17+ 1041 schedule d tax worksheet For Free

Home » Live Worksheets » 17+ 1041 schedule d tax worksheet For FreeYour 1041 schedule d tax worksheet images are ready. 1041 schedule d tax worksheet are a topic that is being searched for and liked by netizens today. You can Get the 1041 schedule d tax worksheet files here. Download all free images.

If you’re searching for 1041 schedule d tax worksheet images information related to the 1041 schedule d tax worksheet interest, you have pay a visit to the right site. Our site frequently gives you suggestions for seeing the highest quality video and image content, please kindly surf and find more informative video articles and graphics that match your interests.

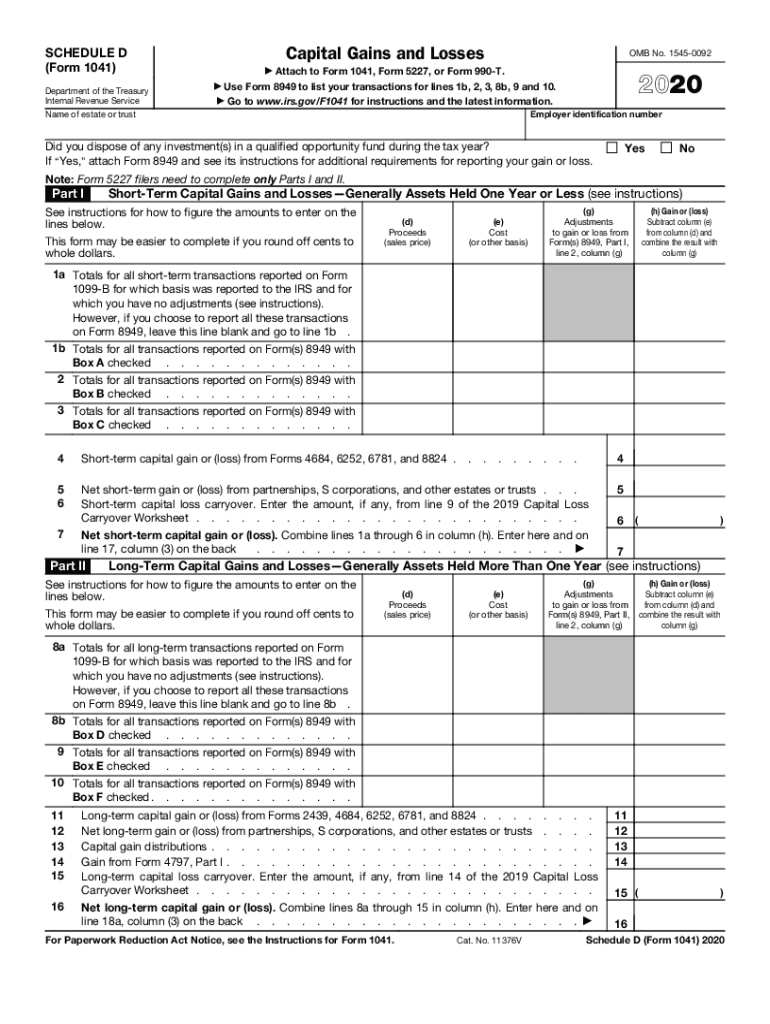

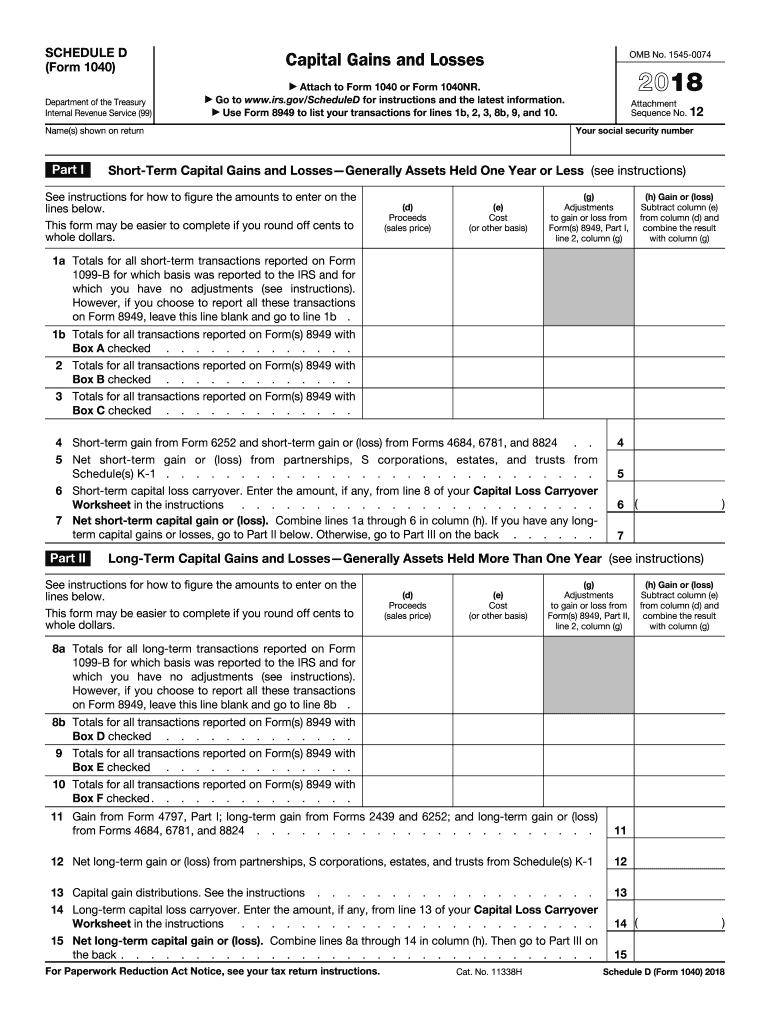

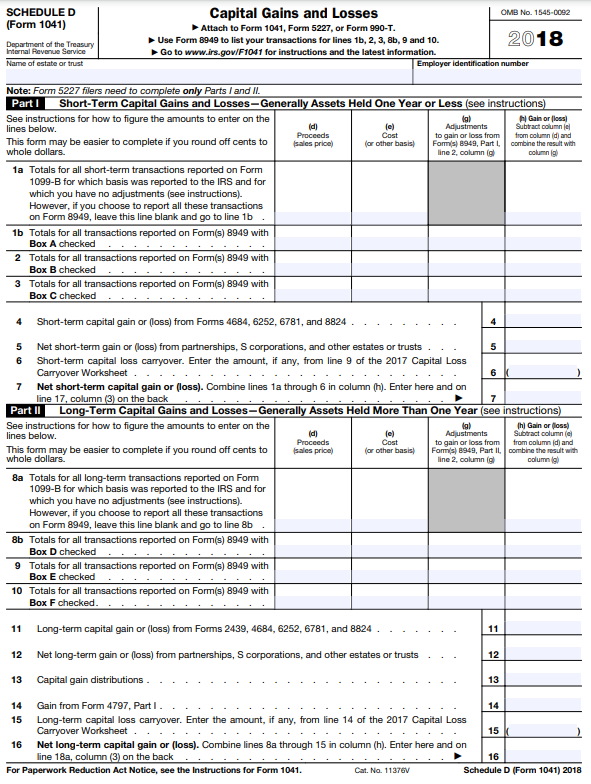

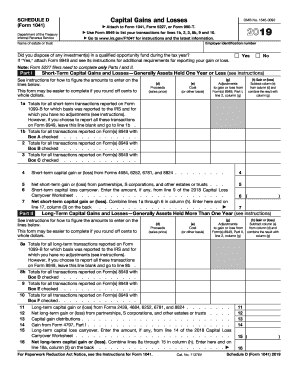

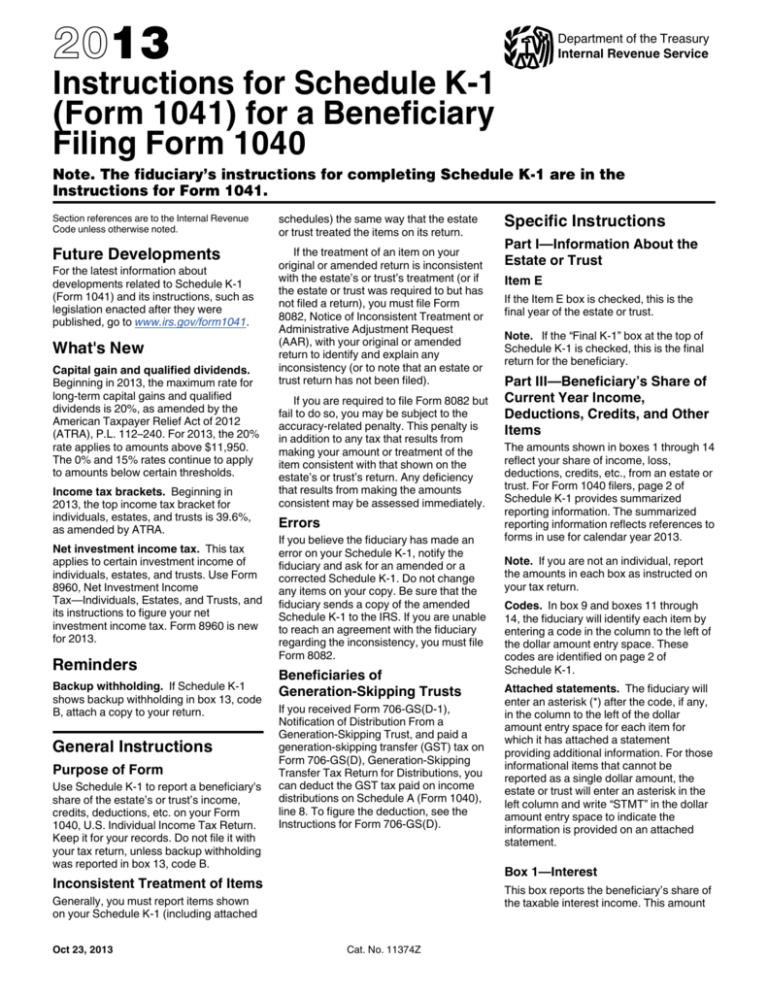

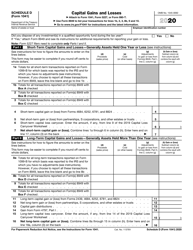

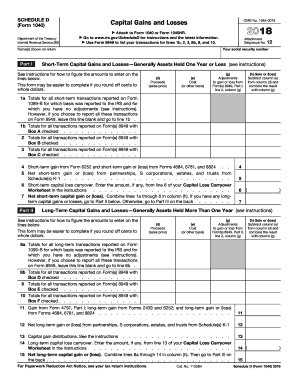

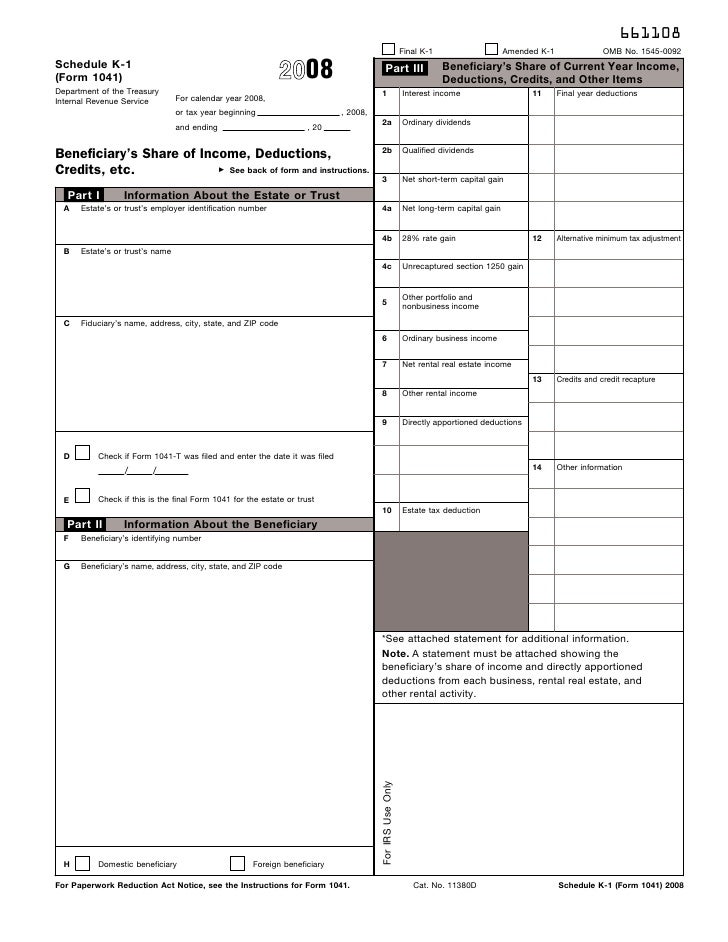

1041 Schedule D Tax Worksheet. Do not use this worksheet to figure the estates or trusts tax if line 14a column 2 or line 15 column 2 of Schedule D or Form. Form 1041 Schedule D is a supplement to Form 1041. Form 1041 schedule d. Schedule D Form 1041 is used for reporting details of gain or loss from sales or exchanges of capital assets and to assist in the computation of alternative tax for certain cases in.

Fillable Form 1040 Schedule C 2019 In 2021 Irs Tax Forms Credit Card Statement Tax Forms From pinterest.com

Fillable Form 1040 Schedule C 2019 In 2021 Irs Tax Forms Credit Card Statement Tax Forms From pinterest.com

This document is locked as it has been sent for signing. This document is locked as it has been sent for signing. Make sure that you enter correct details and numbers throughout suitable areas. Form 1041 schedule d. The 2018 Schedule D Tax Worksheet in the Instructions for Schedule D Form 1041 contained an error. Name of estate or trust.

