48+ 1040 schedule d tax worksheet Ideas In This Year

Home » Worksheets Online » 48+ 1040 schedule d tax worksheet Ideas In This YearYour 1040 schedule d tax worksheet images are available in this site. 1040 schedule d tax worksheet are a topic that is being searched for and liked by netizens today. You can Get the 1040 schedule d tax worksheet files here. Find and Download all royalty-free photos.

If you’re searching for 1040 schedule d tax worksheet images information connected with to the 1040 schedule d tax worksheet interest, you have visit the ideal site. Our website frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly surf and find more enlightening video content and graphics that match your interests.

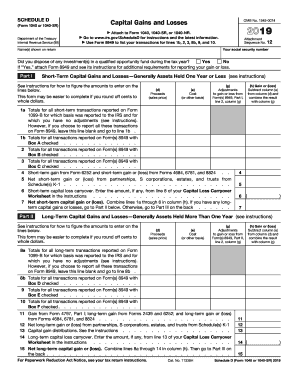

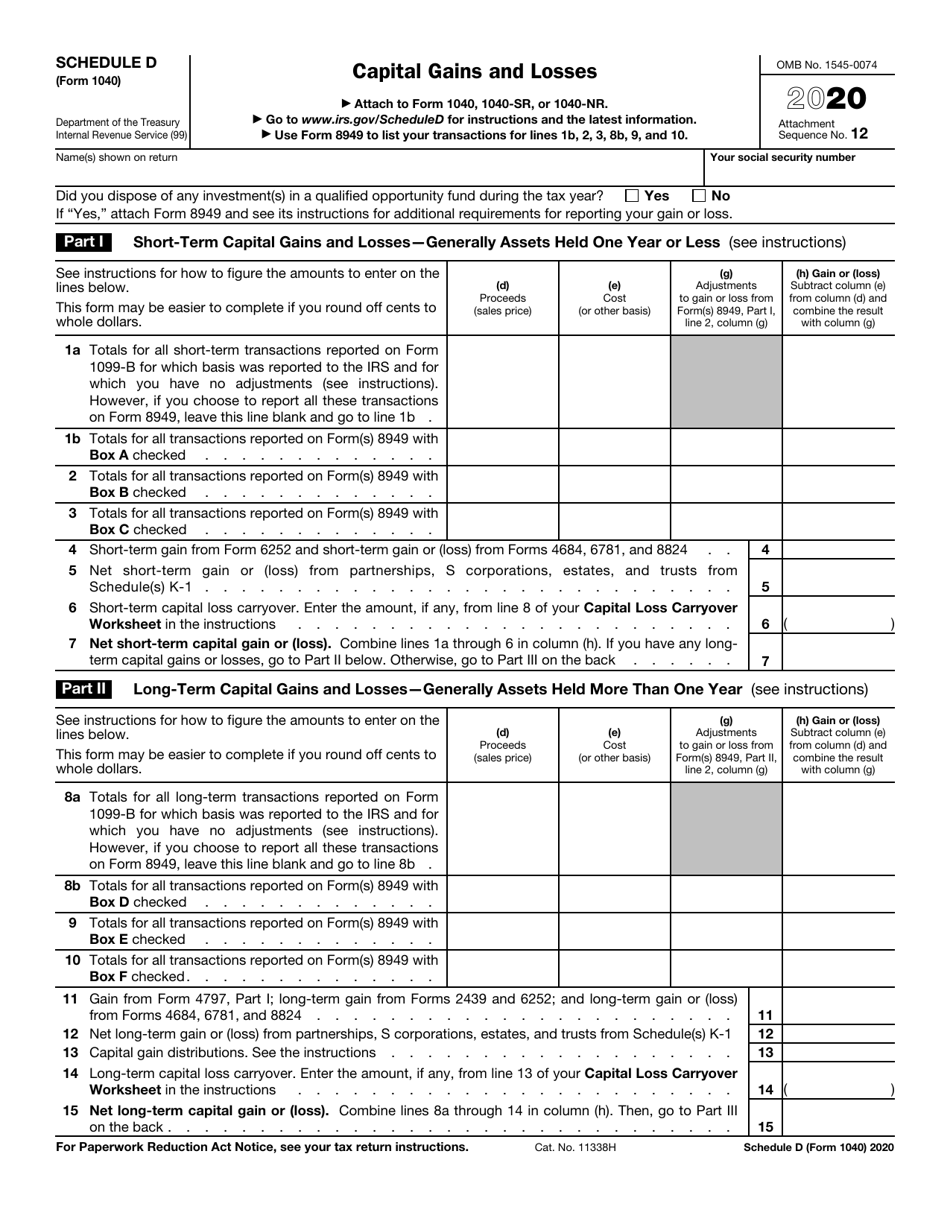

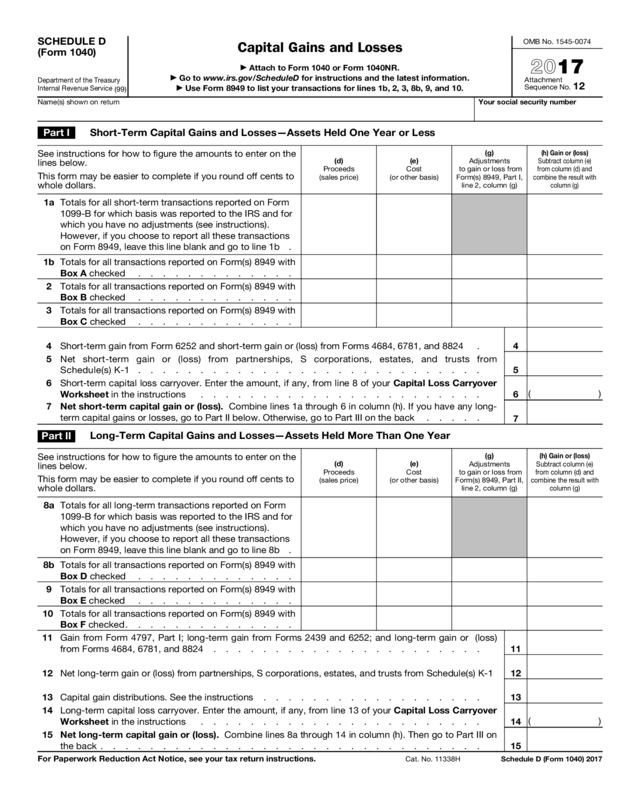

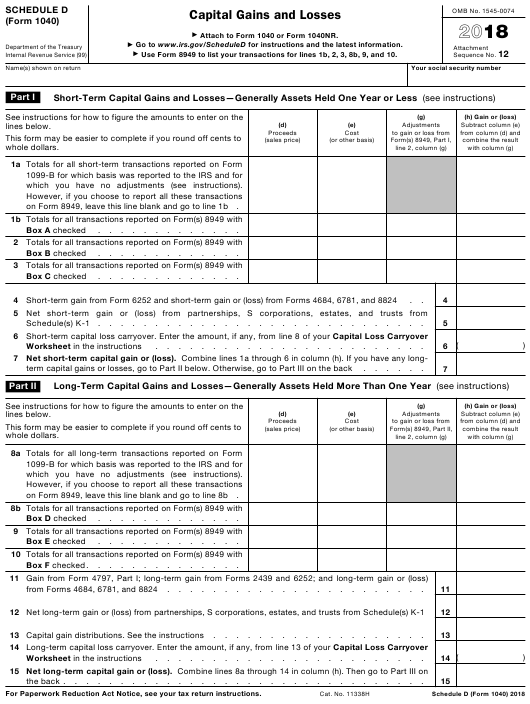

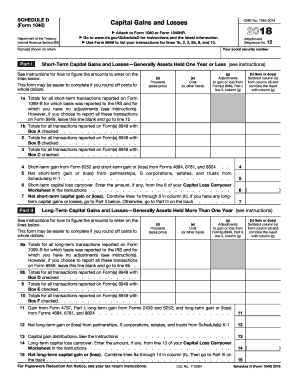

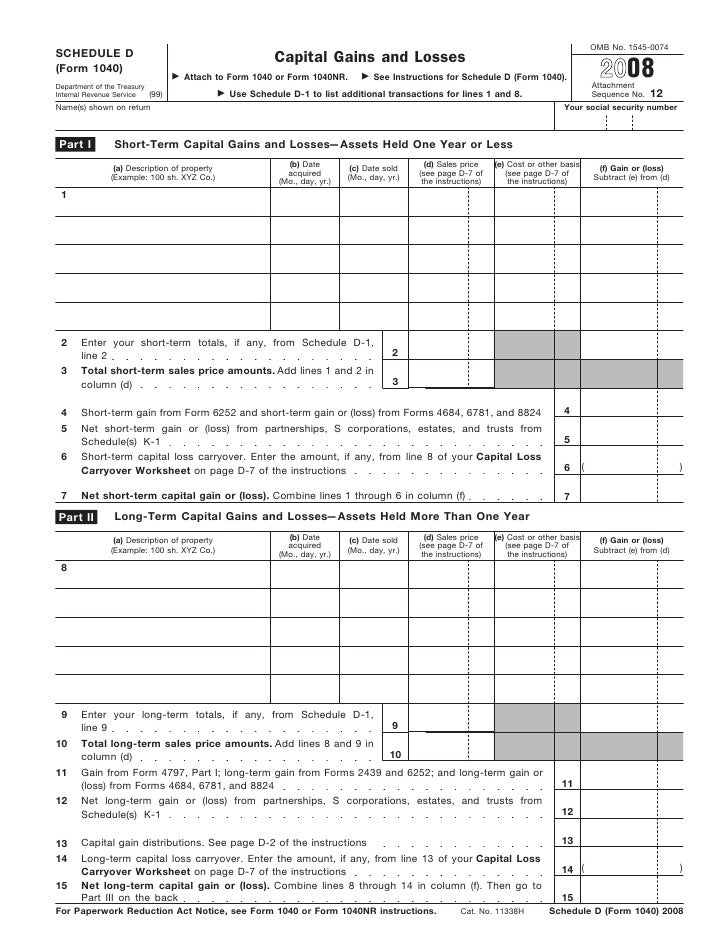

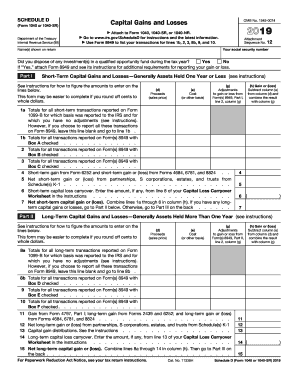

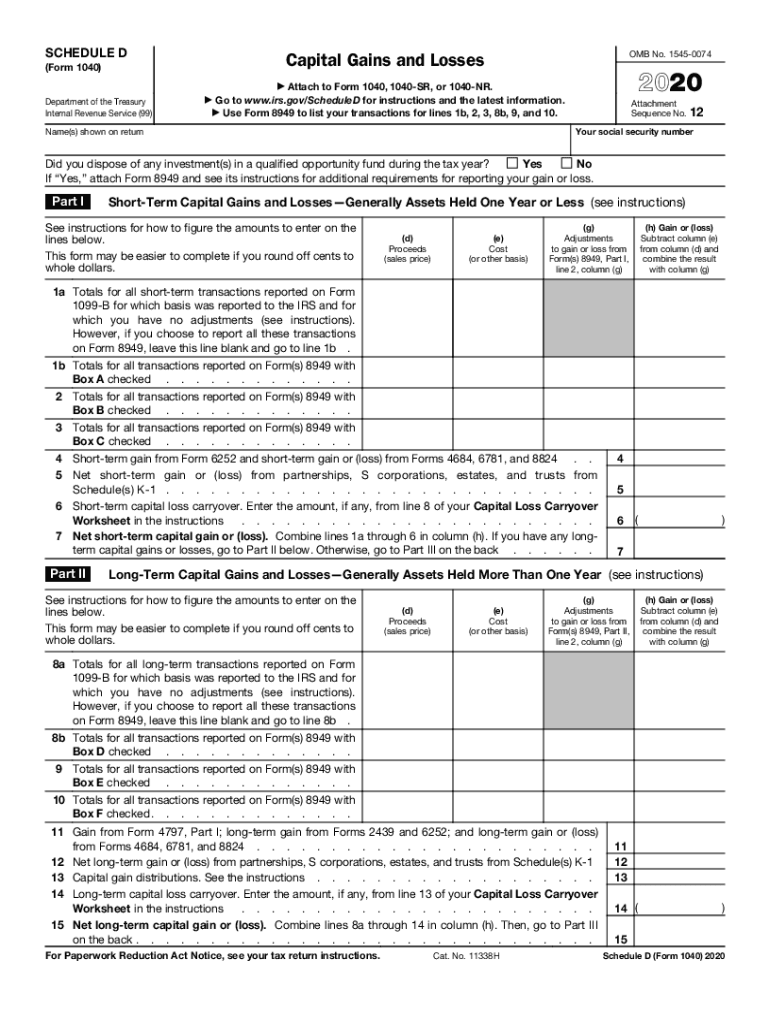

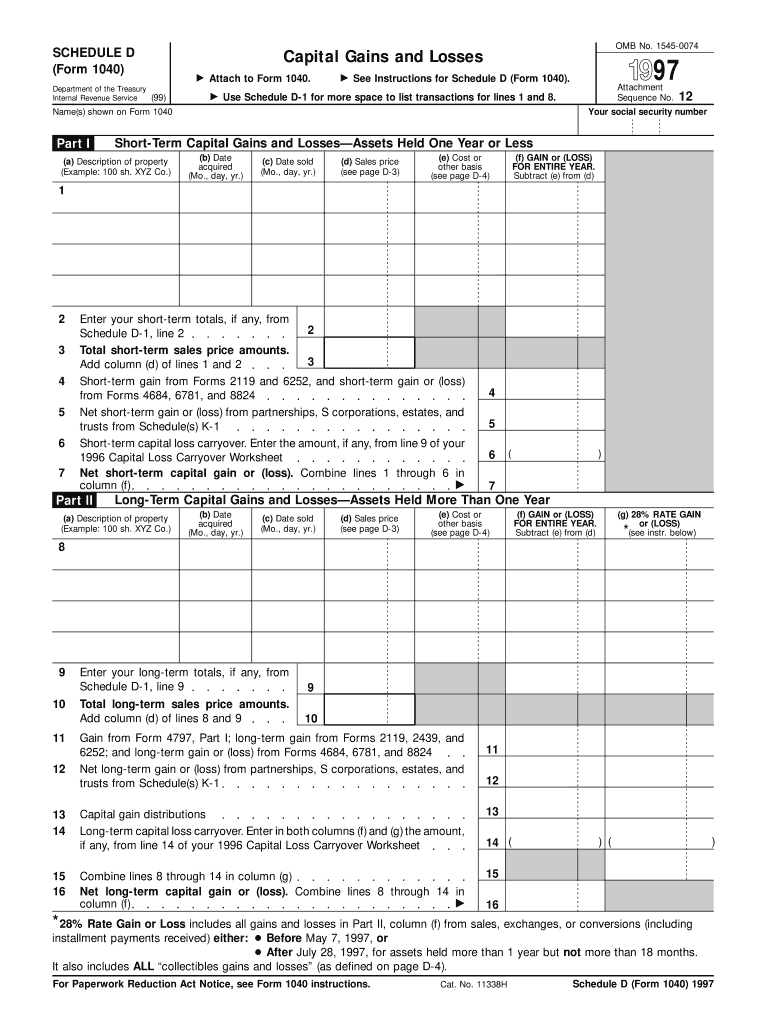

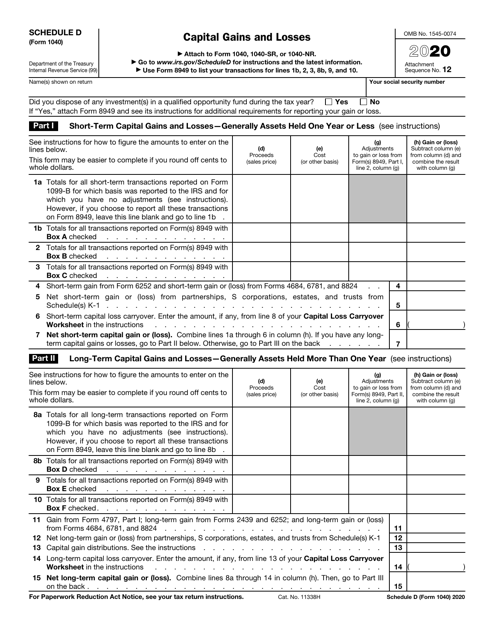

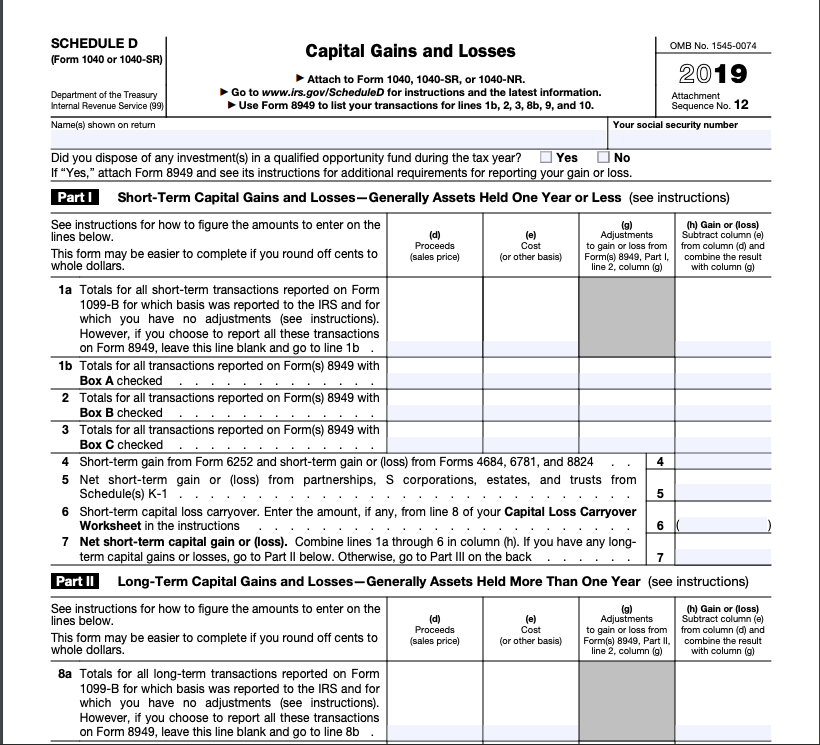

