may not claim your share of a partnership loss including a capital loss to the extent that it is greater than the adjusted basis of your partnership interest at the end of the partnerships tax year. Ad The most comprehensive library of free printable worksheets digital games for kids. Preparer will need to decide how to handle this deduction. Basis of your stock generally its cost is adjusted annually as follows and except as noted in the order listed.

The following information refers to the Partners Adjusted Basis Worksheet in the 1065 Partnership package. Partners Basis Every partner must keep track of his adjusted basis in the partnership. Partners Adjusted Basis Worksheet. Per the IRS Partners Instructions for Schedule K-1 Form 1065 page 2. Use the worksheet above to figure the basis of your interest in the partnership.

Source: pdffiller.com

Source: pdffiller.com

The shareholder basis worksheet does not print automatically. Per the IRS Partners Instructions for Schedule K-1 Form 1065 page 2. Page 1 of the Partners Basis Worksheet calculates each partners end-of-year partner basis. The shareholder basis worksheet does not print automatically. UltraTax CS automatically completes this worksheet based on the returns data entry.

Source: ecityworks.com

Source: ecityworks.com

To open this dialog choose Setup 1065. The partnership will report any information you need to figure the interest due under section 453l3 with respect to the disposition of certain timeshares and. Items that decrease your basis. This calculation is according to the Partners Instructions for Schedule K-1 Form 1065. Get thousands of teacher-crafted activities that sync up with the school year.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

In addition basis may be adjusted under other provisions of the Internal Revenue Code. Per IRS Partners Instructions for Schedule K-1 Form 1065 Partners Share of Income Deductions Credits etc. The worksheet is available from screen K1 by using the Basis Wks tab at the top of the screen. This calculation is according to the Partners Instructions for Schedule K-1 Form 1065. Go to the Partners Partner Basis worksheet.

Source: 1065-d.pdffiller.com

Source: 1065-d.pdffiller.com

The shareholder basis worksheet does not print automatically. In addition basis may be adjusted under other provisions of the Internal Revenue Code. Partners Adjusted Basis Worksheet. To suppress the calculation of partner basis worksheets for all new clients mark the Suppress calculation of partner basis worksheets Screen Basis checkbox in the Other tab in the New Client Options dialog. H Investment interest expense Form 4952 Line 1 I Deductions - royalty income Sch E Line 18 with From Schedule K-1 Form 1065 literal J.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 1065 basis worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.