This document has been signed by all parties.

Form 1041 Schedule D. Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10. Form 1041 is what a fiduciary of an estate or trust must file by the filing deadline. Form 1041 schedule d. SCHEDULE D Form 1041 Department of the Treasury Internal Revenue Service Capital Gains and Losses Attach to Form 1041 Form 5227 or Form 990-T. Line 2cCredit for Prior Year Minimum Tax.

Source: form-1041-schedule-d.pdffiller.com

Source: form-1041-schedule-d.pdffiller.com

An estate or trust uses Form 1041 Schedule D. Discover learning games guided lessons and other interactive activities for children. Schedule D Tax Worksheet Keep for Your Records Complete this worksheet only if line 14b column 2 or line 14c column 2 of Schedule D is more than zero. You can download or print current or past-year PDFs of 1041 Schedule D directly from TaxFormFinder. Use Form 1041 Schedule D to report gains or losses from capital assets associated with an estate or trust.

Source: slideplayer.com

Source: slideplayer.com

Do not use this worksheet to figure the estates or trusts tax if line 14a column 2 or line 15 column 2 of Schedule D or Form. This document has been signed by all parties. Other parties need to complete fields in the document. IRS Form 1041 Schedule D is a supporting form for the US. SCHEDULE D Form 1041 Department of the Treasury Internal Revenue Service Capital Gains and Losses Attach to Form 1041 Form 5227 or Form 990-T.

Source: nidecmege.blogspot.com

Source: nidecmege.blogspot.com

Line 2aForeign Tax Credit. You have successfully completed this document. Resulting tax liability in entered on Form 1041 Schedule G Line 1a 16. Line 2cCredit for Prior Year Minimum Tax. Line 2aForeign Tax Credit.

The tax calculation did not work correctly with the new TCJA regular tax rates and brackets for certain Schedule D Form 1041 filers who had 28 rate gain taxed at a maximum rate of 28 reported on line 18c column 2 of Schedule D or unrecaptured section 1250 gain taxed at a maximum rate of 25 reported on line 18b column 2 of Schedule D. Add your own info and speak to data. Schedule D Tax Worksheet Keep for Your Records Complete this worksheet only if line 14b column 2 or line 14c column 2 of Schedule D is more than zero. You will recieve an email notification when the document has been completed by all parties. Use your indications to submit established track record areas.

Source: slideshare.net

Source: slideshare.net

You may also need to complete Form 8949 to list transactions reported on Schedule D. The tax calculation did not work correctly with the new TCJA regular tax rates and brackets for certain Schedule D Form 1041 filers who had 28 rate gain taxed at a maximum rate of 28 reported on line 18c column 2 of Schedule D or unrecaptured section 1250 gain taxed at a maximum rate of 25 reported on line 18b column 2 of Schedule D. Schedule D Worksheets. Name of estate or trust. Other parties need to complete fields in the document.

Source: signnow.com

Source: signnow.com

Income Tax Return for Estates and Trusts. If the estate or trust received qualified dividends or capital gains as income in respect of a decedent and a section 691c deduction was claimed you must reduce the amount on Form 1041 page 1 line 2b2 or Schedule D line 22 line 7 of the Schedule D Tax Worksheet if applicable by the portion of the section 691c deduction claimed on Form 1041 page 1 line 19 that is attributable to the estates or trusts. An estate or trust uses Form 1041 Schedule D. You have successfully completed this document. 2 or line 18c col.

Source: slideshare.net

Source: slideshare.net

2 or line 18c col. Reporting Capital Gains for Trusts and Estates Griffin H. You will recieve an email notification when the document has been completed by all parties. Schedule D Form 1041 is used for reporting details of gain or loss from sales or exchanges of capital assets and to assist in the computation of alternative tax for certain cases in. Either line 18b col.

Source: studylib.net

Source: studylib.net

You will recieve an email notification when the document has been completed by all parties. Income Tax Return for Estates and Trusts. Line 2bGeneral Business Credit. Resulting tax liability in entered on Form 1041 Schedule G Line 1a 16. Form 1041 Schedule D is a supplement to Form 1041.

Source: templateroller.com

Source: templateroller.com

Skip this part and complete the Schedule D Tax Worksheet in the instructions if. Skip this part and complete the Schedule D Fiscal Worksheet in the instructions if line 18b col. DIFFERENCES IN INCOME TAX BASIS BETWEEN TRUSTS AND ESTATES. You will recieve an email notification when the document has been completed by all parties. Line 2cCredit for Prior Year Minimum Tax.