1040 Schedule D Tax Worksheet. The form analyzes the income from the tax filer and calculates just how much to become paid as tax or refund. 2020 Instructions for Schedule DCapital Gains and Losses These instructions explain how to complete Schedule D Form 1040. Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10. SCHEDULE D Capital Gains and Losses Form 1040 Department of the Treasury Internal Revenue Service 99 OMB No.

Irs Schedule D 1040 Form Pdffiller From pdffiller.com

Irs Schedule D 1040 Form Pdffiller From pdffiller.com

Schedule SE Self-Employment Tax. The form analyzes the income from the tax filer and calculates just how much to become paid as tax or refund. Go to wwwirsgovScheduleD for instructions and the latest information. SCHEDULE D Form 1040 Department of the Treasury Internal Revenue Service 99 Capital Gains and Losses Attach to Form 1040 1040-SR or 1040-NR. My net long-term gains is positive but no long-term gain and qualified dividend worksheet is generated. Each of these worksheets helps you compute certain Schedule D line-item amounts and each also comes with instructions.

Gains from involuntary conversions other than from casualty or theft of capital assets not held for business or profit.

Schedule D contains different worksheets that you may need to complete including the Capital Loss Carryover Worksheet 28 Rate Gain Worksheet and Unrecaptured Section 1250 Gain Worksheet. The 2017 version of the spreadsheet includes both pages of Form 1040 as well as these supplemental schedules. To figure the overall gain or. Then complete the Schedule D Tax Worksheet in the instructions. Schedule SE Self-Employment Tax. We corrected the Schedule D Tax Worksheet in the Instructions for Schedule D Form 1040 by renumbering line 18 as line 18a adding new lines 18b and 18c and updating the text on line 19 to reflect those changes.