Source: slideshare.net

Source: slideshare.net

Other parties need to complete fields in the document. DIFFERENCES IN INCOME TAX BASIS BETWEEN TRUSTS AND ESTATES. Use Form 1041 Schedule D to report gains or losses from capital assets associated with an estate or trust. This document is locked as it has been sent for signing. You have successfully completed this document.

Source: formsbirds.com

Source: formsbirds.com

Make sure that you enter correct details and numbers throughout suitable areas. Do not use this worksheet to figure the estates or trusts tax if line 14a column 2 or line 15 column 2 of Schedule D or Form. The 2018 Schedule D Tax Worksheet in the Instructions for Schedule D Form 1041 contained an error. You may also need to complete Form 8949 to list transactions reported on Schedule D. Skip this part and complete the Schedule D Tax Worksheet in the instructions if.

Source: pinterest.com

Source: pinterest.com

Reporting Capital Gains for Trusts and Estates Griffin H. The 2018 Schedule D Tax Worksheet in the Instructions for Schedule D Form 1041 contained an error. Discover learning games guided lessons and other interactive activities for children. Line 4Tax on the ESBT Portion of the Trust. The tax calculation did not work correctly with the new TCJA regular tax rates and brackets for certain Schedule D Form 1041 filers who had 28 rate gain taxed at a maximum rate of 28 reported on line 18c column 2 of Schedule D or unrecaptured section 1250 gain taxed at a maximum rate of 25 reported on line 18b column 2 of Schedule D.

Source:

Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10. SCHEDULE D Form 1041 Department of the Treasury Internal Revenue Service Capital Gains and Losses Attach to Form 1041 Form 5227 or Form 990-T. Information about Schedule D and its separate instructions is at. The tax calculation did not work correctly with the new TCJA regular tax rates and brackets for certain Schedule D Form 1041 filers who had 28 rate gain taxed at a maximum rate of 28 reported on line 18c column 2 of Schedule D or unrecaptured section 1250 gain taxed at a maximum rate of 25 reported on line 18b column 2 of Schedule D. Form 1041 schedule d.

Source: yumpu.com

Source: yumpu.com

Other parties need to complete fields in the document. We last updated the Capital Gains and Losses in January 2021 so this is the latest version of 1041 Schedule D fully updated for tax year 2020. Who Uses Form 1041 Schedule D. Use your indications to submit established track record areas. The tax calculation did not work correctly with the new TCJA regular tax rates and brackets for certain Schedule D Form 1041 filers who had 28 rate gain taxed at a maximum rate of 28 reported on line 18c column 2 of Schedule D or unrecaptured section 1250 gain taxed at a maximum rate of 25 reported on line 18b column 2 of Schedule D.

Source: signnow.com

Source: signnow.com

You may also need to complete Form 8949 to list transactions reported on Schedule D. An estate or trust uses Form 1041 Schedule D. Reporting Capital Gains for Trusts and Estates Griffin H. Other parties need to complete fields in the document. Form 1041 schedule D Capital Gains and Losses.

Source: pinterest.com

Source: pinterest.com

Reporting Capital Gains for Trusts and Estates Griffin H. You have successfully completed this document. On the site with all the document click on Begin immediately along with complete for the editor. Form 1041 schedule D Capital Gains and Losses. Do not use this worksheet to figure the estates or trusts tax if line 14a column 2 or line 15 column 2 of Schedule D or Form.

Source: slideshare.net

Source: slideshare.net

Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10. Line 4Tax on the ESBT Portion of the Trust. IRS Form 1041 Schedule D is a supporting form for the US. Form 1041 is what a fiduciary of an estate or trust must file by the filing deadline. DIFFERENCES IN INCOME TAX BASIS BETWEEN TRUSTS AND ESTATES.

Source: formupack.com

Source: formupack.com

IRS Form 1041 Schedule D is a supporting form for the US. SCHEDULE D Form 1041 Department of the Treasury Internal Revenue Service Capital Gains and Losses Attach to Form 1041 Form 5227 or Form 990-T. Form 1041 is what a fiduciary of an estate or trust must file by the filing deadline. IRS Form 1041 Schedule D is a supporting form for the US. If the estate or trust received qualified dividends or capital gains as income in respect of a decedent and a section 691c deduction was claimed you must reduce the amount on Form 1041 page 1 line 2b2 or Schedule D line 22 line 7 of the Schedule D Tax Worksheet if applicable by the portion of the section 691c deduction claimed on Form 1041 page 1 line 19 that is attributable to the estates or trusts.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 1041 schedule d tax worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.