Source: formupack.com

Source: formupack.com

Schedule D Tax Worksheet 2016 Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero. You can not file Schedule D with one of the shorter IRS forms such as Form 1040A or Form 1040EZ. Complete Form 8949 before you complete line 1b 2 3 8b 9 or 10 of Schedule D. This form describes your income and your tax return status and it is used from the IRS to collect your tax information. 2020 Instructions for Schedule DCapital Gains and Losses These instructions explain how to complete Schedule D Form 1040.

Source: templateroller.com

Source: templateroller.com

Schedule A Itemized Deductions. Schedule A Itemized Deductions. Then complete the Schedule D Tax Worksheet in the instructions. Do not complete lines 21 and 22 below. My net long-term gains is positive but no long-term gain and qualified dividend worksheet is generated.

Source: handypdf.com

Source: handypdf.com

Schedule C Profit or Loss from Business. Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the Instructions for Form 1040 line 44 or in the Instructions for Form 1040NR line 42 to figure your tax. Schedule D Tax Worksheet. Schedule D Tax Worksheet 2016 Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero. Schedule D contains different worksheets that you may need to complete including the Capital Loss Carryover Worksheet 28 Rate Gain Worksheet and Unrecaptured Section 1250 Gain Worksheet.

Source: formswift.com

Source: formswift.com

2018 Form 1040 Schedule D Tax Worksheet The IRS Form 1040 form is the standard one that many individuals use to submit their tax returns to the government. The 2017 version of the spreadsheet includes both pages of Form 1040 as well as these supplemental schedules. A Form 1040 taxpayers regular tax calculation using the worksheet is potentially impacted if. Gains from involuntary conversions other than from casualty or theft of capital assets not held for business or profit. Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line 44 or in the instructions for Form 1040NR line 42 to figure your tax.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

Use Schedule D Form 1040 or 1040-SR to report the following. In part III of Schedule D the long-term capital gain and short-term capital gain are simply combined in Line 16 then put the sum in 1040. Please use the link below to download 2020-federal-1040-schedule-dpdf and you can print it directly from your computer. To figure the overall gain or. Form 1040 Schedule D Worksheet Form 1040 form is an IRS tax form utilized for person federal income tax filings by US residents.

Source: 1044form.com

Source: 1044form.com

Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10. Do not complete lines 21 and 22 below. You can not file Schedule D with one of the shorter IRS forms such as Form 1040A or Form 1040EZ. In part III of Schedule D the long-term capital gain and short-term capital gain are simply combined in Line 16 then put the sum in 1040. Schedule D Tax Worksheet.

Source: investopedia.com

Source: investopedia.com

Complete Form 8949 before you complete line 1b 2 3 8b 9 or 10 of Schedule D. Schedule D contains different worksheets that you may need to complete including the Capital Loss Carryover Worksheet 28 Rate Gain Worksheet and Unrecaptured Section 1250 Gain Worksheet. What Is Form 1040 Schedule D. Then complete the Schedule D Tax Worksheet in the instructions. Schedule A Itemized Deductions.

Source: pdffiller.com

Source: pdffiller.com

Schedule D Tax Worksheet. 2014 Form 1040 Schedule D K 1 Instructions Forms Resume Examples from Schedule D Tax Worksheet. To figure the overall gain or. Schedule SE Self-Employment Tax. Then complete the Schedule D Tax Worksheet in the instructions.

Source: incometaxpro.net

Source: incometaxpro.net

Complete Form 1040 through line 43 or Form 1040NR through line 41. Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the Instructions for Form 1040 line 44 or in the Instructions for Form 1040NR line 42 to figure your tax. What Is Form 1040 Schedule D. Schedule D contains different worksheets that you may need to complete including the Capital Loss Carryover Worksheet 28 Rate Gain Worksheet and Unrecaptured Section 1250 Gain Worksheet. Schedule D Tax Worksheet.

Source: slideshare.net

Source: slideshare.net

To figure the overall gain or. Gains from involuntary conversions other than from casualty or theft of capital assets not held for business or profit. Schedule SE Self-Employment Tax. Use this worksheet to figure your capital loss carryovers from 2019 to 2020 if your 2019 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2019 Schedule D line 16 or b if the amount on your 2019 Form 1040 or 1040-SR line 11b or your 2019 Form 1040-NR line 41 if applicable would be less than zero if you could enter a negative amount on that line. Schedule D Tax Worksheet.

Source: chegg.com

Source: chegg.com

Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10. Page one of IRS Form 1040 and Form 1040NR requests that you attach Schedule D to report a capital gain or loss of income if required. 1545-0074 2020 Attach to Form 1040 1040-SR or 1040-NR. Schedule D contains different worksheets that you may need to complete including the Capital Loss Carryover Worksheet 28 Rate Gain Worksheet and Unrecaptured Section 1250 Gain Worksheet. I wonder if this is a bug in TurboTax.

Source: pdffiller.com

Source: pdffiller.com

Do not complete lines 21 and 22 below. The form analyzes the income from the tax filer and calculates just how much to become paid as tax or refund. Schedule D Tax Worksheet 2016 Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero. Schedule D Tax Worksheet. Capital Gains and Losses along with its worksheet Form 2210.

Source: uslegalforms.com

Source: uslegalforms.com

Use Schedule D Form 1040 or 1040-SR to report the following. Schedule A Itemized Deductions. The 2017 version of the spreadsheet includes both pages of Form 1040 as well as these supplemental schedules. Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero. SCHEDULE D Capital Gains and Losses Form 1040 Department of the Treasury Internal Revenue Service 99 OMB No.

Source: uslegalforms.com

Source: uslegalforms.com

Gains from involuntary conversions other than from casualty or theft of capital assets not held for business or profit. Schedule D contains different worksheets that you may need to complete including the Capital Loss Carryover Worksheet 28 Rate Gain Worksheet and Unrecaptured Section 1250 Gain Worksheet. The spreadsheet includes both pages of Form 1040 as well as these supplemental schedules. Use Schedule D Form 1040 or 1040-SR to report the following. Go to wwwirsgovScheduleD for instructions and the latest information.

Source: templateroller.com

Source: templateroller.com

The spreadsheet includes both pages of Form 1040 as well as these supplemental schedules. The 2017 version of the spreadsheet includes both pages of Form 1040 as well as these supplemental schedules. Each of these worksheets helps you compute certain Schedule D line-item amounts and each also comes with instructions. To figure the overall gain or. Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

Capital Gains and Losses along with its worksheet Form 2210. Otherwise you dont have. Part 1 of form Schedule D is used to calculate your net short-term capital gain or loss for assets held one year or less. Form 1040 Schedule D Worksheet Form 1040 form is an IRS tax form utilized for person federal income tax filings by US residents. You can not file Schedule D with one of the shorter IRS forms such as Form 1040A or Form 1040EZ.

Source: chegg.com

Source: chegg.com

Go to wwwirsgovScheduleD for instructions and the latest information. Otherwise you dont have. 2018 Form 1040 Schedule D Tax Worksheet The IRS Form 1040 form is the standard one that many individuals use to submit their tax returns to the government. Schedule D Tax Worksheet. Complete Form 1040 through line 43 or Form 1040NR through line 41.

Source: investopedia.com

Source: investopedia.com

The tax calculation did not work correctly with the new TCJA regular tax rates and brackets for certain Schedule D filers who had 28 rate gain taxed at a maximum rate of 28 reported on line 18 of Schedule D or unrecaptured section 1250 gain taxed at a maximum rate of 25 reported on line 19 of Schedule D. Form 1040 Schedule D Worksheet Form 1040 form is an IRS tax form utilized for person federal income tax filings by US residents. In part III of Schedule D the long-term capital gain and short-term capital gain are simply combined in Line 16 then put the sum in 1040. SCHEDULE D Form 1040 Department of the Treasury Internal Revenue Service 99 Capital Gains and Losses Attach to Form 1040 1040-SR or 1040-NR. Schedule D Tax Worksheet.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 1040 schedule d tax worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.